CBA’s dividend can’t stop a new high (WTC, WES, VOC, CWN)

WHAT MATTERED TODAY

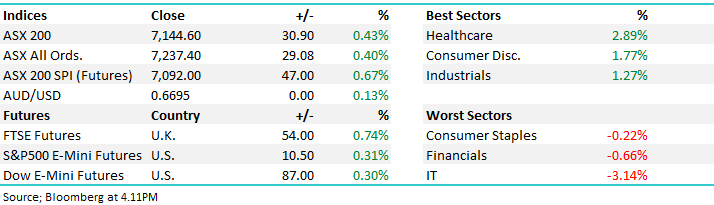

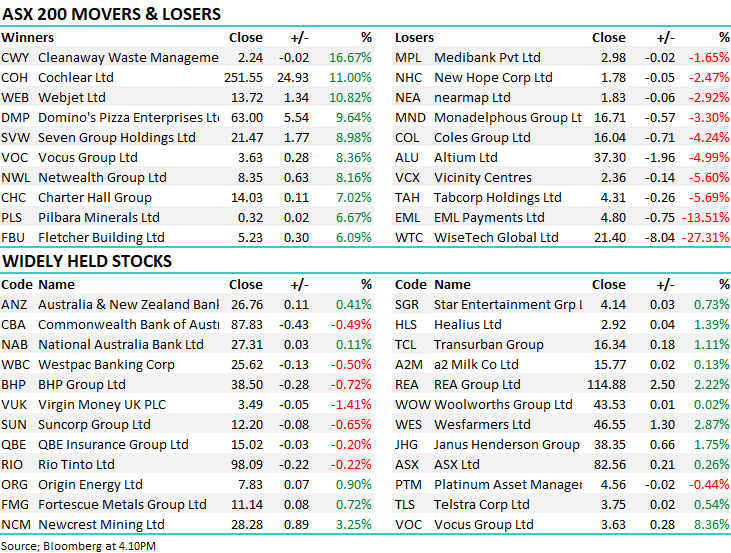

A reasonable day for the index today despite the heavyweight CBA going ex-div for $2. The biggest bank took 14pts off today but was little resistance to the broader market which set a (marginal) new all-time high for the close. Strength came from healthcare in particular, where CSL and COH both hit all-time highs. Consumer discretionary names were dragged higher by great results out of Wesfarmers and Dominoes. Tech slumped despite the broad rally as Wisetech tumbled more than 25%.

Reporting schedule available here: CLICK HERE

Overall, the ASX 200 rose 30pts / +0.43% today to close at 7144. Dow Futures are trading up +87pts/+0.30%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

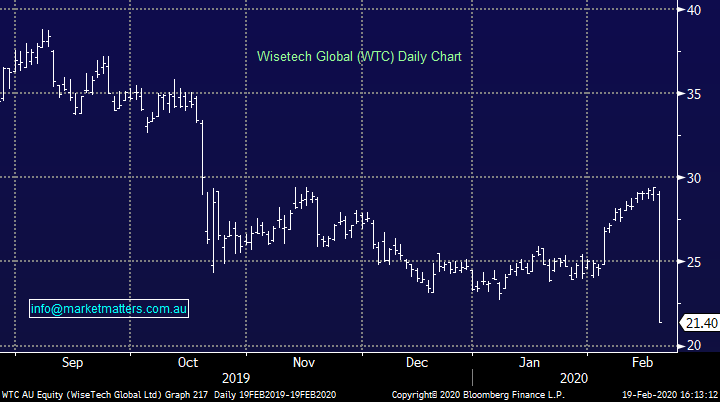

Wisetech (WTC) -27.31%: today’s biggest loser was logistics tech company Wisetech which missed at their half year results and came in below consensus for full year guidance as corona impacts global supply chains. At the half year, revenue came in at $205.9m dropping down to NPATA of $33.5m. EBITDA margins tightened by 1bp as costs ran ahead of revenue with a number of new rollouts happening in the half. Their main product, CargoWise, delivered organic growth of 24% as customers increase their use, new features are integrated, and new customers come online. The big concern for the market though was the downgrade to guidance. Revenue guidance for the full year was dropped to $420-450m from $440-460m, while EBITDA is now expected in the range of $114-132m down from $145-153m. consensus was sitting above guidance for revenue and near the top end for EBITDA, so it was a 6.5% & 18.9% miss to the street respectively.

Wisetech (WTC) Chart

Wesfarmers (WES) +2.87%: first half result for Wesfarmers reasonably close to market’s expectations, however the stock was bid up one some signs the slowdown in Bunning’s sales growth may be behind it. Revenue and earnings were both up around 6% on a comparable basis. Bunnings, which now accounts for around half of the earnings, saw EBIT rise around 3% while same store sales grew 4.7% for the half. This compares to +4.0% in 1H19 and +3.8% in 2H19 with the company attributed the good result to improvements both in store and online. Kmart Group, which includes Target, saw revenue up 7.6% which was all driven by a standout half from Kmart, while Target slipped with the company not expecting a rebound any time soon. The last retail brand is Officeworks which added 4% to EBIT in the half to beat expectations.

