China facing stocks feel the brunt as the Chinese market recommenced trade (BHP, IEM)

WHAT MATTERED TODAY

**Firstly, apologies for a late report this morning. Our overzealous email security picked up a term used in a subscriber question and quarantined the report before it was sent**

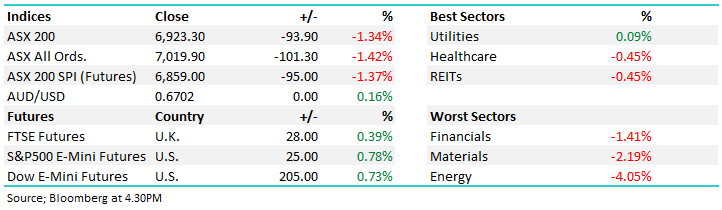

Following on the from weakness we saw overseas on Friday where the Dow Jones fell more than -600pts/-2%, Australian stocks were under the pump today, particularly the sectors leveraged to the Chinese economy. After a very weak open, the ASX 200 put in a low below 6900 around midday and then ebbed and flowed throughout the session, with some tentative buyers stepping up to the plate. MM was active the morning increasing weightings to 3 stocks and by the end of the session that felt a reasonable move. The Chinese market came back online at 12.30 today after a week off for Chinese New Year, and unsurprisingly, stocks fell more than 9%. The Chinese open actually corresponded with the Hang Seng trading higher while our own ASX rallied from that low point of the session, clearly the market was positioned for more on the downside amongst Chinese equities. US Futures also rallied during our time zone.

At a sector level today, Chinese exposure was clearly on the nose, Copper, Iron Ore & Oil down sharply in Asian trade - resource stocks still under pressure particularly Copper names like Oz Minerals (OZL) which fell more than 4% however we did see the bigger more diversified players find some love early with the low for the day happening at the start of trade. Most IT stocks did well in a soft market, ditto for the Telcos and some of the more defensive areas like Gold which performed nicely, Evolution up by +2.96% on the session while Service Stream (SSM) also looked the goods today adding nearly +5% in a weak market – MM holding 2 of the top 4 stocks in the ASX 200 today. Elsewhere, banks were okay, property stocks were relative performers on decent building approvals data out for December while the more volatile mining services stocks came under pressure. All up, obviously a weak session but there wasn’t a lot of panic to it.

Overall, the ASX 200 fell -93pts / -1.34% today to close at 9623. Dow Futures are trading up by +200pts

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

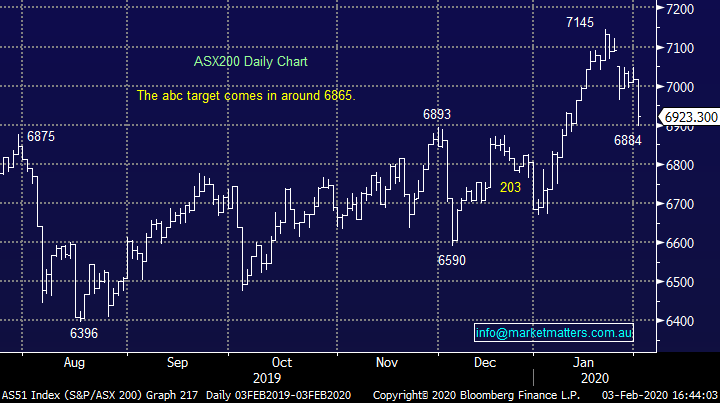

Macro Driven Day: Day’s like this are driven by the prevailing macro news flow and on the whole, these were clearly negative. Coronavirus spreading, the majority of boarders are in lock down crippling global travel and now a lot of businesses in China are shutting their doors while things settle down. Chinese stocks down 9% on open following a week off was to be expected, and as we wrote this morning, it was probably a better outcome than many thought. While a decline of 90+ points for our market is clearly a weak session, the US Futures did rally through our time zone and the rally stepped up around the time the Chinese market opened, again, implying that the ‘herd’ was expecting a more aggressive decline.

Shanghai Composite Chart

The PBOC injected 1.2 Trillian Yuan (about $250b) into their financial system today to maintain adequate liquidity, a sign they’ll do what it takes to ensure the juggernaut continues to perform while locally, a rate cut is not well and truly on the cards, not tomorrow but certainly in the next few months. Ultimately assets will be priced off interest rates which are more likely now to stay lower for longer while any short-term impact on growth will likely be met with stimulus from central banks globally.

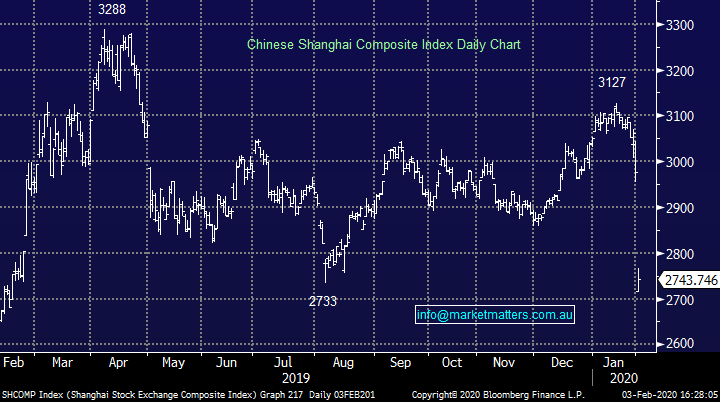

While it’s a hard environment to remain bullish in, buying stocks on the back foot continues to make sense. One position we added to today was BHP in our Growth Portfolio.

