Buying returns, eyes turn to the Rio result (BVS, CGC, JHG, VOC, SEK)

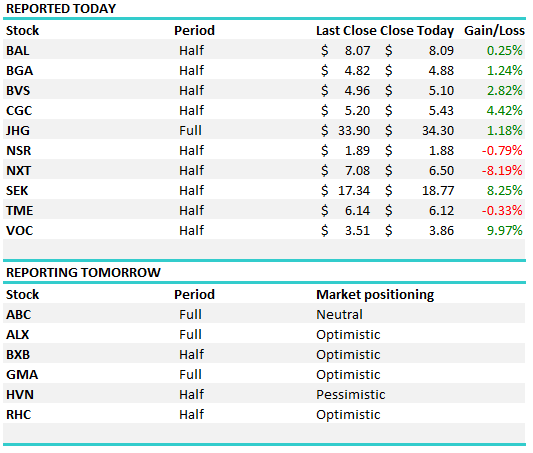

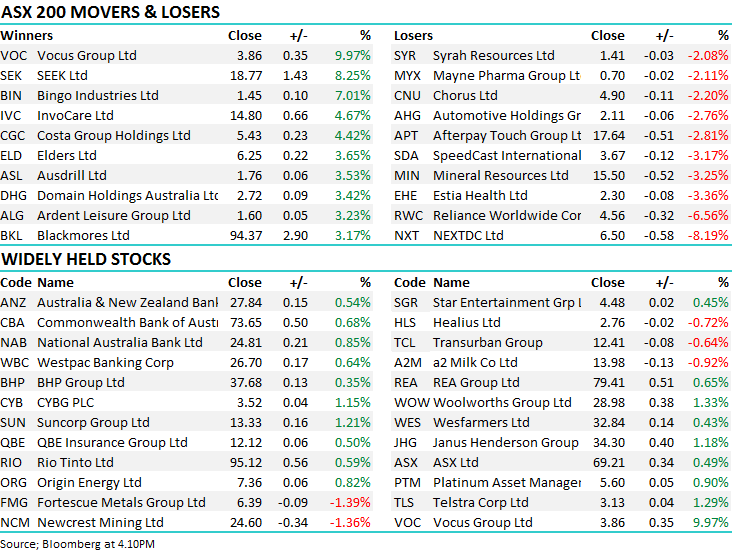

WHAT MATTERED TODAY

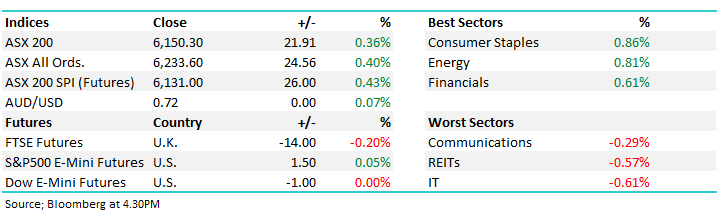

Money made its way back into the market today after yesterday’s sea of red. Futures showed signs of jitters early in the session but for the most part the market was bid up well throughout the day and saw some particularly strong buying late in the session. Australian construction data was again weak falling -3.1% for the quarter but was mostly expected by the market. Banks were fortunate, Telcos took a hit however this was mostly Telstra trading ex it’s big dividend.

Reliance Worldwide (ASX: RWC) took a tumble today after it announced the retirement of Chairman Johnathan Munz as well as the sale of the 10% stake the Munz family holds – it was traded at $4.65, a 4.7% discount to yesterday’s close with the stock falling -6.56% today to close at $4.56.

On the regional banks – fortunes were mixed - Bendigo fell -0.41% while Bank of Queensland rallied +1.36% – surprising particularly given BEN is set to pay their interim dividend of 35c fully franked on Friday. We discussed these two names in today’s income report here.

Eyes will be on Rio Tinto’s (ASX: RIO) performance tonight as they are set to announce their full year results at any moment. The market is searching for ~$8.5b at the profit line, but investors will be keen to see a capital management update with over $4b of net cash still on the balance sheet.

