China Fires Back (MQG, IAG, CYB)

WHAT MATTERED TODAY

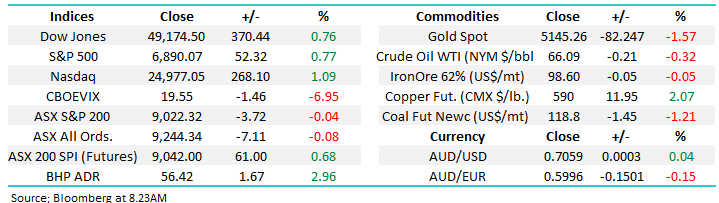

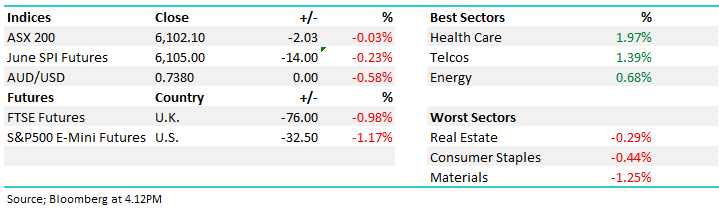

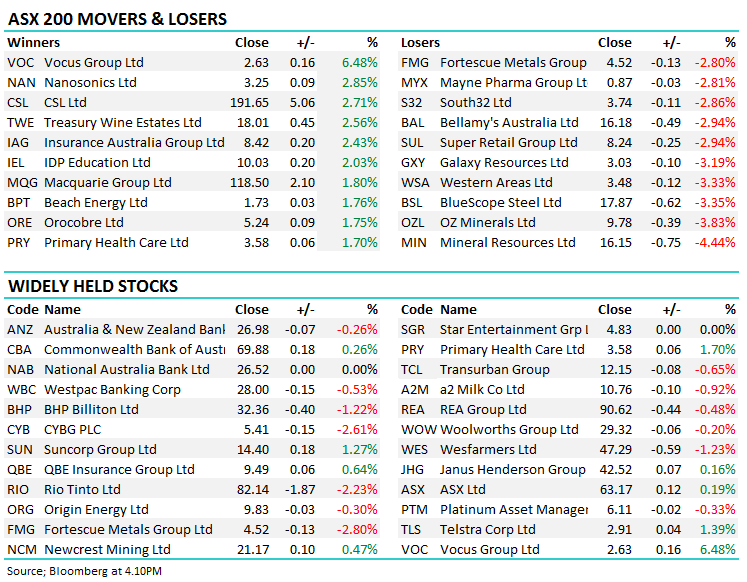

Australian stocks enjoyed a strong hour or so of outperformance this morning with the banks again offering support to the index, however the war of words between Donald Trump and his Chinese counterparts over trade intensified putting pressure on US Futures which turned sharply lower – Asian markets also copped selling while Gold rallied during our time zone. The steepest slides were seen in Hong Kong and China -- where the Shanghai Composite Index headed for a two-year low.

On the local bourse we saw some aggressive late selling, although we slid for most of the session from our early highs - the defensive areas saw most love, Healthcare enjoying an uptick in volatility and a bounce back in Ramsay Healthcare (RHC) while the Telco sector was okay, Telstra (TLS) adding +1.39% to close at $2.91 ahead of a much anticipated strategy day tomorrow. Andy Penn is clearly in the pressure cooker, more so now given the stock has rallied ahead of the update! One we’ll be watching very closely tomorrow and I’ll provide updates throughout the day.

Overall the ASX 200 index lost -0.03% or -2 points to 6102 while the DOW Futures are trading down -368pts at time of writing.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; The Morgan Stanley upgrade of Macquarie garnered most attention today – a topic we’ve covered in more detail below, while analysts seem to like the CYBG deal for Virgin Money despite the share price feeling the pinch today.

Here’s the current broker calls….

