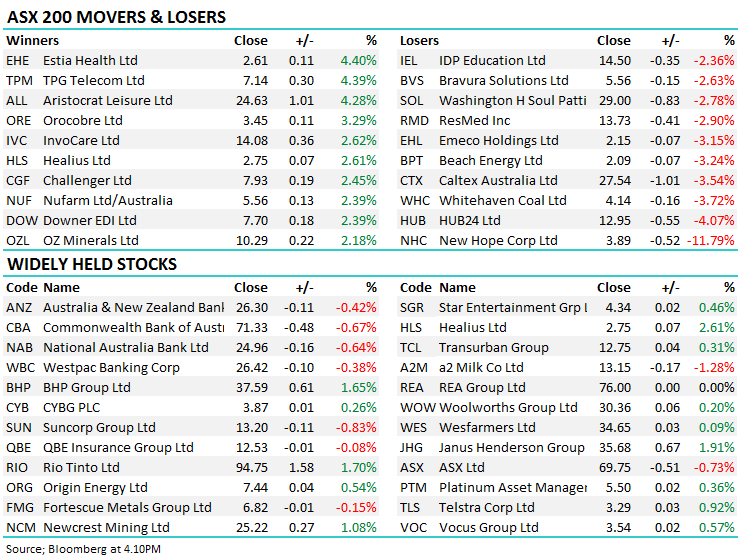

China snubs Aussie Coal (FMG, NHC, WBC, CTX, WTC, HSO)

