Cimic shows why doing business in the Middle East is not all Beer & Skittles (CIM, DOW, WBC)

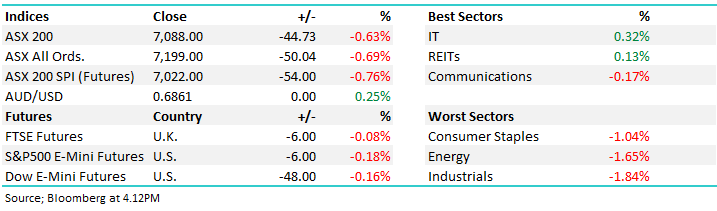

WHAT MATTERED TODAY

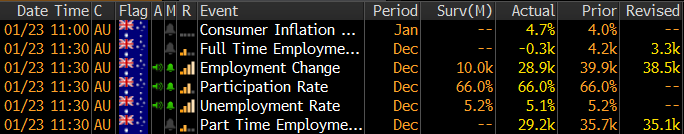

The market opened fairly well this morning following a flat session overseas, however weakness crept in at 11.30am following a better than expected employment print with a strong rise in part time jobs which reduced the unemployment rate to 5.1% versus the 5.2% expected. Stronger employment reduces the chance for rate cuts and that was supportive of the AUD which rallied to a high around 68.80c. While the employment data was clearly better, the composition was questionable given the big rise in part time positions will full-time jobs actually went backwards.

Today’s economic data

Source Bloomberg

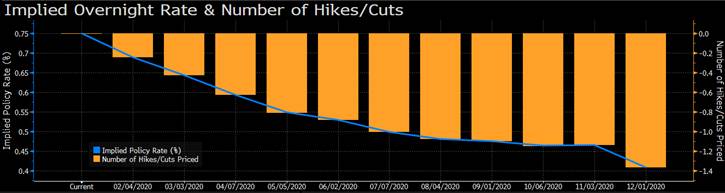

In any case the market is still pricing further rate cuts with the trajectory of those detailed in the chart here, i.e. nearly 1.4 cuts by December 2020 = 43bps or current rates to more than halve.

Implied rate cuts this year – a 24% chance of a cut in Feb.

Source Bloomberg

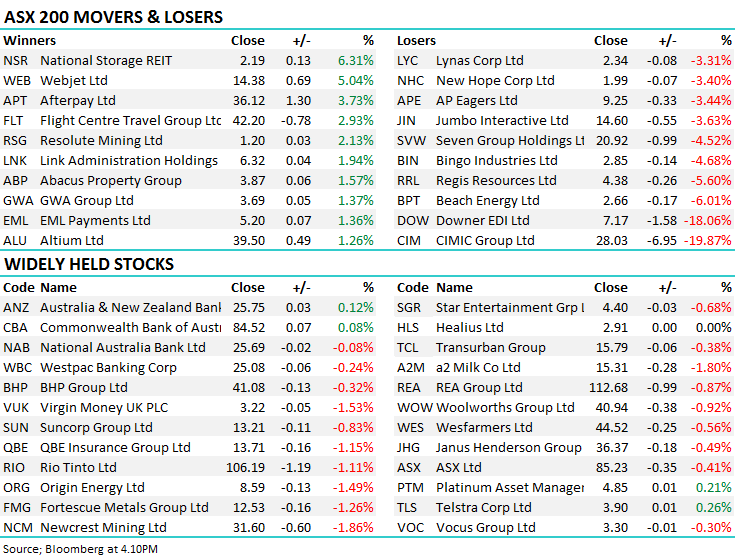

At a sector level today, the IT names were best on ground closing higher on the session as did the REITS following a takeover offer for National Storage (NSR) while on the flipside, Cimic (CIM) and Downer (DOW) were crunched, Harry covers below. Just in terms of NSR, while we don’t own the stock, we do own Abacus (ABP) and the bid should re-focus attention on the value of their storage assets, which seem terribly undervalued basis todays non-bonding proposal from US based Gaw Capital Partners.

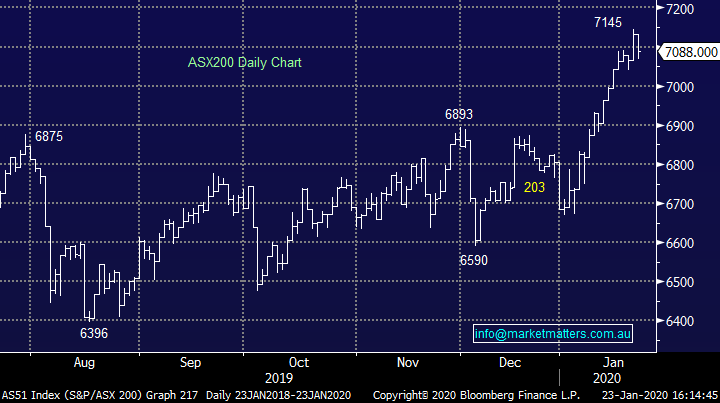

Asian markets were against weaker today, most down over 2% so the decline of 0.63% in Oz was respectable, US Futures also ticked marginally lower during our time zone.