· Macquarie Upgraded to Outperform at Morgan Stanley PT A$130.00

· Super Retail Downgraded to Neutral at UBS; PT Set to A$8.70

· Senex Upgraded to Buy at Canaccord; PT A$0.50

· Ramsay Health Upgraded to Buy at Wilsons; PT A$65

· Mayne Pharma Downgraded to Sell at Bell Potter; PT A$0.77

· Mirvac Group Downgraded to Neutral at Credit Suisse; PT A$2.38

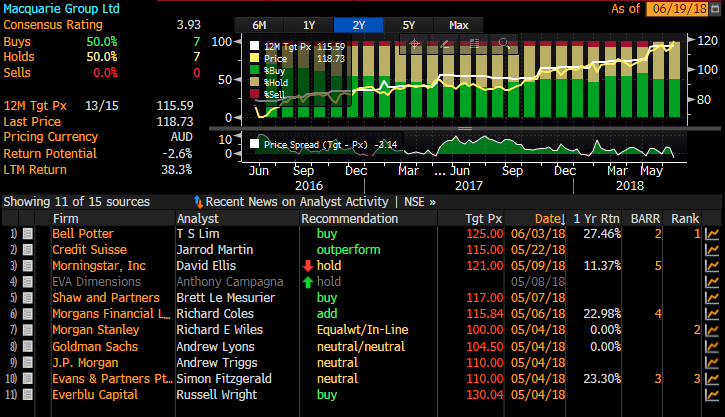

Macquarie (MQG) $118.50/ 1.80%; Morgan Stanley have put out a bullish note on Macquarie (MQG) today, pinning a $130.00 price target on the stock. They give 10 reasons to underpin their bullish stance, notably - (1) Earnings and ROE upgrade cycle continues; (2) Geared to the real economy, not just financial markets; (3) Leading Alternative Asset Manager; (4) Lumpy revenues pipeline is growing, reducing near-term earnings risk; (5) Initial guidance is usually conservative, implying upside risk to consensus; (6) 5 year growth potential gives us longer term confidence; (7) Offshore earner; (8) Leveraged to segments with structural growth; (9) Flexibility on the compensation ratio; and (10) Strong capital position. (source Morgan Stanley)

Their earnings expectations now sit about 10% above consensus – a bullish stance (clearly)! Here’s current broker calls…although Morgan Stanley is hot off the press so has not yet been updated on Bloomberg.

Source; Bloomberg

While the trend in Macquarie is clearly bullish, and Morgan Stanley make some good points, we can’t help but think their change of stance will prove to be the tipping point for the stock – or in other words, the catalyst for a meaningful high in Macquarie. Equity markets were weak today led lower by US Futures on another Trump trade tantrum – with the futures pricing a drop of -368pts when the Dow Jones opens in the US. Macquarie is an equity linked play, and any weakness in the market should be amplified in the MQG share price. We sold too early, however we don’t share the short term optimism from MS.

Macquarie (MQG) Chart

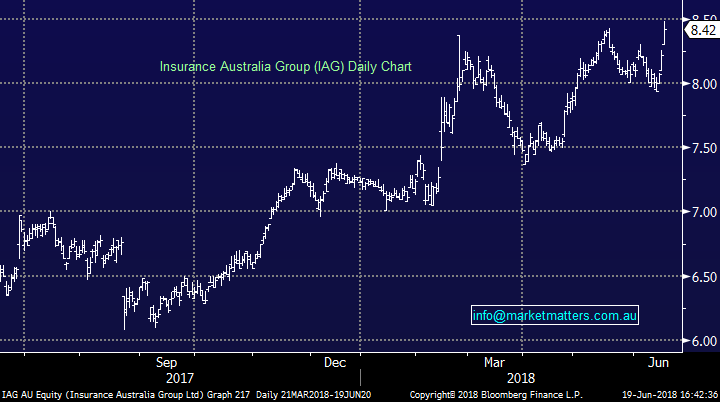

Insurance Australia (IAG) $8.42 / +2.43%; IAG has sold out of its businesses in Vietnam, Thailand and Indonesia in two separate transactions following a strategic review into its Asian operations. The sales will add $200 mil to next year’s NPAT, coming 6 months after the review was announced. IAG still hold minority stakes in businesses in Malaysia and India, however today’s announcement sees the end of IAG controlling assets in the region.

Overall, the review found the businesses weren’t contributing to the company’s growth in a meaningful way, and the fund’s generated will find their way into shareholder’s pockets one way or another. Another example of the ASIAN push for growth, followed by the RETREAT! It’s a positive for the company in the shorter term given likely capital management, however we are reluctant to chase the share price at current levels, preferring Suncorp and QBE for insurance exposure.

IAG Chart

Clydesdale Bank (CYB) $5.45 /-2.61%;Clydesdale’s takeover of Virgin Money is all but set after both board’s unanimously supported the deal for a new 1.2125 CYB shares for each Virgin Money share. It’s unusual for a takeover to be a win for both companies but this one seems to be. From the Virgin side, the +20% rally in the stock price obviously helps the all scrip deal while CYB will benefit from the Virgin brand and distribution channels. The combined entity will now have a much larger revenue and funding base and will become the 5th or 6th largest UK Bank.

This deal makes sense because the company with the inferior performance (CYB) was trading at a higher share price multiple while the company with the superior performance but lower share price multiple was the target (Virgin Money). The former is substantially owned by Australians and the latter is not. CYB announced cost synergies of £120M, which represents one-third of the Virgin Money cost base. Such a planned reduction is common place amongst takeovers of financial companies.

CYBG (CYB) Chart

OUR CALLS

No changes to the MM Portfolio’s today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here