BHP Billiton (Chart)

Broker moves;

- Oil Search Cut to Underweight at JPMorgan; PT A$6.85

- GUD Holdings Raised to Neutral at UBS; PT A$11.50

- GUD Holdings Cut to Sell at Morningstar

- ResMed Cut to Neutral at UBS; PT $174

- Beach Energy Cut to Underweight at Morgan Stanley

- Caltex Australia Cut to Equal- Weight at Morgan Stanley

- Senex Raised to Overweight at Morgan Stanley

- Autosports Cut to Market-Weight at Wilsons; PT A$1.69

- Sonic Healthcare Cut to Sell at Morningstar

- Newcrest Raised to Hold at Morningstar

- Bluescope Raised to Hold at Morningstar

- Panoramic Resources Cut to Reduce at Hartleys Ltd

- Pilbara Minerals Cut to Reduce at Hartleys Ltd

- Metals X Cut to Hold at Canaccord; PT 18 Australian cents

OUR CALLS

We added to existing positions in Oz Minerals (OSL), Boral (BLD) & BHP (BHP) in the Growth Portfolio today.

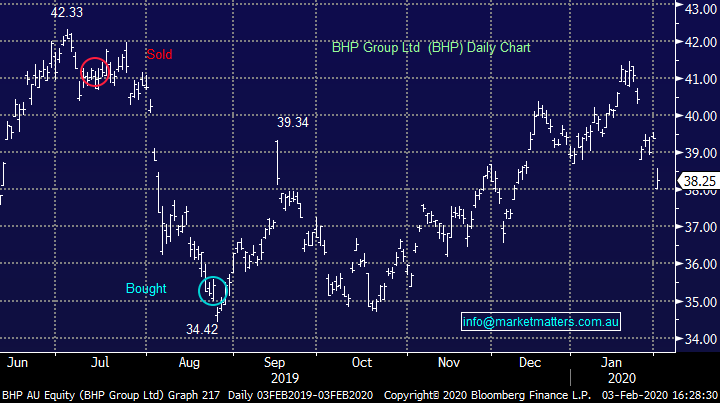

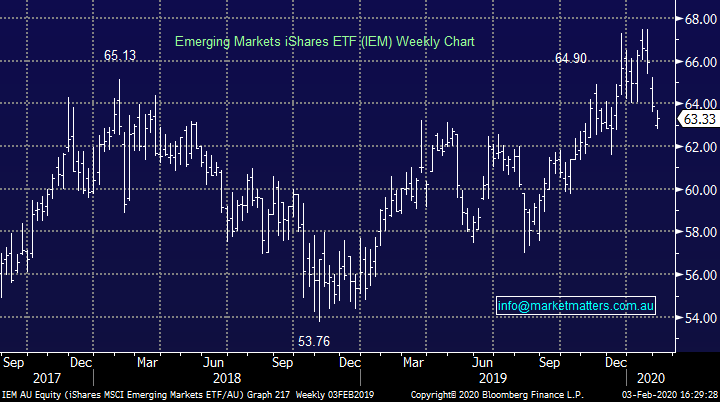

We were looking to add to our emerging markets exposure in the Macro ETF Portfolio today, however spreads were fairly wide. We will revisit tomorrow.

Emerging Markets Chart

US Futures are trading strongly at our close, for that reason, we will hold fire on our International Equities Portfolio today.

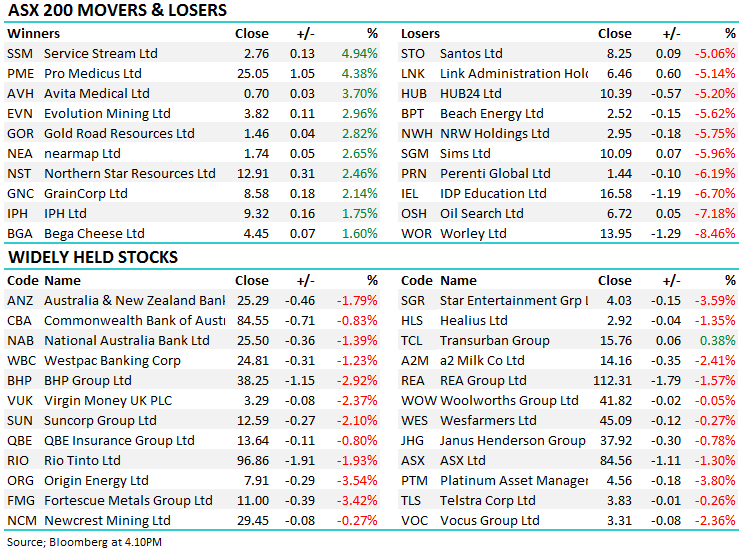

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.