Commodities look toppy!

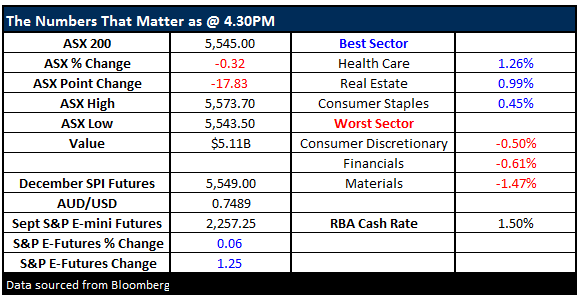

What Mattered Today

The market pulled back today with the index closing near enough to the lows – which is fairly typical after a good five session bounce from below 5400. We expect some consolidation/ slight weakness in the short term before we have a crack at higher levels into the back end of December. Worth remembering that seasonally this is a very strong period for equities – particularly the second half of the month, however we have moved higher in early December, which is more unusual. That feeds our thinking that from a very short term tactical sense, we’ll pullback / consolidate in the coming days before moving up again. It seems there is a genuine fear of missing out (FOMO) trade underway and this should keep equities supported on pullbacks.

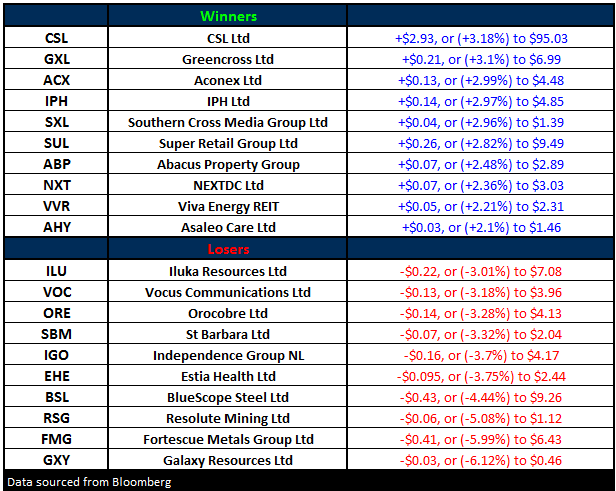

Some of the recent underperformers had a better day today – CSL the main example here putting on more than +3% while some of the recently strong commodity stocks found some selling.

CSL Daily Chart

The contract price for Met Coal used in Steel was settled last night for the next quarter, and it was better than the market thought at $275/t while the spot price sits at $285/t. Big prices and a huge difference from this time last year however there are a few more bearish trends starting to emerge in that area of the market that should be considered. We’re big believers in going against the trend and the coal stocks have been on a tear this year – the market is now very positive. Whitehaven (WHC) is your leveraged play in this space and we’ve written a number of times that we think this stock is the canary in the coal mine – or more clearly, WHC has topped and will be the stock to leads the rest of the commodity sector into a correction. Picking tops is difficult, but signs are starting to emerge.

Coal has been the bellwether for the broader commodity space - it was sold off more than others last year and has bounced more than the rest this year. Contract pricing is still strong but if we look at spot pricing Thermal Coal has dropped more than ~20% in the last month or so, while Met Coal is down around ~10%. As we wrote above, the majority are now turning bullish the broader commodity story (Citi an example here) who recently turned from outright bearish to outright bullish – despite the already BIG run up in prices. We think caution is warranted here and now have no commodity exposure in our portfolio.

Whitehaven Coal (WHC) Daily Chart – the canary?