Wesfarmers smaller chemicals, energy & fertilizers and industrials & safety units continue to track higher. They continue to splash cash here to diversify their earnings, acquiring lithium name Kidman Resources in the half. Interestingly, alongside the announcement Wesfarmers sold part of their stake in Coles (COL) a day after their result. The 4.9% stake represents around a third of the holding and was sold at $16.08 – Coles closed the day down 4.24%, a small discount to the deal.

Wesfarmers (WES) Chart

Vocus Communication (VOC) +8.36%: A good day for the telco after delivering their 1H20 results this morning which carried the headline ‘Clear progress on Vocus Turnaround’. They reported EBITDA growth of 11% on the back of 6% revenue growth. In terms of guidance, they flagged underlying EBITDA for the group in the range of $359-$379m, which implies a small ~2% upgrade to current market expectations of $363m, while progress on debt reduction was also a positive. The underlying tone of this morning’s update implies the business is turning after a tough period, a good outcome today for VOC.

Vocus (VOC) Chart

Crown (CWN) -0.34%: A weaker than expected 1H20 result for Crown today with mixed operating conditions across their properties. They saw overall growth in Perth gaming, Melbourne was flat on the period, while VIP took a big hit down by 34% relative to the prior year, however the fewer VIP gamblers that were playing had worse luck (Crowns benefit) therefore underpinning an actual rise in VIP revenue. All in all, not a great half for CWN although a lot of bad news currently in the price.

Crown (CWN) Chart

Elsewhere in reporting:

Lovisa (LOV) +2.91%: jewellery retailer’s global push helped lift first half profits ahead of expectations, opening 35 stores adding 22% to global revenue. Warnings around a corona virus impact didn’t stop the market enjoying the result.

Fortescue Metals (FMG) +0.72%: Good / inline result, dividend 76cps was big, market was at 61cps however our analyst bullish at 90cps. At 76cps, that’s 6.79% FF yield for the half. Rallied early but pullback hard showing how bullish the market was here.

Corporate Travel (CTD) +0.12%: Downgraded due to coronavirus however they were tracking towards the lower end of previous forecasts all the same. They now expect FY20 underlying EBITDA of $125-150m, the market was previously at $167m. That’s a 17% downgrade but the stock managed to close marginally higher on the day. Baffling.

Dominoes (DMP) +9.64%: Great result, same store sales growth of +4.1% for the half was strong while they also say for the start of the 2H they are printed SSS growth of 6.3%, that’s the key for DMP

Cleanaway (CWY) +16.67%: Strong beat at the profit line, mkt looking for 1H NPAT of ~$65m and they printed $76.2m, the integration of Tox Free was a concern in the mkt however they say that is on track. FY20 EBITDA guidance of ~$515-525m, market was sitting at $505m, a 3% upgrade. We hold Bingo (BIN) in the Growth Portfolio, they report tomorrow.

Stockland (SGP) +1.63%: Resides in the income portfolio, and delivered a decent result plus reconfirmed guidance for full year of funds from operations (FFO) growth of ~1%. NTA increased 2% to $4.12, dividend inline at 13.5cps for the half based on 84% payout ratio.

Pact group (PGH) +1.63%: No capital raise = positive, earnings okay, gearing heading in the right direction. The market has low expectations, stock should trade higher from here.

Tabcorp (TAH) -5.69%: Soft, NPAT at $213.5m v $221m exp, half year dividend 11cps fully franked, below the 12cps expected

EML Payments (EML) -13.51%: 1H EBTIDA up 42% to nearly $20m, with guidance at $39.5m-$42.5m for the full year, represents an 11% miss to market

Broker Moves:

· IOOF Holdings Raised to Buy at Baillieu Ltd; PT A$8

· Sims Raised to Neutral at UBS; PT A$10.80

· Ansell Cut to Neutral at Citi; PT A$32

· Ansell Cut to Underweight at JPMorgan; PT A$28

· Cochlear Raised to Outperform at Macquarie; PT A$250

· Cochlear Raised to Overweight at Morgan Stanley; PT A$251

· SG Fleet Raised to Outperform at Macquarie; PT A$2.60

· ResMed GDRs Cut to Equal- Weight at Morgan Stanley; PT A$24.30

· CSL Cut to Equal-Weight at Morgan Stanley

· Netwealth Raised to Neutral at Credit Suisse; PT A$7.90

· Netwealth Raised to Buy at Ord Minnett; PT A$8.72

· Netwealth Raised to Neutral at Evans & Partners Pty Ltd

· OZ Minerals Cut to Hold at Morgans Financial Limited

· Emeco Raised to Buy at Hartleys Ltd; PT A$2.66

· IGO Raised to Neutral at JPMorgan; PT A$5.70

· Western Areas Raised to Overweight at JPMorgan; PT A$3

· Beach Energy Raised to Add at Morgans Financial Limited

OUR CALLS

No trades today.

Major Movers Today – the NSR bid is a positive for ABP given their exposure to storage, creates a positive readthrough for storage valuations.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.