Caltex lifts dividend pay out to combat rising franking balance

Stock

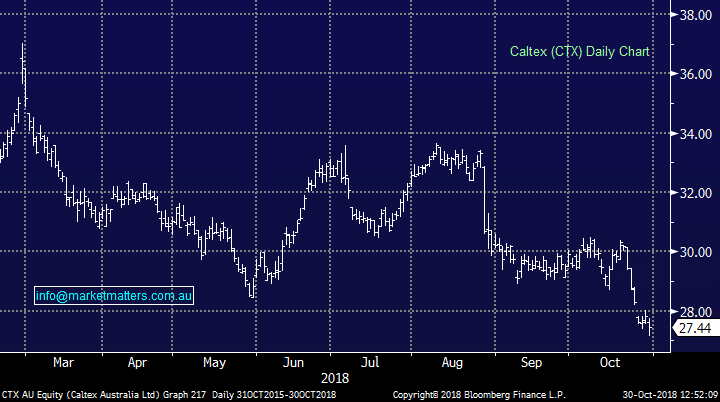

Caltex (CTX) $27.49 as at 30/10/2018

Event

Fuel refiner and retailer Caltex lifted their payout ratio in what looks like an effort to unlock some value in the large franking credit balance the company holds. Caltex have been eying off ways to return excess capital to shareholders as their transformation nears completion, and in their investor day presentation today, they announced the increase in pay out while also mentioning their “preferred method of incremental capital returns is via an off market buyback.” Caltex has over $900m worth of franking credits on the balance sheet, and clearly, there is a desire to realise this value for shareholders – a matter that has become more pressing with recent plans by Labor to cease cash refunds on franking credits.

Along with the pay out ratio changes, CTX updated refiner margins for the September quarter with realised margins rising from the previous quarter, but that was off a low base and they remain lower than the same time last year. Sales were also softer for the quarter due to outages at the Lytton facility.

Source; Company presentation

Caltex (CTX) Chart

Source; Company presentation

Caltex (CTX) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook