Buyers step in to early weakness (S32, CGF, TCL)

* Register to our upcoming Webinar on Wednesday 24th June 2020 4pm - 5pm AEST CLICK HERE*

WHAT MATTERED TODAY

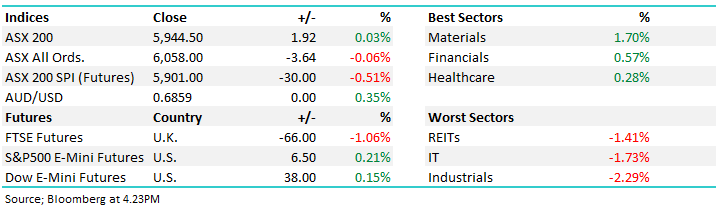

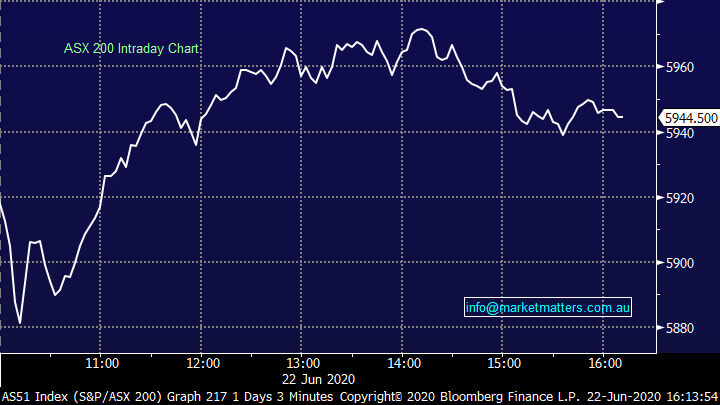

Stocks opened on the backfoot this morning as a confluence of bad news over the weekend in terms of the virus plus a weak lead from overseas markets on Friday conspired against stocks early, however the buyers again stepped in to weakness and the market put on +90pts from the 10.30am low to the mid-afternoon high. While the market sold off into the close, we still managed to end a tick over par with the materials and financials back in favour. Buyers emerging into bad / negative news which occurred over the weekend is a positive sign.

US Futures provided good support moving from -1% early to up +0.5% late while Asian markets all finished lower, Hong Kong shares the weakest of the bunch down ~1%.

There was some credit card data from New Zealand out today and while its generally inconsequential to us it showed a 41% contraction in April was overshadowed by a 54% bounce in May, indicative of the strong recovery we’ve seen domestically as economies re-open.

Overall, the ASX 200 added +2pts / 0.03% today to close at 5944 - Dow Futures are trading up 75pts/0.30%

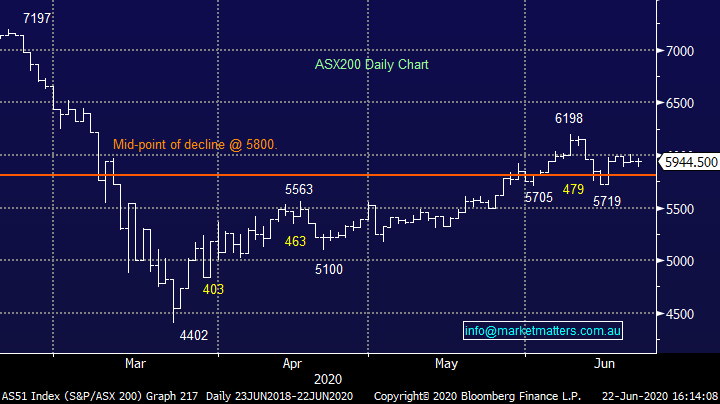

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Fortescue Metals (FMG) & South32 (S32) tie up? The AFR picked up on some analysis from Citi this morning about a potential tie up between FMG and S32, effectively saying that given where FMG are trading and the high value of their shares, they should be using them to diversify their exposures. Citi reckon S32 makes sense given their bullish on coal, aluminium, alumina, nickel, zinc and silver prices over the next 12 months, which are all housed in South32's portfolio. At MM we think FMG is in a great position to build out their asset base and diversify their exposures, however will S32 be a targeted? I asked Peter O’Connor, our resource analysts, here’s his take with the conclusion being…never say never but probability likely low … why?

- FMG is a world class business

- S32 is a wellrun, financially sound, leveraged play on some key commodities – alumina, met coal, manganese

- FMG growth strategy has focussed on company strengths

- Infrastructure/logistics – FMG’s port/rail/mine are world class, moving massive tonnages, very competitively and efficiently – and lower FOB cost than global peers BHP, RIO, Vale.

- Financing – At times over the past decade or so, it felt like a seat of the pants ride, but the FMG finance team have a proven track record at large financing

- Large scale earth moving – think large scale open pit mines – iron ore, copper, copper gold etc

- Focus on embryonic opportunities … a little like how FMG started ie looking around in Ecuador, Latam, NSW and NW Australia. No signs of preparedness to acquire 2nd tier companies

- FMG’s biggest recent foray … was as an under bidder in the auction of Simandou iron ore blocks in Guinea – some of the largest and highest-grade iron ore deposits in the world. FMG missed out to a Chinese consortium.

“If I were to wrap a percentage around the idea of FMG for S32 I would say … the probability of a deal is Not zero, but likely sits between 0% and 50%, but most probably closer to zero than 50%”

The market didn’t give the idea much weight today, with S32 only up a touch, however S32 is a stock on MM’s radar.

South 32 (S32) Chart

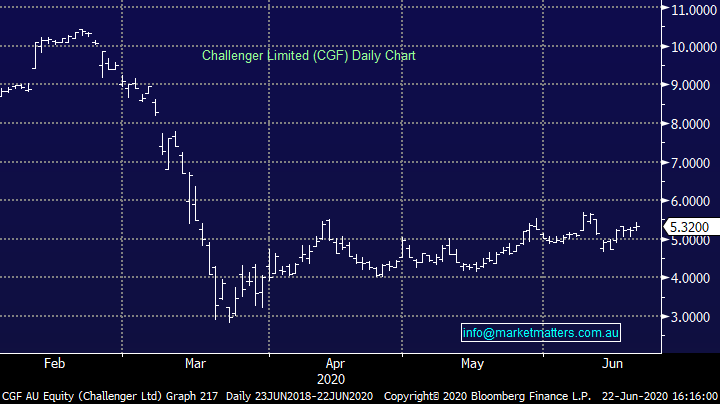

Challenger Group Financial (CGF) $5.32: CGF announced a $300M equity raising today of which $270M is underwritten at $4.89 per share, the proceeds being used to increase the risk in the investment portfolio to (hopefully) improve returns. It’s being reported that the raising was well supported however there will be downgrades for FY21 as a result of the higher share count. The equity raise was expected given the volatility in the markets which plays into their investment portfolio and risk metrics. We’re neutral here.

Challenger Group Financial (CGF) Chart

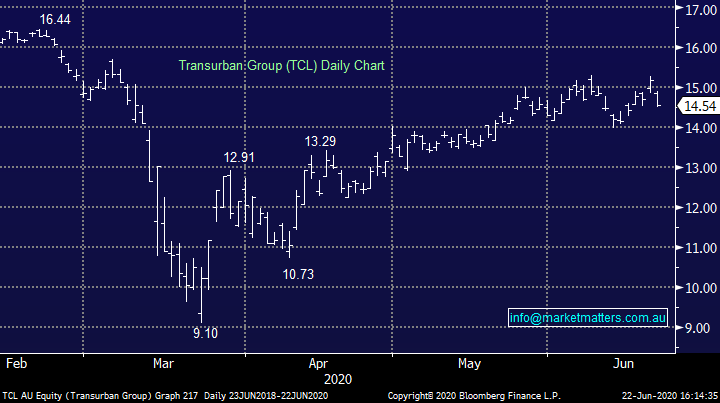

Transurban (TCL) -4.09%: the toll road operator out today with a trading update and cut to their dividend for the full year, announcing that a 16c payment will be made for the final dividend of FY20, nearly half that paid at the half year – not unexpected but clearly not a positive.