Overall today, the ASX 200 added 21 points or +0.36% to 6150. Dow Futures are currently trading flat.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

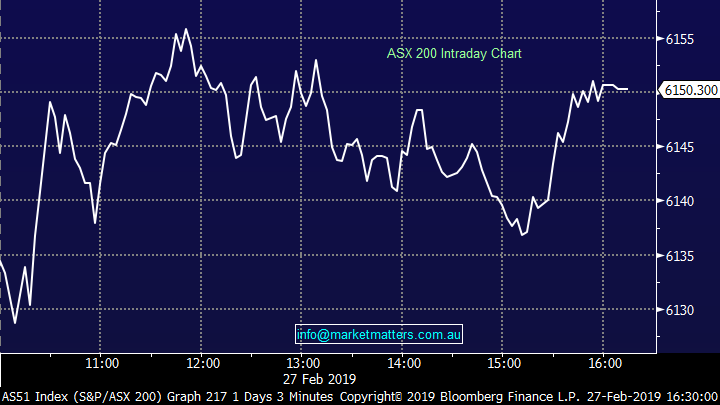

Reporting today; Reporting season is slowly coming to an end locally with the vast majority already opening their books. Janus Henderson (ASX: JHG), which we hold in the Growth Portfolio, came out today closing over 1% higher – we look at its report in more detail below. We also have a close look at Vocus (ASX: VOC) which topped the boards after their half year numbers, adding nearly 10% in the session – a big effort after initially trading as much as -5.4% lower.

Seek (ASX: SEK) only lost out to Vocus today as the jobs platform posted a +8.25% climb. Net profit was slightly lower than the previous year’s first half, however the company reaffirmed full year EBITDA growth guidance of 5-8% on revenue growth of 16-20% which the market clearly liked. Investors are enjoying the significant growth the business is managing out of Asian markets and are happy to see investment in the region jump higher.

We also saw Costa Group (ASX:CGC) +4.42% today following the release of their 1H results booking NPAT of $8.5m, which was low relative to this time last year but in line with expectations – remember they downgraded in early January and were whacked from ~$7 to ~$4.50 on what we thought were seasonal factors. Other metrics were on the softer side but importantly, guidance was strong and they expect profit growth of ‘at least’ 30% for CY19 which was up from previous guidance of 30% + they said crop performance and weather conditions have been generally positive in the early part of the year. We have been targeting a buy in CGC nearer $4.00 and the stocks has rallied today to close at $5.43

Wealth management software service Bravura (ASX: BVS) initially jumped over 14% but slowly eased throughout the day to close ~3% higher. They reported half year numbers which saw EPS grow 15% on a 24% growth in revenue. The company revised full year guidance higher as a result, now looking for EPS growth in the mid to high teens.

NextDC (ASX: NXT) which operates data storage centres slumped today, reversing much of the solid share price rally over the past 8 weeks. While revenue growth was solid, it sunk into a loss for the first half of -$3.1m, $11.6m below last year’s first 6 months. While EBITDA guidance for the full year remained unchanged, revenue guidance was revised slightly lower as well as an increase in capital expenditure as it brings construction and upgrades forward.

Vocus (ASX: VOC) +9.97%; 6 months into the year the communications company looks to be on the right track as it progresses with its turnaround. Revenue might have added 0.7% to $974.2, EBITDA for the half fell 10% on the first half of FY18. Net profit came in at $48.8m, almost a 30% slide on the corresponding period last year. At the full year, consensus is looking for a profit of around $107m and at the half way point, VOC is almost halfway there and the company often has a big second half skew to earnings. Vocus is also a big turnaround story with new management taking the reins not too long ago. At this juncture, the company has been able to reiterate guidance at EBITDA of $350m-$370m for FY19 – in line with consensus.

Vocus’ product is sold and it is able to differentiate itself from NBN based names as it has its own network that is often much more reliable. Key to the upside here is the ability for the company to penetrate the enterprise business which Telstra currently dominates. Any increase to market share here will see earnings increase significantly. Still though, it is a longer term play with the company looking to double revenue across each of its businesses over the next 5 years. We would be buyers on a 60c pullback, although today’s price action is very bullish.