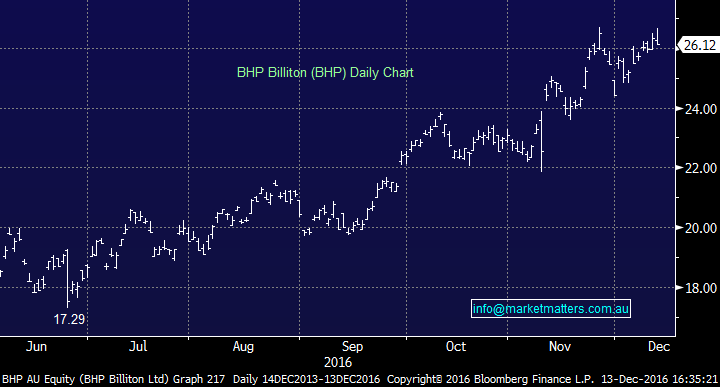

BHP Daily Chart (BHP) – top forming here although likely to remain choppy

RIO Tinto (RIO) Daily Chart

At 6am on Thursday morning we are likely to see US interest rates move higher. The market has positioned for it – is expecting it and it should happen. If they don’t raise rates the market would likely take this as a negative and sell off. The unlikely scenario eventuating is one that has been typical of 2016, and we would be stupid to discount that outcome – but it’s a long shot. Then again, so too was Trump!! The issue for the Fed is around guidance going forward. Be too hawkish and the $US rallies hard which at some point will provide a big handbrake to US economic growth, be too dovish and they threaten temperamental consumer confidence. Getting the message right will be key on Thursday and clearly this does present a near term risk - we will keep this in our thought processes for the remainder of the week.

Although we now have 16% cash in our portfolio after taking a nice profit on Ansell yesterday (ANN), we’re looking for opportunities into the short term weakness – the Fed may play into that .

We had a range today of +/- 30 points, a high of 5573, a low of 5543 and a close of 5545, off -17pts or -0.32%.

ASX 200 Intra-Day Chart

ASX 200 Daily chart

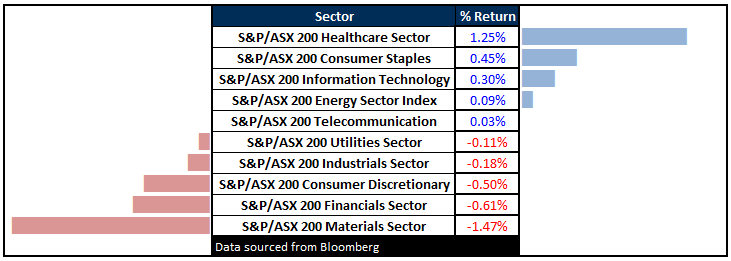

Sectors

ASX 200 Movers

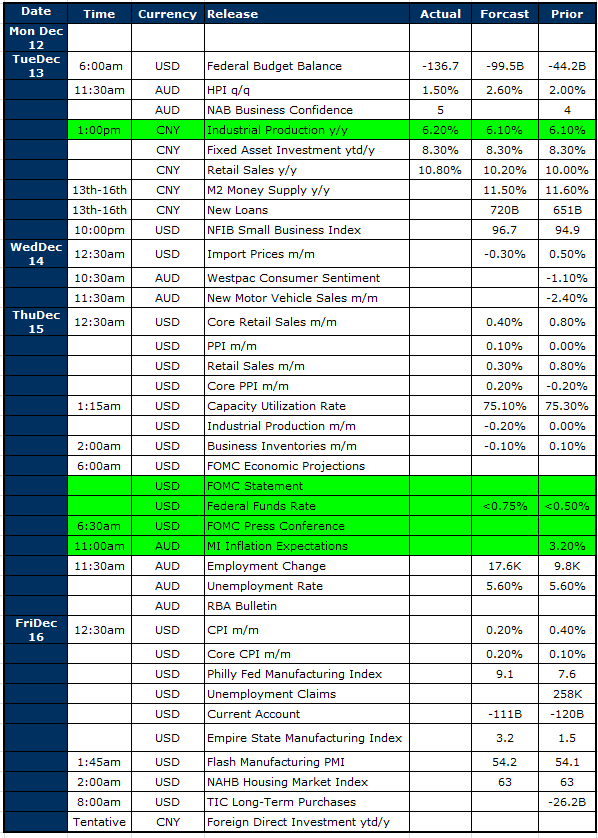

Select Economic Data - Stuff that really Matters in Green

What Matters Overseas

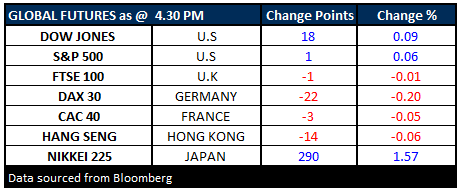

FUTURES mixed….

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/12/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here