In terms of the trading update they said traffic volumes have been on the improve, more notably in areas that have reduced restrictions where some roads are seeing around 90% of the pre-COVID use. Across the network traffic for the week of 14 June was around 20% below last year, continuing the improvement from the circa 60% hit seen in April. Today’s announcement caused some issue for investors chasing distributions – Transurban flagged that dividends for FY21 will be paid out of free cash flow (FCF) and won’t be topped up with any capital return that has helped bolster the yield for the stock over recent years. The capital will instead be used to strengthen the balance sheet and fund further developments as they come up. Transurban looks like it will manage to sneak through the COVID-19 period without the need to raise capital given they are still compliant with debt covenants, but investors will feel it in falling distributions as a result. We like TCL though and it will continue to improve as we return to the road. We remain holders in the Income Portfolio.

Transurban (TCL) Chart

BROKER MOVES:

A few things worth highlighting across the analyst sphere today in addition to the Citi muted FMG / S32 tie up:

- Altium Slumps Most in 6 Weeks After Updating Sales Outlook: Shares fell as much as 7.3%, most since May 12, after the company said revenue would miss analyst estimates as a second wave of coronavirus curbs expected sales.

- Morgans: Australian Bank View Positive as Bad Debt Factored In: The damage from the impact of bad debts has been factored into share prices and is overdone, except for Commonwealth Bank, analysts led by Azib Khan write in June 19 note.

Elsewhere: Damstra which I’ve highlighted below is a new SaaS business we’re starting to cover. More in this one in time – looks interesting.

- Sigma Healthcare Raised to Neutral at UBS

- Evolution Cut to Neutral at Macquarie; PT A$5.40

- ANZ Bank Raised to Add at Morgans Financial Limited; PT A$21

- Costa Raised to Overweight at Wilsons; PT A$3.35

- McMillan Shakespeare Raised to Overweight at Morgan Stanley

- Eclipx Raised to Overweight at Morgan Stanley; PT A$1.70

- oOh!media Cut to Hold at Morningstar

- Orora Raised to Buy at Morningstar

- Damstra Holdings Pty Ltd Rated New Buy at Shaw and Partners

- Ramelius Rated New Buy at Shaw and Partners; PT A$2.36

OUR CALLS

No changes today

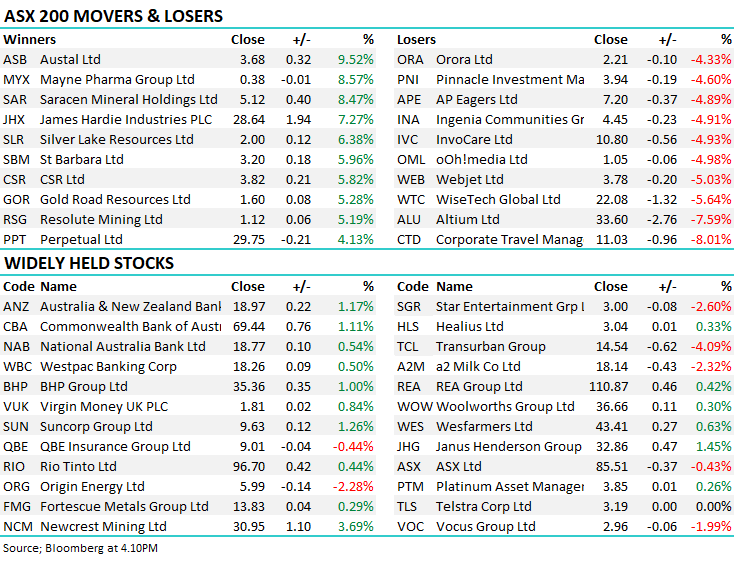

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.