Building a diversified income strategy

This week James Gerrish sat down with James Marlay from Livewire Markets to discuss the important aspects of implementing an income focused diversified portfolio. Click here to see the webinar

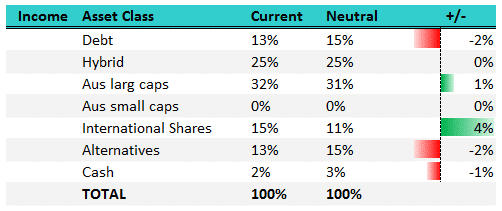

Below is a typical asset class mix for an income focused portfolio. The neutral stance is the base case, when all asset classes are around about fair value however it’s important to tweak this mix when asset classes are relatively cheap or expensive at any given time.

Right now debt is expensive, hybrids are now bordering on the expensive side, shares are cheap relative to interest rates, with international shares cheaper than Australian shares, liquid alternatives are a broad church which I’ll get to below, while cash is yielding very little, making it expensive.

Asset Allocation Mix – Current allocations

Below is a typical asset class mix for an income focused portfolio. The neutral stance is the base case, when all asset classes are around about fair value however it’s important to tweak this mix when asset classes are relatively cheap or expensive at any given time.

Right now debt is expensive, hybrids are now bordering on the expensive side, shares are cheap relative to interest rates, with international shares cheaper than Australian shares, liquid alternatives are a broad church which I’ll get to below, while cash is yielding very little, making it expensive.

Asset Allocation Mix – Current allocations

The asset allocation mix above with a neutral stance implies around ~40% towards defence and ~60% towards offense – which is typically a balanced portfolio.

The asset allocation mix above with a neutral stance implies around ~40% towards defence and ~60% towards offense – which is typically a balanced portfolio.