Bottom feeding obvious today as the market rallies…

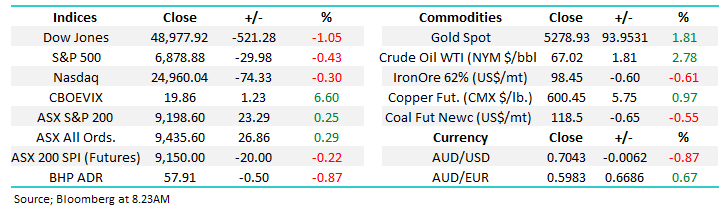

What Mattered Today

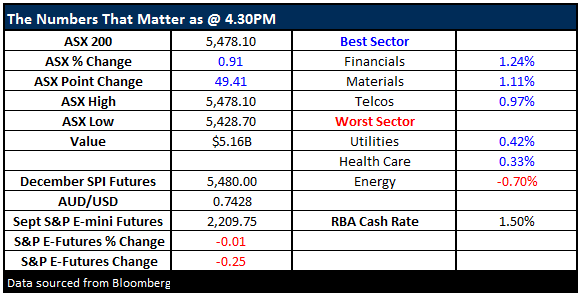

The market opened up strongly this morning and saw sustained buying throughout the session, and importantly the index closed up above the 5450 level we’ve been highlighting; we’re now targeting a run up to 5550/5600. Remember, December is a seasonally strong time for markets – average return ~1.7% with gains 75% of the time, and if we overlay high cash levels both here and the States, we can see the mkt pushing higher before St Nicholas makes an appearance!

GDP data was out today and it was soft, with the economy going backwards in the September quarter by -0.5%. A weak number was expected, but not that weak + we also had a downward revision to the prior quarter. We’re not economists at MM, although we have gotten a couple calls wrong of late which makes us feel a bit like one – however the upshot is the economy is OK – isn’t headed for a recession despite the negative print (lots of one off issues impacted todays number), however it’s not strong enough for the RBA to think about raising interest rates, particularly given we’ve seen banks hike out of cycle on the back of higher funding costs.

The RBA looks at the price the consumer is paying for credit and if we think that the last rate cut was only partially passed on, now we’ve seen banks hike out of cycle, the RBA will sit on their hands for an extended period in our view. That doesn’t mean that bond yields will not tick higher as they will, however it more than likely means that the recent rally in yields might stall here for a period. We mentioned the 2% level on the Aussie 3 year bond this morning as a resistance level. If that holds in the near term, we’ll likely see some of the stocks that have been hit on the back of higher rates recover. They include the yield plays (WFD, TCL, SYD) + it would also include the high PE stocks that have re-rated in the past few months.

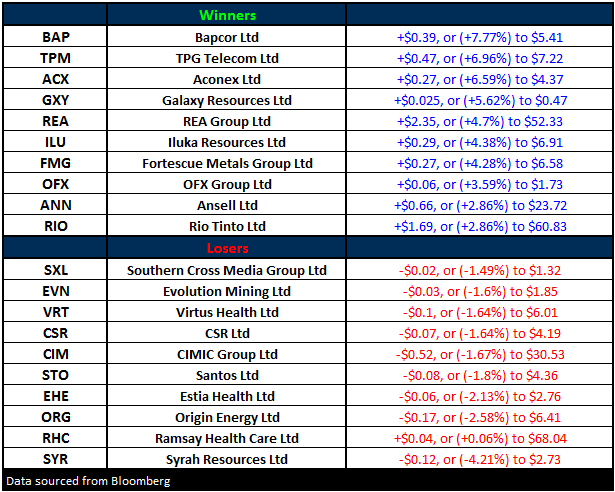

We started to see that play out today with a few of the better known, better loved stocks of recent times starting to find some interest after a fairly bleak few months…REA Group (REA)…Vitagroup (VTG) – which we bought this morning, TPG Telecom (TPM), Aconex (ACX), & Bapcor (BAP) to name a few.

REA Group (REA) Daily Chart – A stock we’ve looked at often has come back to more palatable levels of late.