Overall, the ASX 200 fell -44pts / -0.63% today to close at 7088. Dow Futures are trading lower by -75pts/-0.25%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

CIMIC (CIM) -19.87%: The old Leightons showed clearly today why doing business in the Middle East is not all beer and skittles after they made the painful decision to extract themselves from the region as they try to sell their non-controlling 45% interest in BIC Contracting. When all is said and done, CIM will recognize a one off post-tax impact of around A$1.8b in its 2019 financial statements, representing all exposure to BICC, the impact including an expected cash outlay net of tax of around A$700m during 2020. That means CIM will not declare a final dividend for 2019.

In terms of their underlying business, excluding BICC impact, CIMIC sees NPAT for 2019 of around A$800m in line with 2019 guidance. While we have often written about the complexity of the CIM business, and this move is massively painful, once the stock settles it will be worth revisiting (at some point). One for the watch list but probably from lower levels.

CIMIC (CIM) Chart

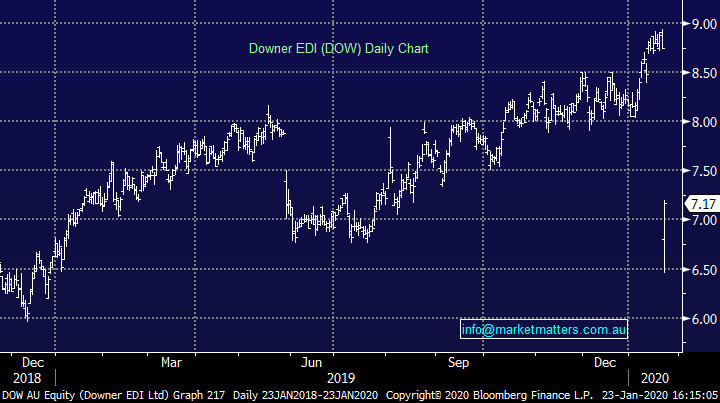

Downer (DOW) -18.6%; the big service contractor was also whacked today after downgrading NPAT for the year. The company was forced to take a knife to expectations as a result of a number of loss making contracts in their Engineering, Construction and Maintenance division with net costs to complete these projects increased by $43m whilst also taking a restructure costs or $10m, and lowering revenue expectations for the division by $20m as a result of project delays. Still seems very hard to make money / not lose money in engineering.

The mining division wasn’t spared from the hits with a $12m cut to earnings in the second half as two projects had starts delayed. All this results in an $85m pre-tax hit to NPATA where guidance has been lowered to $300m for FY20, a 22% cut to prior expectations but an 18% miss to where the market was expecting. The company made a failed attempt at protecting the share price by announcing a small 5 year mining contract and increasing Work in Hand numbers at the same time, but the market saw straight through the ploy. Shares dumped to 12-month lows. BANG!

Downer (DOW) Chart

Westpac (WBC) -0.24%: named their new chairman today in John McFarlane. The 72-year-old joins the bank at a turbulent time with his first big call in the hot seat is to pick out a permanent CEO. The hire was welcomed by the market which has been keen to see more permanent names in the top roles in the bank, although WBC shares did finish lower. John has worked around the world, with more than 40 years’ experience including heading up ANZ, more recently Chairman of Barclays whilst also chairing TheCityUK which coordinates financial services.

Westpac (WBC) Chart

Broker moves;

· St Barbara Cut to Underperform at Macquarie; PT A$2.50

· Regis Resources Cut to Underperform at Macquarie; PT A$4.20

· Regis Healthcare Raised to Hold at Jefferies; PT A$2.35

· Sigma Healthcare Raised to Hold at Jefferies

· Healius Raised to Buy at Jefferies; PT A$3.40

· Cochlear Cut to Underperform at Jefferies; PT A$205.50

· CSL Cut to Hold at Jefferies; PT A$312.40

· Ansell Cut to Hold at Morningstar

· Seven Group Cut to Sell at Morningstar

· Gold Road Raised to Hold at Haywood Securities

· Link Administration Rated New Neutral at Goldman; PT A$6.65

OUR CALLS

No changes across portfolios today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.