Chinese market starts to attract some buying (IEM, SIM, LYC)

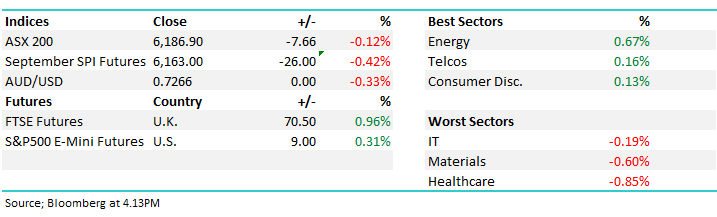

WHAT MATTERED TODAY

A reasonable session to kick off the week with the ASX brushing off a potentially damaging breakdown in US / China trade negotiations over the weekend to finish only marginally lower on the session. US Futures traded down during our time zone while Asian markets were mixed – Hong Kong the weakest link down by ~1.7% while the Chinese market was up an impressive +2.5%, and has bounced well from recent lows – it seems Chinese investors are becoming more optimistic on trade negotiations since authorities have pushed back on US demands…

Shanghai Composite Chart

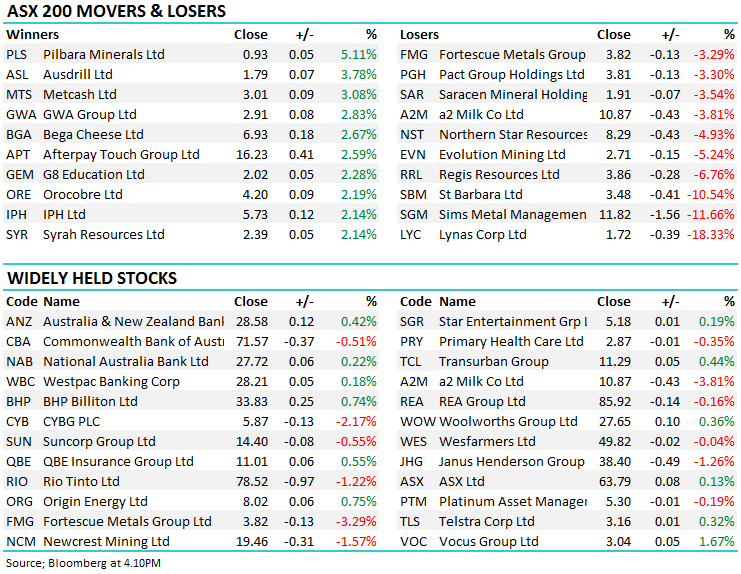

Locally, it was the energy names that were strong with BHP outperforming the likes of RIO and Fortescue (FMG) while the healthcare stocks were the weakest link – selling in CSL continued with the stock down -1.35% to close at $204.32. The stocks bounced from the $200 last week however we ultimately see it trading towards $180 – here’s the rationale

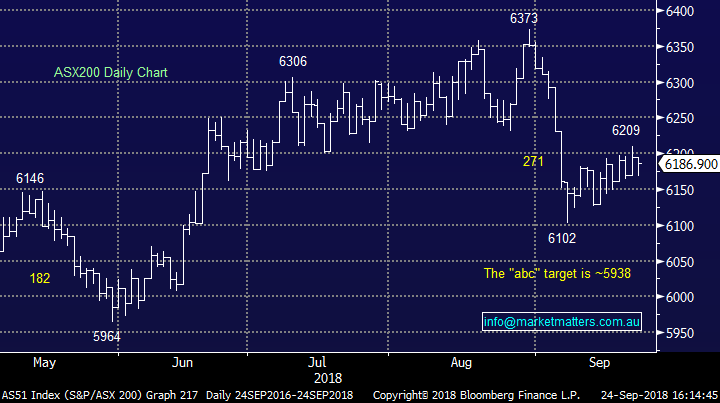

Overall, the index closed down -7 points or -0.12% today to 6187. Dow Futures are currently trading down -75pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Not a huge amount circulating around today…

RATINGS CHANGES:

· Whitehaven Upgraded to Buy at Citi; PT A$5.90

· Independence Group Downgraded to Sell at Morningstar

· Challenger Downgraded to Hold at Morningstar

· Premier Investments Downgraded to Hold at Blue Ocean; PT A$17

· South32 Upgraded to Neutral at Redburn

· Mesoblast Rated Outperform at Oppenheimer; PT $16

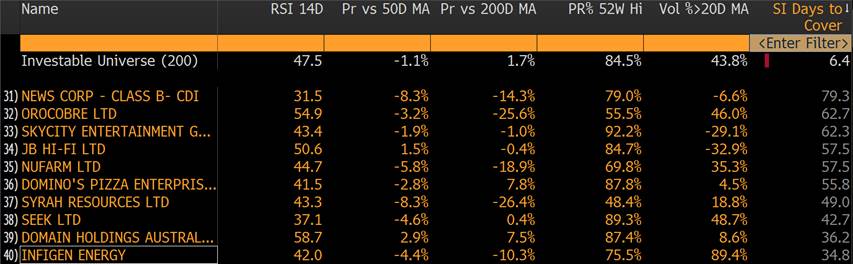

TOP 10; Below are the Top 10 performers from the ASX 200 year to date, Top 10 cheapest stocks in terms of forward P/E, Top 10 forecasted yield, & the Top 10 biggest shorts, in terms of days to cover. In terms of shorts, days to cover is worth tracking given it puts the total volume of shorts in context to the usual daily volume of the stock.

