Caltex drags energy but the index pushes higher (CTX, CYB, RIO)

WHAT MATTERED TODAY

The local market did very little in the first hour of trade, and was actually trading marginally lower by 11AM only to turn the corner sharply, bid strongly throughout the rest of the session. Buying found its way in following the FOMC meeting in which the Fed turned noticeably more dovish, pointing to further rate cuts. The market does have three priced in for the year, while the Fed sits at 2 – room for the market to be surprised to the downside here.

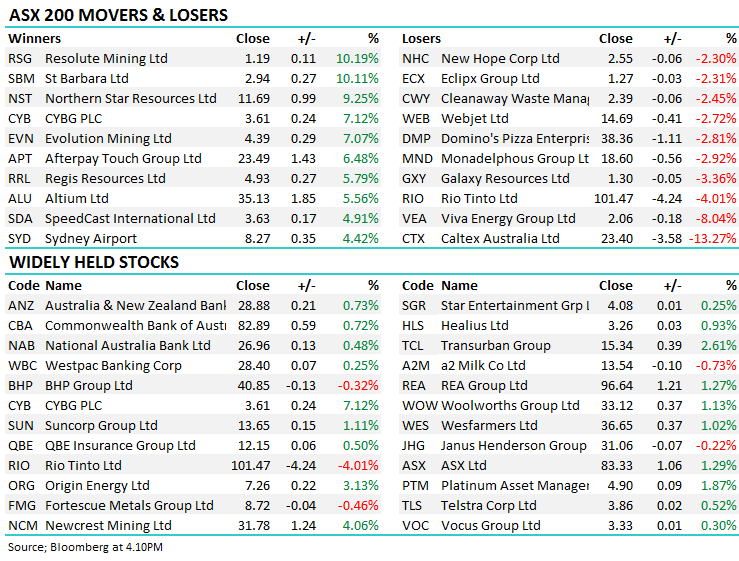

Energy was the only sector to finish in the red for the session, dragged by a downgrade from Caltex which also dragged Viva Energy (VEA) down with it. IT finished over 2% better as the tech names continue to see buying with AfterPay (APT) rebounding from panic lows at $20 earlier in the week.

Materials were a mixed bag today – iron ore names slightly softer on the back of Vale’s announcement that it had received the go ahead to restart production at their Brucutu mine, and also dragged by Rio Tinto (RIO) which downgraded production numbers. The full story on RIO below, however it highlights the volatility we will continue to see in the commodity. Bank of Queensland (BOQ) – a stock we own both portfolios – was marginally softer, but well underperformed the financial index after announcing their CFO would leave the bank after their FY19 results. Twice overlooked for the top job, he has moved in search of a CEO role.

Overall, the ASX 200 added +39 points or +0.59% to 6687. Dow Futures are trading up +78pts / +0.29%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Caltex (CTX) -13.27%; Today’s biggest loser on the back of disappointing guidance ahead of the half year result. Early in the day, shares fell to new 5 year lows, crashing ~24% to the day’s low. EBIT is expected to fall in all segments of the business compared to the first half of 2018 with NPAT falling by more than 50% on the previous comparable period. Refining margins and outages will see their Lytton facility less than 10% of the EBIT than pcp to contribute less than $10m to the half. Convenience retail has suffered with the struggling consumer spending environment and is projected to post $75m-$85m EBIT, around half on last year’s effort.

While there are a number of issues with the performance of Caltex here, the focus will now be on the retail focussed strategy which has not helped the result. Competition is rife in the space and there is little to suggest that retail spending will pick up anytime soon. The market will be forced to put through downgrades here, with the consensus full year NPAT at $485m likely unachievable – there would have to be a 25:75 skew to the second half to go near achieving this. We aren’t excited by the Australian consumer market and hence not excited by Caltex.

Caltex (CTX) Chart

Rio Tinto (RIO) -4.07%; A surprise cut to Iron Ore production guidance has seen the stock sold off fairly hard today after they said Pilbara shipments for 2019 would be between 320M tonnes and 330M tonnes (previously between 333M tonnes and 343M tonnes) implying a about a 7% downgrade. This is clearly a surprise announcement given: (1) it adds to recent down grades post 1Q cyclones and (ii) it looks like a more sinister grade/quality issue at RIO which may be a bit more problematic in the medium term.

The company saying that they are experiencing mine operational challenges, particularly in the Greater Brockman hub in the Pilbara which is resulting in a higher proportion of certain lower grade products, partly to protect the quality of their flagship Pilbara Blend. To me, that seems like a more sustained issue than something one off + obviously the higher achieved prices currently mean that a loss of 23mtpa is significant.

Rio Tinto (RIO) Chart

Clydesdale Bank (CYG) +7.12%; rallied today after outlining some fairly aggressive targets across their business at an investor day in the UK. They reckon they can achieve the following financial performance targets by FY22:

1. Statutory ROE greater than 12%;

2. high single digit annual growth in current accounts (which are the lowest cost funding);

3. above system asset growth; and

4. 13% common equity tier 1 (CET1) ratio.

These are bullish / optimistic targets from CYB and if achieved the share price would be significantly above todays level. As an investor, we have two options. To trust or to track. Trust is generally built over time from companies delivering what they say they will and unfortunately, CYB hasn’t delivered in the past, meaning that we’re trackers rather than trusters of these new targets. One to watch but the company has certainly become bullish on themselves!

Clydesdale (CYB) Chart

Broker moves;

- Coles Group Downgraded to Sell at Morningstar

- Seven Group Downgraded to Sell at Morningstar

- Perpetual Downgraded to Sell at Morningstar

- Star Entertainment Downgraded to Hold at Morningstar

- AusNet Upgraded to Buy at Goldman; PT A$2.10

- Mercury NZ Downgraded to Sell at Goldman; PT NZ$3.85

OUR CALLS

No changes today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/06/19

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.