CBA drags market into the red (CBA, RWC, LLC, REA)

WHAT MATTERED TODAY

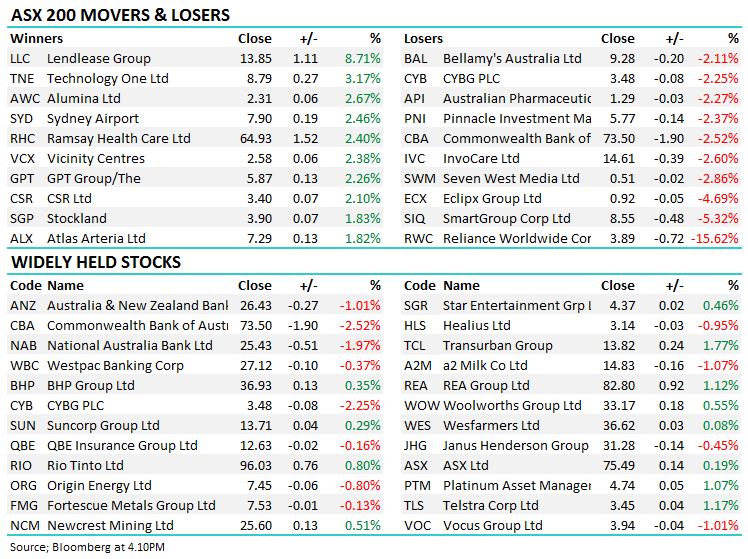

Another fairly busy session today with weakness in US Futures before our open this morning thanks to Trump’s tweets over the weekend ensuring we opened on the back foot, while a weaker than expected quarterly update from CBA had the banks in the crosshairs + throw in a downgrade for Reliance Worldwide (RWC) – the stock down -25% off the bat and there wasn’t a lot to like about today’s mkt in the early stages. The banks + Macquarie dragged the index down 30 points on the session (ANZ & MQG did trade ex-divi) with CBA doing most damage taking 11 points from the ASX 200 by the close – however it wasn’t all bad news with the market showing strength in the face of some pretty negative influences.

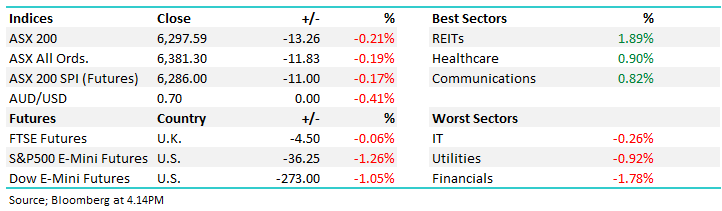

Overall today, the ASX 200 lost -13 points or -0.21% to 6297. Dow Futures are trading down -300pts / -1.15%.

It was clearly a resilient performance from the mkt today as we once again ignored the bulk of the weakness coming from US Futures during our time zone, while Asian markets were down, but not aggressively so. Hong Kong was closed for Buddah’s birthday!

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

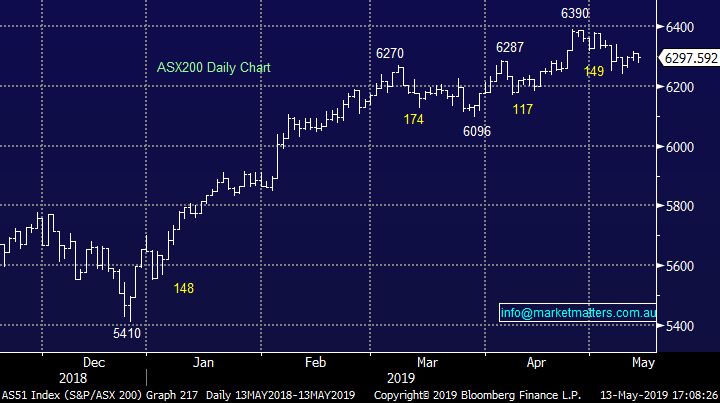

Commonwealth (CBA) – 2.52% - hit after announced a 3rd quarter trading update that was weaker than expected, a cash profit of $1.7B for and a statutory profit of $1.75B. The main areas of note being $715M in additional customer remediation provision, an overall decline in non-interest income and no growth in net interest income from the quarterly average of 1H19 to 3Q19, as a result of margin decline offsetting loan growth. Expenses are up 1% from the quarterly average of 1H19 to 3Q19 on an underlying basis and asset quality deteriorated with past due home loans increasing. Capital was low at 10.3% however the completion of the announced asset sales should take this ratio to 11.5%. All in all, a weak result, income down, expenses and bad debts up.

At Shaw, this has prompted a downgrade forecast EPS by the tune of 9%, 8% and 6% for FY19, FY20 and FY21, respectively. Our analyst cut the stock from buy to hold and dropping PT from $76 to $73. Not CBA’s finest hour

Commonwealth Bank (CBA) Chart

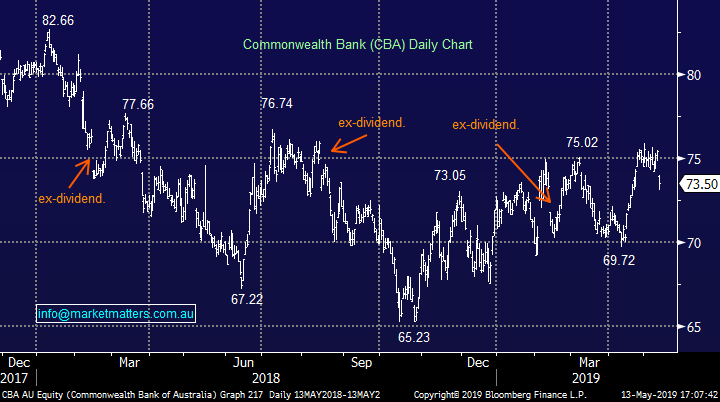

Reliance Worldwide (RWC) -15.62% down sharply on an earnings downgrade however they were worse early on, off by 26% at the worst. We saw a lot of flow through the desk today in that name, Rog who sits on the Insto team behind me had been pushing the short thesis on the stock for a while and today it came through in a big way. A great call but what now?? Their new FY19 Ebitda guidance is range of A$260M-A$270M, down from A$277m-A$287m with the market sitting at $282.4 before today’s update. Assume $265m midpoint, that’s a 6% downgrade at the Ebitda line and more at the profit line. They also said that while tariff changes are not likely to impact FY19 Ebitda, they may potentially have negative impact on Americas in FY20 – RWC generates ~70% of revenue in the US. While we like the stock technically below $4, the stocks now on 20x with no growth – expect downgrades to flow through tomorrow.

Reliance Worldwide (RWC) Chart

Lend Lease (LLC) +8.71%... on news that a Japanese company is circling LLC . LLC denied the approach however where there is smoke….Shares rallied strongly today, and the sellers of the early spike were run over in the afternoon and buyers held firm into the close. Now one firmly on our radar.

Lend-Lease Chart

Real-Estate…The Govt has promised to help support lower income first-home buyers by helping fund part of the deposit. A proposal that was matched by the opposition today. The 5% cut to the deposit rate is a boost for listing volumes and that helps the likes of Domain & REA Group – the latter rallying today on the news.

REA-Group (REA) Chart

Broker moves:

· Technology One Raised to Buy at Bell Potter; PT A$9.50

· Fletcher Building Cut to Neutral at Forsyth Barr; PT NZ$5.25

· AGL Energy Downgraded to Sell at Citi; PT A$20.87

· Cochlear Downgraded to Neutral at Citi; PT Set to A$198

· Oil Search Downgraded to Hold at Deutsche Bank; PT Set to A$8

· Evolution Upgraded to Add at Morgans Financial; PT A$3.55

· FlexiGroup Upgraded to Outperform at Macquarie; PT A$2.04

· Credit Corp Upgraded to Hold at Morningstar

· GrainCorp Upgraded to Buy at Morningstar

· Domain Holdings Cut to Negative at Evans and Partners; PT A$2.42

OUR CALLS

No changes today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.