Vocus (ASX: VOC) Chart

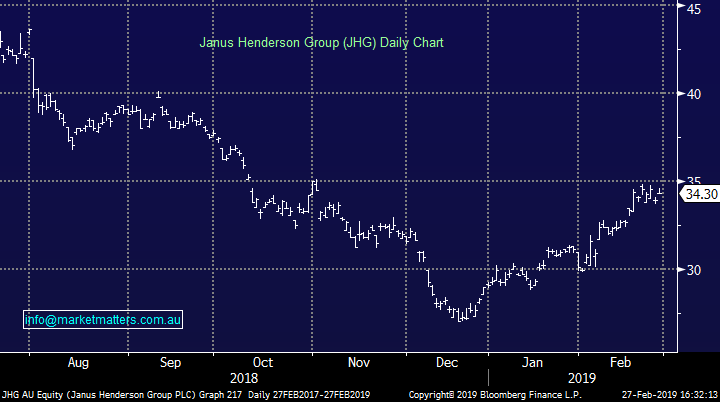

Janus Henderson (ASX:JHG) +1.18%; released full year results this morning, and while they showed a decrease in assets under management (AUM) of 11% down to $328.5b – largely a result of weak markets plus net outflows - their reported earnings were actually a tad ahead of market expectations – on a P/E below 10x, there’s not a lot of optimism baked into this cake! JHG also achieved costs synergies of US$125m which was well ahead of prior guidance and they’ll buy back another US$200m worth of stock during 2019. We hold JHG in the Growth Portfolio , however following its rally from ~$27 to ~$35, we’re nearer the sell side.

Janus Henderson (ASX:JHG) Chart

Broker Moves;

· Yancoal Australia Downgraded to Hold at BOC Intl

· WiseTech Upgraded to Buy at Citi; PT A$21.31

· FlexiGroup Upgraded to Buy at Deutsche Bank; PT Set to A$1.80

· Caltex Australia Cut to Hold at Deutsche Bank; PT Set to A$27.50

· Brambles Downgraded to Neutral at Evans and Partners; PT A$11.31

· Iress Upgraded to Hold at Morningstar; PT A$11.80

· ARB Downgraded to Sell at Morningstar

· Nanosonics Downgraded to Hold at Wilsons; Price Target A$4

· Spark Infra Downgraded to Sector Perform at RBC; PT A$2.30

· Spark Infra Cut to Underweight at Morgan Stanley; PT A$2.28

· SpeedCast Downgraded to Neutral at Credit Suisse; PT A$3.70

· Money3 Upgraded to Buy at Shaw and Partners; PT A$2.37

· Gr Engineering Downgraded to Hold at Moelis & Company; PT A$1.22

· G8 Education Downgraded to Hold at Morgans Financial; PT A$3.16

OUR CALLS

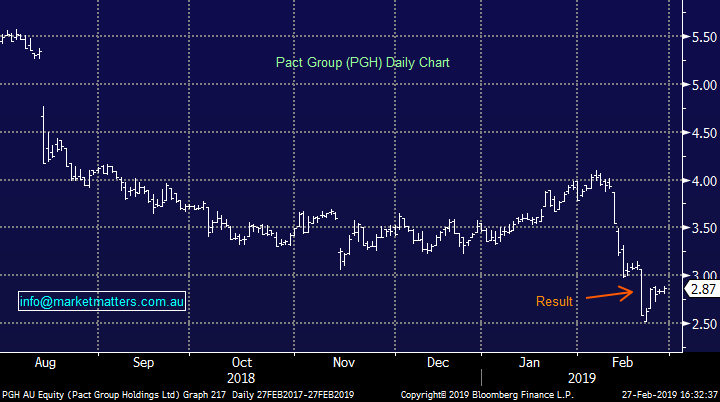

We bought Bank of QLD (ASX: BOQ) for the Income Portfolio & Pact Group (ASX: PGH) for the Growth Portfolio today. Here’s our reasoning on PGH for those who missed it.

We have written about packaging company Pact Group (ASX:PGH) in recent notes flagging the stock as a potential ‘value play’ into weakness – we framed it at the time as one of the ‘dogs’ to consider. The stock has been sold down from a February high of $4.10 to trade today at $2.83 for a couple of reasons. Like our recent foray into Bingo, PGH requires some further explanation.

This is a packaging company that carries significant debt – around $630m relative to forecasted earnings (EBITDA) of $230m-$245m - clearly a big load to carry that at some stage will need to be addressed. The next debt maturity is in FY20 so they do have some time to work on it.

If they achieve forecasted earnings then gearing will come down and the threat of a capital raise will fall, and the stock price should rally. Put simply, we think the stock is priced for a raise that may or may not happen. Technically, a bounce back towards ~$3.60 or ~30% higher seems achievable.

We are adding this ‘dog’ to the Growth Portfolio with a 2% weighting.

Pact Group (ASX:PGH) Chart

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.