Top 10 performers year to date – clearly dominated by tech and doesn’t really offer any new insight

Top 10 cheapest – in terms of forward Price to Earnings (P/E) – stocks that interest us on the buy side include BSL, JHG, WHC, SVW, ECX & AWC. On the sell side, QAN & LYC

Top 10 Yield – in terms of forecasted dividend yield from here. Dividend traps include G8 & AMP

Top 10 Shorts – in terms of days to cover – the last column is the main focus here detailing to number of days it would take for all shorts to cover.

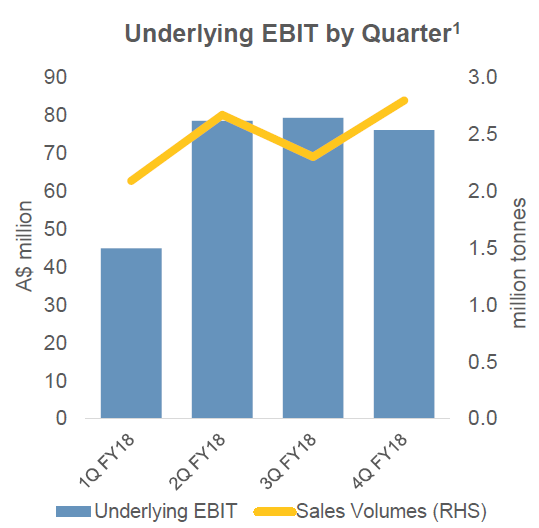

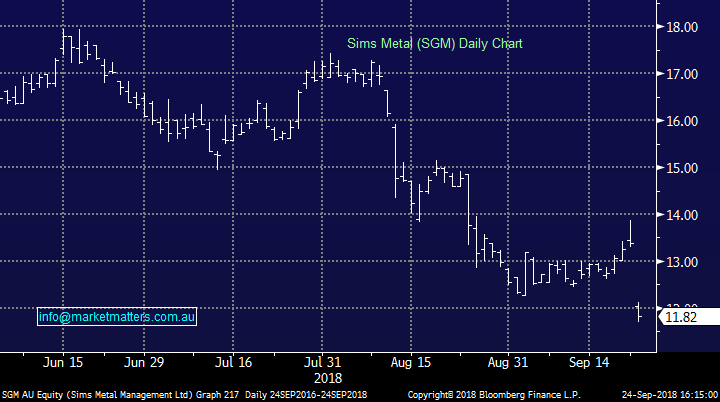

Sims Metals (SGM) $11.82 / -11.66%; Metal recycling company Sims was lower today after it warned the market of a weaker than previously expected first quarter of FY19 . The company blamed the weak performance on their SA Recycling joint venture based in the US which has seen volumes fall on the 4th quarter 2018. EBIT for the 1st quarter is expected to be between $58m & $63m above 1Q18, but well below the remaining quarters of FY18. The joint venture has seen recycled metal intake volumes fall while sales of Zorba, a mixture of non-ferrous metals mostly made up of Aluminium, has weakened while the company looks to produce a higher quality product.

Source; Sims Metals FY18 Results

In the FY18 result, the company guided for this quarter to be broadly in line with 4Q18, with the new update representing around a 20% downgrade for the quarter. While it is a poor update, this is a volatile business particularly on a quarterly basis – big swings are not uncommon. The scrap market has been weak for some time as China reduces its scrap metal processing capacity and discounts between scrap and new product blow out - Sims has clearly felt the brunt of it. This downgrade may be an opportunity to buy, although it would be against the trend and high risk.

Sims Metal (SGM) Chart

Lynas Corporation (LYC) $1.715 / -18.33%; Media reports and a rebuttal from Lynas Corporation has caused a wave of selling today with the rare earths producer currently trading around -21%. Reports from Malaysia attacking Lynas’ operations, where they process a variety of minerals from their WA mine, as unsafe and environmentally damaging to the area. Although a formal review has not been announced, Lynas had noted that the new Malaysian Government was known to be more environmentally conscious, while also highlighting that licence renewals had been delayed longer than expected.

The plant has been running since 2012 and has attracted a lot of unwanted attention due to its environment footprint. Waste from the facility can be highly radioactive and locals fear that this could contaminate the area, particularly while the company is yet to fully pay a $US50mil environmental bond. An inquiry would create an issue for Lynas – as has been evidenced in the past hence the move today in the stock. In recent times, Lynas was seen as a net beneficiary to the latest round of US tariffs on China which initially included rare earths. Now they have been hit with the double whammy of rare earths being left off the final list and now the risk of an evaluation into its Malaysian operations.

Lynas (LYC) Chart

OUR CALLS

We added the iShares Emerging Markets ETF (IEM.AXW) to the Growth Portfolio today with an initial 3% weighting. ETFs are traded on the ASX with market makers. When buying or selling an ETF investors can generally ‘get set’ in the midpoint between the bid & ask / the buy and sell price of the market makers. Generally there is no need to hit the ask as some traders did today (as shown below)

In the example below which was the market in IEM this afternoon, we saw traders hit the $58.96 offer price when generally an order would have been filled at around $58.91 – which is the mid-point between the market maker at $58.86 and the market maker at $58.96. Although only a small difference, watching the pennies over time does pay off!

Source; Iress

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.