Coles (COL) sales boosted by panic buying

Coles (COL) –4.14%: out yesterday morning with a very strong sales update. Supermarkets experienced like for like sales growth of +13.1% on 12 months ago, with not only a strong (and expected) COVID-19-driven ‘pantrydemic’ episode but also a strong January and February by the look. They also said price inflation was +2.6% vs. +0.9% this time last year showing that they had success rising prices during this period of increased demand – something that won’t be featured in their ads!

Not surprisingly (if our household was anything to go by), Liquor sales were strong with LFL sales growth at +7.2% vs. last year and that was despite the negative impact of bushfires in January. They also saw good growth in their convenience business. In terms of current trading they said “In the first four weeks of the fourth quarter, which included the Easter period and ANZAC Day, Supermarkets comparable sales growth has broadly trended back toward the levels seen in the early part of the third quarter (pre COVID-19).”

The last line there explains why the stock is trading down 3% this morning + it also speaks to an increasing level of normality across the economy, a positive for other areas.

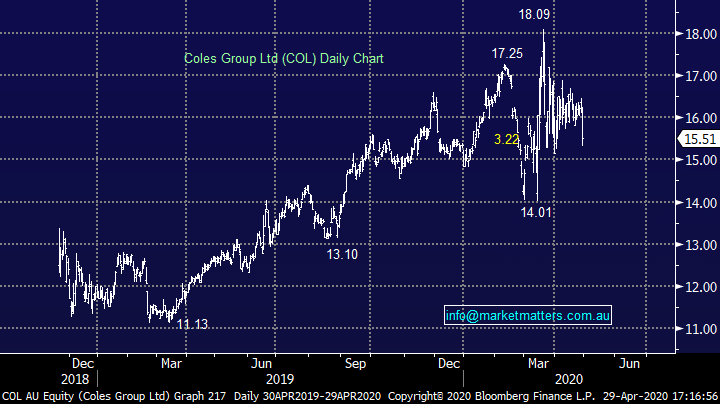

Coles (COL) Chart