Calls for the week – CBA, ABC & BSL

**This is an extract from the Market Matters Weekend Report from 7 July. Click here to get access to the full report and more

Chart of the week.

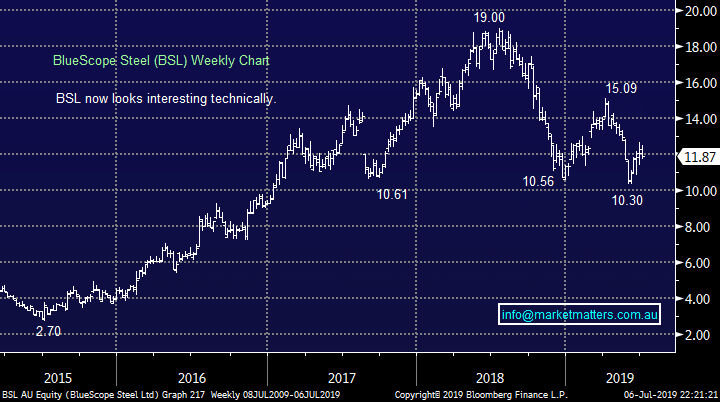

Commonwealth Bank has rallied over 30%, if we include dividends, from its Royal Commission induced panic low in late 2018. The technical picture has been fairly good over recent weeks and if the pattern continues to unfold as we anticipate 2 reasonable moves in the months ahead:

1- First a fresh 2019 high around $85 before another pullback to test the $80 region or an “abc” pullback towards $78.50 before we see ~$85.

2 – After one of these corrections we expect a rally of over 10% towards $90.

Obviously lots of water to go under the bridge with this call but If this unfolds as above we may tweak our banking exposure at respective levels. In simple terms its predicting levels where we feel investors are likely to buy CBA for yield as opposed to selling it over concerns around margin contraction.

In the bigger picture CBA still looks good.

Commonwealth Bank (CBA) Chart

Investment of the week.

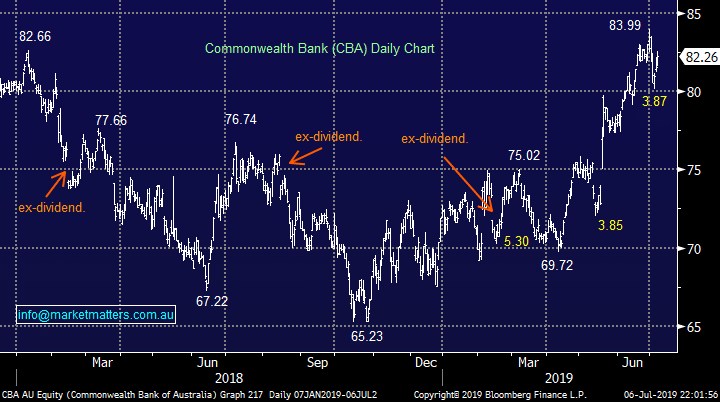

We are currently considering the out of favour Adelaide Brighton (ABC) which is one of Australia’s largest manufacturers of construction materials including cement and lime hence it’s not rocket science to comprehend the company’s share price struggle in the wake of the housing market’s contraction.

However following the stocks major correction 3 things are sparking our interest – a 4.84% projected dividend yield, exposure to government infrastructure spend and lastly the technical picture looks great as investors look for “cheap” opportunities.

MM is bullish ABC with an initial target ~15% higher.

Adelaide Brighton (ABC) Chart

Investment of the week.

We are currently considering the out of favour Adelaide Brighton (ABC) which is one of Australia’s largest manufacturers of construction materials including cement and lime hence it’s not rocket science to comprehend the company’s share price struggle in the wake of the housing market’s contraction.

However following the stocks major correction 3 things are sparking our interest – a 4.84% projected dividend yield, exposure to government infrastructure spend and lastly the technical picture looks great as investors look for “cheap” opportunities.

MM is bullish ABC with an initial target ~15% higher.

Adelaide Brighton (ABC) Chart

Trade of the week.

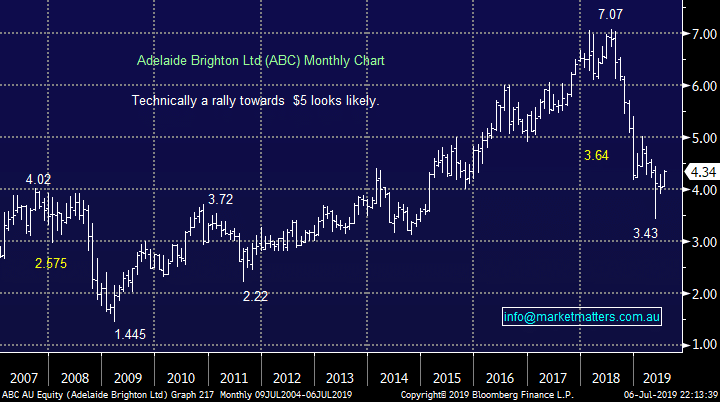

BlueScope’s (BSL) has endured a horrible 18-months falling over 45% at its worst. However we feel the tide has turned and are happy buyers of BSL with an initial stop below $11.40.

MM likes BSL initially targeting ~15% upside.

BlueScope Steel (BSL) Chart

Trade of the week.

BlueScope’s (BSL) has endured a horrible 18-months falling over 45% at its worst. However we feel the tide has turned and are happy buyers of BSL with an initial stop below $11.40.

MM likes BSL initially targeting ~15% upside.

BlueScope Steel (BSL) Chart