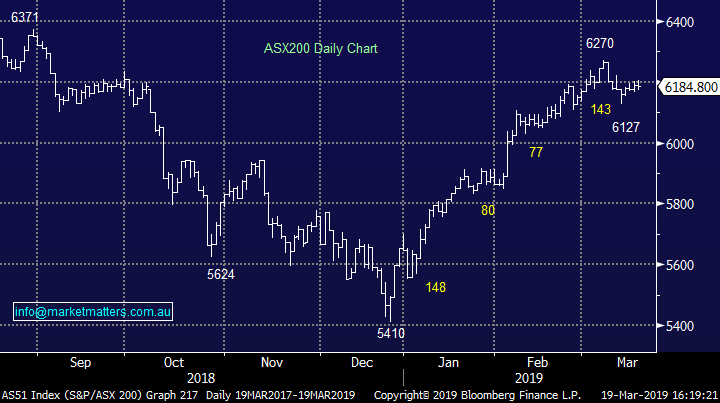

WHAT MATTERED TODAY

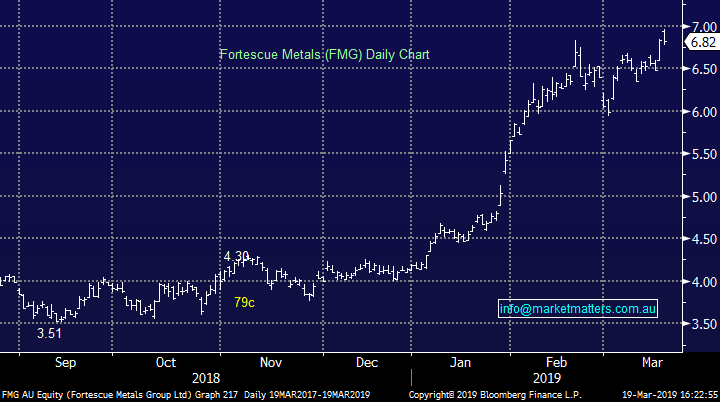

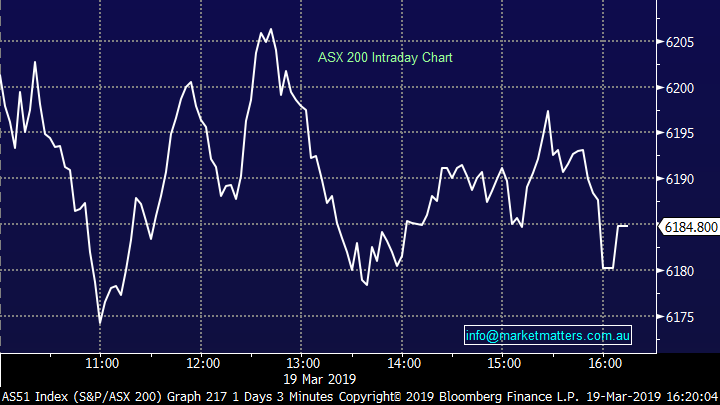

Another very choppy session for the ASX with a lot going on under the surface yet the index finished fairly flat on the day. Banks were weak and the market finds it hard to rally when banks are offered + there was another decent seller of SPI Futures at stages throughout the day – 1000 lots done this morning in 10 mins whacked the index down 25points in short order. This looks like an overseas seller getting set through futures – the sell Australia call once again rearing its head following a period of outperformance. Our preferred scenario remains a pullback from here, although dips are still being bought even through rallies are being sold.

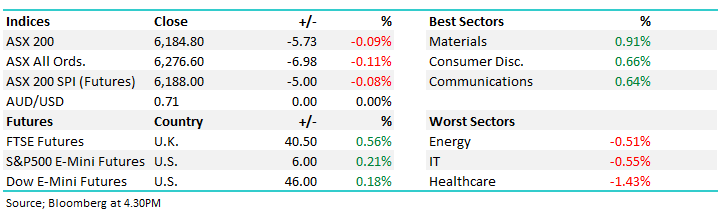

The banks took -6 index points from the ASX 200 offset by the large cap resource stocks that performed well once again. BHP +1.65%, RIO +1.70% while FMG hit an early high of $6.96 before reversing and closing down 1c at $6.82. As we suggested on the Weekend and reiterated this morning ~$7 is the technical sell point for FMG and today that played out. We had FMG’s CFO in at lunchtime today and while they’re enjoying the Iron Ore price tailwind, they’re certainly not expecting the strength to continue unabated.

Fortescue (FMG) Chart

US Futures were flat throughout our time zone while Asian markets were a tad lower.

Overall today, the ASX 200 lost -5points or -0.09% to 6184. Dow Futures are up +27pts / 0.10%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Newhope Coal (NHC) –11.79% Reported first half earnings today which were okay however the company said that Australian coal cargoes are being diverted away from China to countries including Japan and South Korea. NHC’s revenue from Japan was A$262.9m in the six months through January, up from A$188.2m a year earlier while revenue from China was A$11.8m, down from A$78.7m. So – there are curbs coming from China and this is impacting Aussie Coal stocks, Whitehaven also hit today down -3.72%. Coal stocks now look technically bearish.

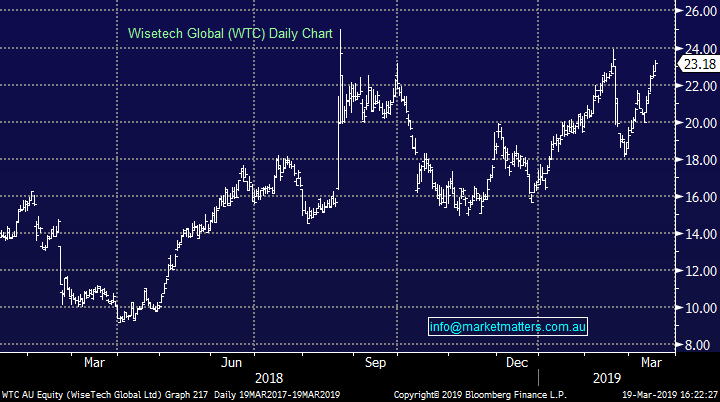

WiseTech (trading halt) – is kicking the can around for $250m from institutions + another $30m from retail investors in another example of a hot tech stock taking advantage of current market buoyance, and rightly so. The bookbuild expected to involve between 3.9-4.1% of existing WiseTech shares in issue, based on an indicative price range of A$20.30-$21.50 per new share which represents a discount of 7.2-12.4% on last closing price. They also reiterated prior guidance of FY19 revenue A$326m-$339m and Ebitda A$100m-$105m with the proceeds of the raise being used in the continued disciplined execution of growth strategy….i.e. nothing specific but more acquisitions to come.

WiseTech (WTC) Chart

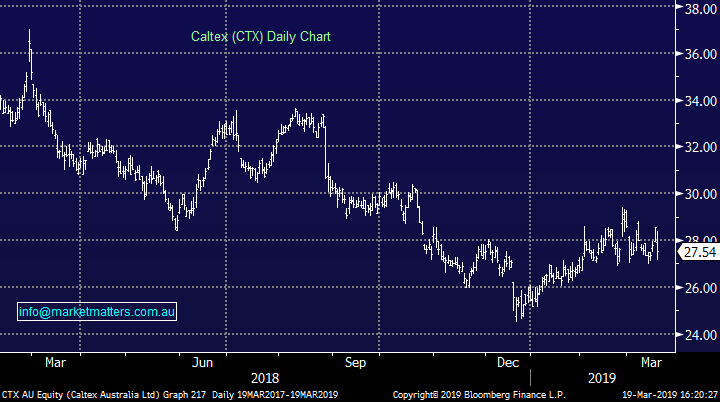

Caltex -3.54% hit today on news that 1Q Retail Fuel Margins have softened due to the rapid rebound in crude oil price and competitor activity. While CTX remains cheap + they have a buy-back under way, weak margins on fuel and a difficult operating environment in terms of retail means CTX should continue to struggle...

Caltex (CTX) Chart

Westpac -0.38% was sold off along with the rest of the banks plus today they announced plans to rid themselves of their advice business. They plan to restructure the wealth division by exiting advice while still retaining the BT Financial brand by dissolving the group between its consumer and business divisions. The exit strategy will include the option for salaried planners to move to Viridian where Westpac has been trailing an external referral system since early 2018. Last year the wealth business lost $53m – immaterial for the bank, but that is pre-remediation costs that has plagued each of the big 4’s wealth operations as a result of the Hayne Royal Commission. The total loss was $190m last year, rising from a $48m loss in FY17. The bank still plans to invest in robo-advice technology, while they'll integrate the superannuation, platform and private banking areas into to the business division and insurance will be managed from the consumer banking division. This hits WBC earnings by around 3% in FY19 with no impact on outer years.

Healthscope (HSO) unchanged today with rumours that one of the two suitors in the takeover battle has stopped work on the deal. To recap, private equity firms BGH capital and Brookfield have been in a standoff over Healthscope for almost a year now, with the latest offer from Brookfield under a scheme of arrangement at $2.50/share (or off-market acquisition at $2.40) being unanimously recommended by the board last month.

BGH is still at the table, however does not appear to be offering anything better for HSO shareholders, so the only thing in Brookfield’s way now appears to be the BGH consortiums ~19% stake in the company. Unlikely to be a big enough holding to block the takeover – and unlikely that the consortium would not vote for the offer now that they are out of the race and would be looking to sell down in any case. A scheme meeting to vote on the Brookfield bid is expected to be held in May / June this year. The transaction will play out in one of 2 ways.

1) a Scheme of Arrangement valued at $2.50/share ($2.465 + $0.035 interim dividend) which requires 75% shareholder approval or

2) a simultaneous takeover offer valued at $2.40/share ($2.365 + $0.035 div) which requires only 50.1% shareholder approval. We would be selling at current levels.

Broker Moves:

· Sydney Airport Cut to Hold at Deutsche Bank; PT Set to A$7.50

· Beach Energy Downgraded to Sell at Morningstar

· Technology One Upgraded to Buy at Bell Potter; Price Target A$8

OUR CALLS

No changes today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.