CBA in the crosshairs again…!

A soggy session for Aussie stocks today with what looked to be futures led (index selling) pressuring stocks early on and they failed to pick themselves up off the mat – until a slight whimper at the death. Iron Ore had a massive intra-day move today – up early and down late – a range of +6% to be trading -3% lower at time of writing . We talked about risk/reward in terms of Material stocks in todays Direct From The Desk recording (available below) and we continue to think that as the mkt has become bullish this space, we should be very vigilant about taking profits…

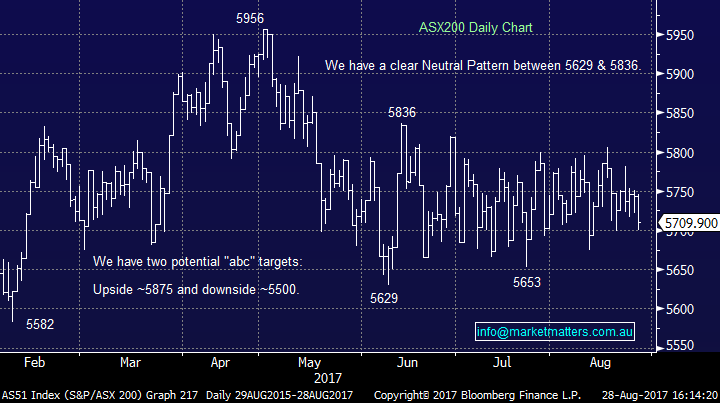

In terms of the overall index and as per comments in recent reports, the market remains range bound with the following technical levels playing out on the index;

1. Daily – Support 5629 – 5655 and resistance 5836 -5810.

2. Weekly – Support 5582- 5629 and resistance 5956 – 5909

Obviously reporting season has been key however looking from above, it’s been as per expected - nothing really out of the ordinary in aggregate terms. Shaw’s Head of research – Martin Crabb put it well in his Friday report…

1. Sales have come within 0.10% of consensus, EBITDA within 0.15%, NPAT within 0.70%. Yes there have been beats and misses, but at an aggregate level, earnings have been fine.

2. Not much change to 2018. Sales growth is expected to be 3.25% in FY18. It was 3.22% on June 30. 2018 EBITDA Margins have been revised from 26.47% to 26.15% and NPAT growth from 2.58% to 4.05% for the ASX300 since June 30 (and 3.70% on July 31).

3. Banks beat, miners missed, but no one cares because their cash generation was immense and they are not pi$$ing it up the wall for a change.

4. Most of the market’s growth is in the big banks and the small and mid caps.

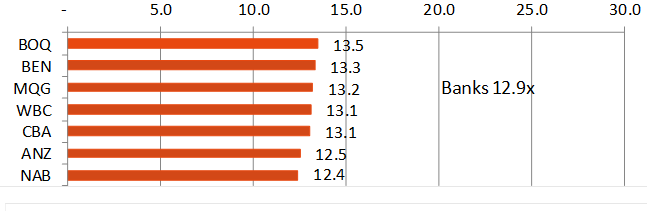

The Banks are clearly in focus at the moment, and you’d be forgiven if thinking that the resources actually beat forecasts and the banks missed, however clearly banks are on the nose, CBA with the biggest stench that was amplified today with APRA becoming the latest regulator to zone in - Ian Narev will be counting down the days! CBA typically trades at a PE premium of more than 1 P/E point versus the sector. This time last month it was trading on 13.7x versus ANZ, which was the cheapest at 12.4x, NAB on 12.6x, BOQ on 12.7x WBC on 13.0x and Bendigo on 13.1x – Now we have CBA at a very slight premium to the sector = value. It’s typical PE premium is there for a number of reasons, but in short they get better, more consistent returns over time and history has shown they can justify it. CBA trading inline with its peers is a clear opportunity, despite the near term headline risk…

Source; Shaw and Partners

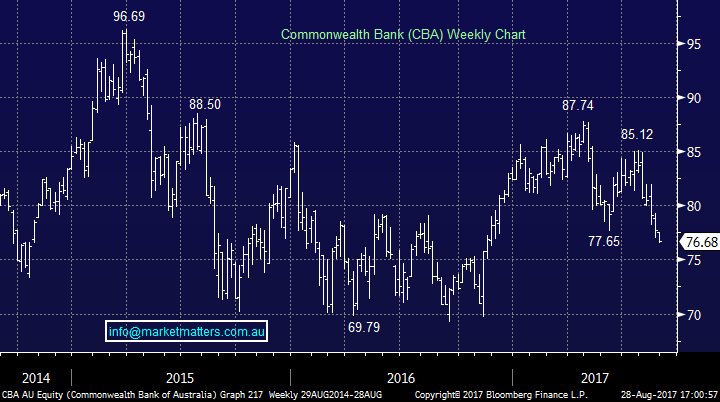

Commonwealth Bank Weekly Chart

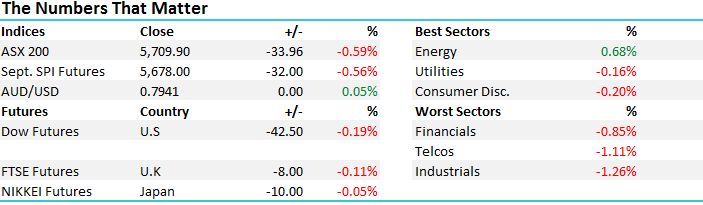

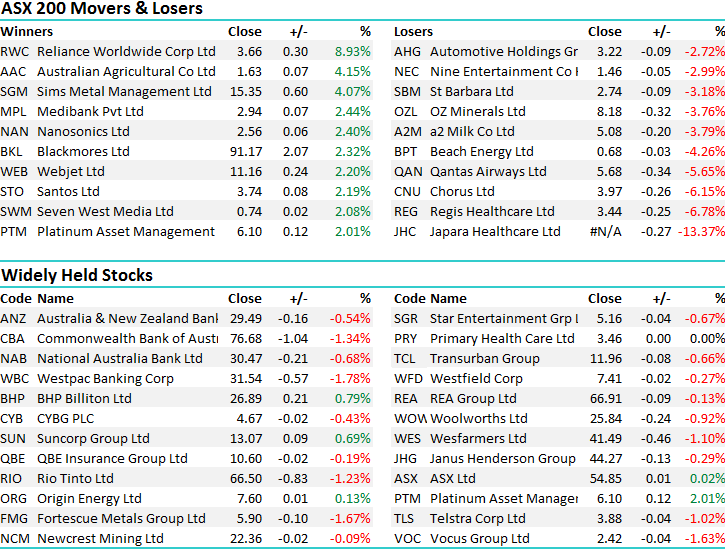

On the broader market today, the Energy stocks were the only sector to trouble the scorer adding +0.68% courtesy of a hurricane impacted Oil price while wost weigh was felt in the Industrials - an overall range of +/- 47 points, a high of 5746, a low of 5699 and a close of 5709, off -34pts or -0.59%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Direct From The Desk – Reporting season trends - Sydney Property – Our Positioning

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 28/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here