Aconex (ACX) Daily Chart – A stock we’ve mentioned a few times, not owned it but one we like in terms of its business (document/projects management collaboration in the construction and resource sectors)

Bapcor (BAP) Daily Chart – a very well owned growth stock, automotive parts, extremely well manages, high valuation but growth to support, good buying in the stock today

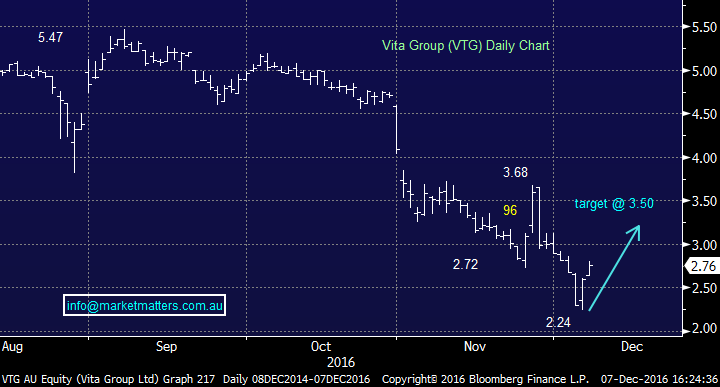

Vitagroup (VTG) Daily Chart – a stocks we like, wrote about a few times and bought this morning – some reasonable buying about for this stocks throughout the session.

On the broader market today, we had a range of +/- 45 points, a high of 5478, a low of 5433 and a close of 5478, up +49pts or +0.91%.

ASX 200 Intra-Day Chart – good follow through buying all day

ASX 200 daily chart

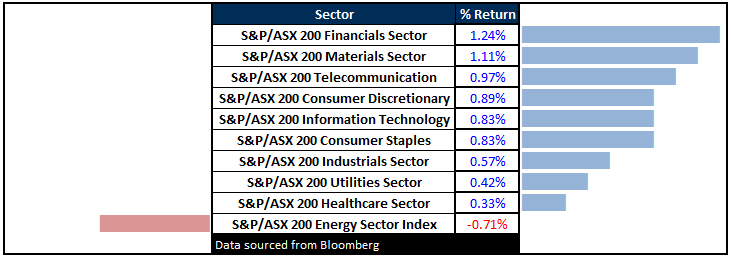

Sectors – Financials best on ground again today – we remain positive that sector for now

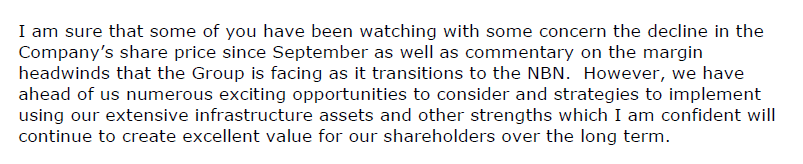

ASX 200 Movers – TPM help its AGM this morning offering the following commentary on the route in the share price

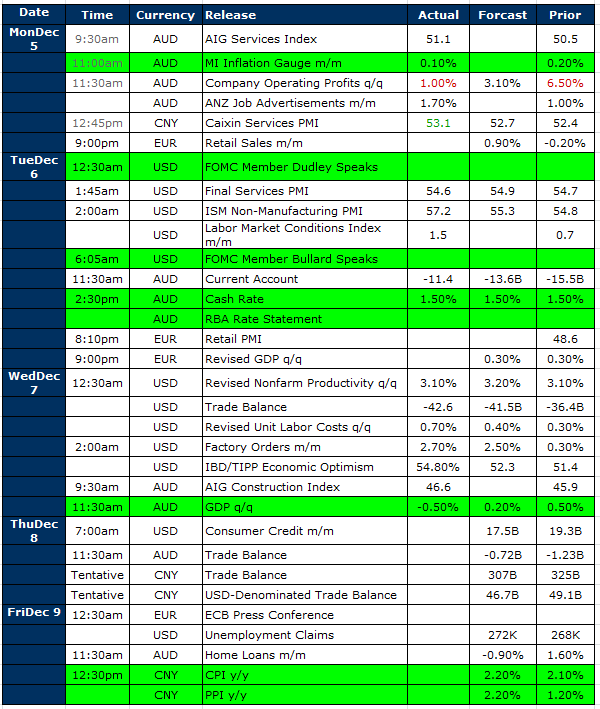

Select Economic Data - Stuff that really Matters in Green

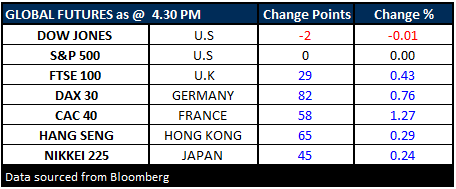

What Matters Overseas

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of Market Matters holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/12/2016. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here