Centuria Office (COF) fund shows not all land was created equal

Centuria Office REIT (COF) +7.38%

Reported full year earnings which were surprisingly upbeat despite all the doom and gloom in the office landlord space. The trust owns and operates 23 high quality office buildings across the country with 98.1% of the space leased at the end of the period and a WALE of 4.7 years. Despite the negativity surrounding rent collections, COF managed to collect 92% of lease commitments through the last quarter of the financial year thanks to nearly 80% of the income “derived from, multinational, ASX and government tenants.”

Gearing remains reasonable at 34.5% with interest cover over 6x. Funds from operations (FFO) at 18.6c/unit was slightly behind guidance provided at the half year, however the total distribution for the year at 17.8c was in line. Centuria continue to talk up the office market despite the obvious concerns around absorption of space. While the change to office leases may not be as drastic as, say, the impact on retail landlords, demand for square meterage will go through a structural shift as people return to the workplace after the pandemic. As a result, risks remain around future earnings and they opted against providing FFO guidance for the year ahead. COF did guide to 16.5c of distributions through FY21, which puts it on a very attractive yield of 8.5% at today’s close.

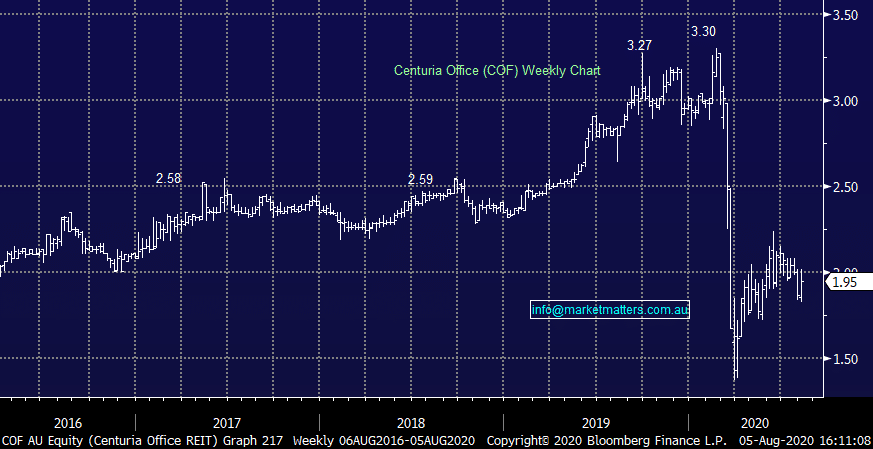

Centuria Office REIT (COF) Chart