Central banks spook markets, biggest fall since 87 (COH, SGR, CGF)

WHAT MATTERED TODAY

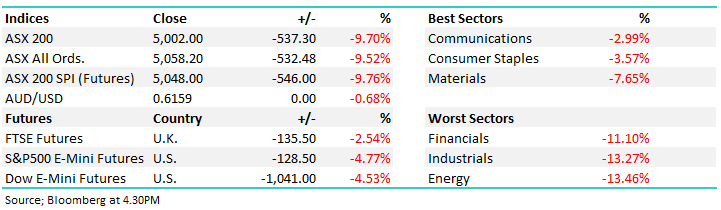

Friday a distant memory as selling resumed on the ASX today, the index suffering its worst decline since 1987 as central banks hit the panic button, cutting interest rates and launching stimulus.

- New Zealand cut interest rates by 0.75% to 0.25

The US cut interest rates to near zero and launched a large asset purchase program

The Bank of Japan raised its ETF annual purchase target to 12 trillion yen and said it will take additional easing measures as / when needed

The RBA is expected to cut rates again this week, while the Australian Government is about to launch another round of stimulus

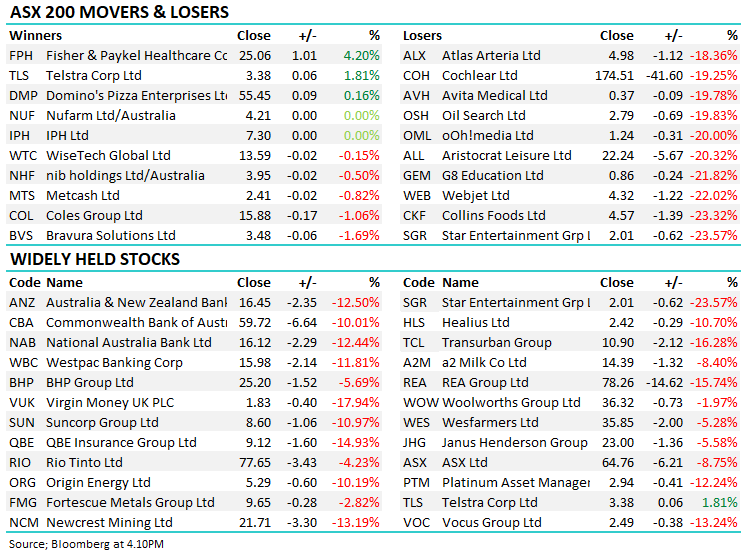

All this lead to a big decline in bond yields with US Treasury Yields on track for the biggest one day drop since 2009, risk assets (equities) were sold hard with just 3 stocks in the ASX 200 closing in the green, while 6 stocks in the top 200 closed down more than 20%. Also adding to the pressure was US Futures which were limit down (a decline greater than 4.77%) so they were halted before our market opened, meaning that selling was targeted into other markets, like our own.

Asian markets were weaker today, although in a relative sense were fairly calm, Japan off just 1.32% thanks to BOJ buying wile Chinese stocks were off by around 2%.

In terms of sectors, Energy, Industrials & Financials down more than 11% a piece, that’s not something you see often.

From the 7197 high set just 17 trading ago, the market closed today at 5002, down 2195pts / 30.5%

Overall, the ASX 200 fell -537pts / -9.70% today to close at 5002 - Dow Futures are trading down -1041pts/-4.53%, although that is limit down.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Stocks Moving: In a sell-off like this there’s very few safe havens and today was a clear example of that. Telstra (TLS) closed up, so did Dominoes (DMP) which makes sense with the country about to start working from home, elsewhere it was tough across the board, Cochlear (COH) hit hard -19.25% after scrapping guidance, the hearing implants provider expects a significant hit to sales from the coronavirus and has thrown away previous expectations.

Cochlear (COH) Chart

The Casino’s have also been hit hard, Crown (CWN) losing 11% today while Start Entertainment (SGR) was hit harder, down by 23.57% after rolling out further preventative measures, including the deactivation of every second gaming machine and electronic table game to create additional distance, reducing the capacity at table games, including increasing distancing at seated table games between players and restricting the total number of players at each stand up table game and restricting the number of patrons in food / drinking venues. This is an area hit very hard in recent times with the virus simply another major headwind.

Star Entertainment (SGR) Chart

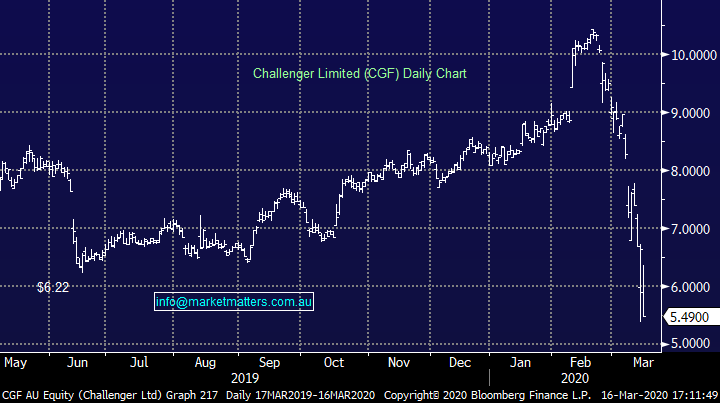

Challenger Group Financial (CGF) another company out today, along with many others that flagged an earnings hit, falling ~17%. CGF had recently upped full year guidance but have now pared that back - CGF is a complicated business with large exposures to a cross section of markets which underpin their annuities, hard not to see them hurting more in this sort of environment.

Challenger Group Financial (CGF) Chart

BROKER MOVES:

· NAB Raised to Overweight at Morgan Stanley; PT A$19.50

· Treasury Wine Raised to Buy at UBS; PT A$15.40

· APA Group Raised to Buy at UBS; PT A$11.40

· Santos Raised to Add at Morgans Financial Limited; PT A$7.97

· Boral Raised to Outperform at Credit Suisse; PT A$4.70

· Sydney Airport Raised to Neutral at Credit Suisse; PT A$6

· South32 Raised to Outperform at Macquarie; PT A$2.24

· JB Hi-Fi Raised to Overweight at JPMorgan; PT A$38

· Fortescue Raised to Buy at Bell Potter; PT A$9.10

· IPH Raised to Buy at Bell Potter; PT A$8.50

· Sonic Healthcare Raised to Buy at Jefferies; PT A$31.45

· Ansell Raised to Buy at Jefferies; PT A$31.45

· CSL Raised to Buy at Jefferies; PT A$315.95

OUR CALLS

No changes domestically today

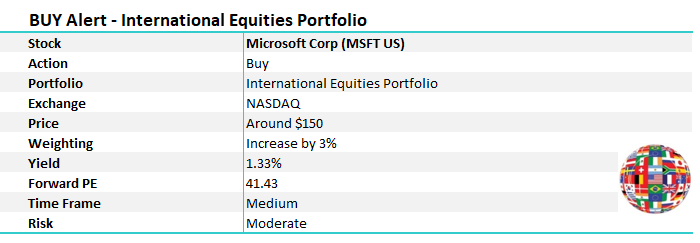

We are increasing our position in Microsoft in the US tonight, taking the position to an 8% portfolio weighting.

Microsoft (MSFT US) Chart

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.