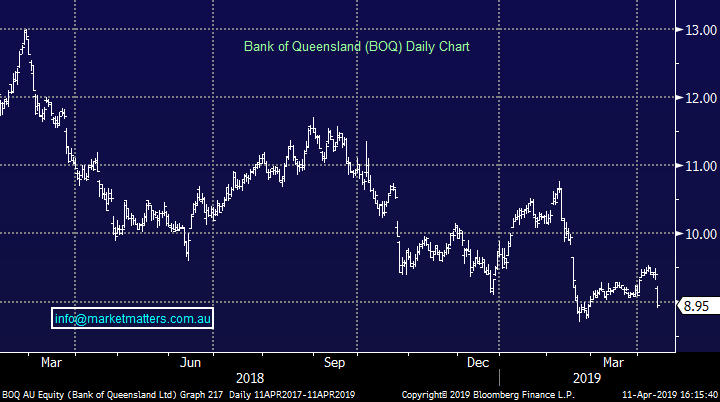

BOQ kicks off bank reporting (BOQ, ASL)

WHAT MATTERED TODAY

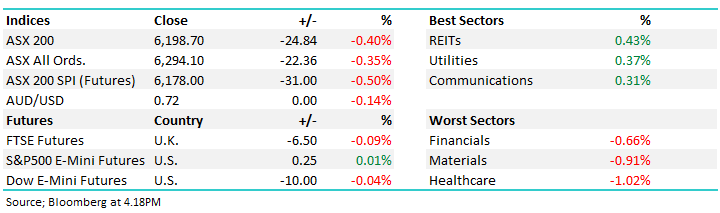

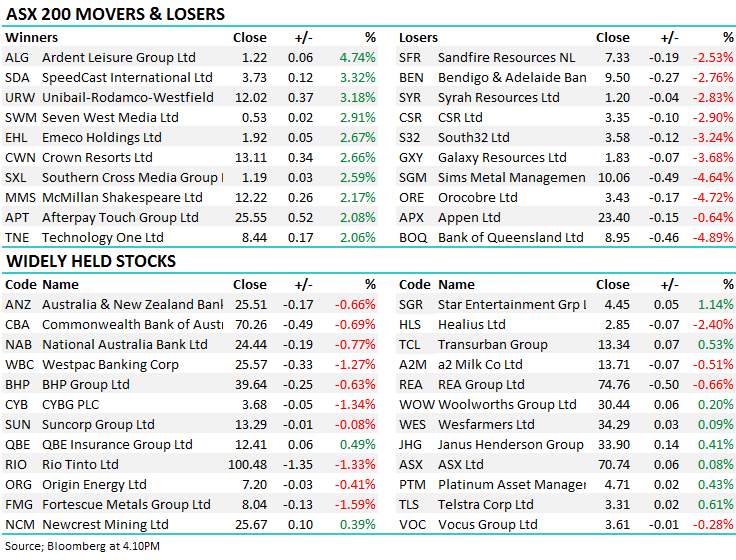

The local market couldn’t replicate the strength seen in the US overnight. There was a switch out of growth names today into more defensives as resources and financials were hit but money was seen moving into telcos and, utilities and REITs. Asian markets were also trading lower as we closed this afternoon. The biggest news out today was Scott Morrison calling the election for 18 May. The market looks to have priced in a Labor win here, and although I wouldn’t be betting against that at this stage, the market has a poor track record of predicting voting outcomes of late.

A few minor pieces of news on the stock level today. Rio Tinto held their AGM in London overnight, and the major shareholder made it clear it doesn’t want to see further buybacks as it would raise their holding over 15%. Expect the company to use special dividends if the cash balance blows out. Zip co (Z1P) set a new all-time high close today at $2.15. Bank of Queensland (BOQ) posted a soft first half while Ausdrill sold some assets – more on these two below.

Overall today, the ASX 200 ended down -24 points, or -0.4%. Dow Futures are trading down -10pts / -0.04%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

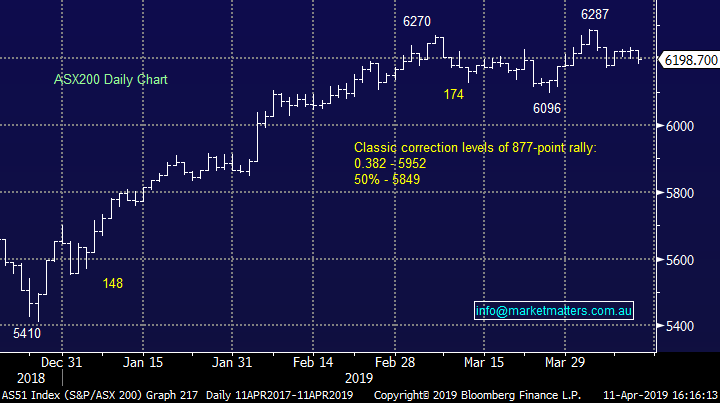

Ausdrill (ASL), +0.3%, announced the sale of its water well drilling business for a $16m fee. The mining services firm was been reviewing its assets and deemed this non-core so away it goes. It was sold to a Vysarn (VYS), which has had shares in a trading halt for nearly 3 years and had no operations until it picked up this asset. Overall, the water welling business wasn’t a large contributor to Ausdrill’s earnings, so it is neither here nor there to the ongoing operations while the proceeds can be used to fund a ramp up in core assets. We own ASL in the growth portfolio

Ausdrill (ASL) Chart

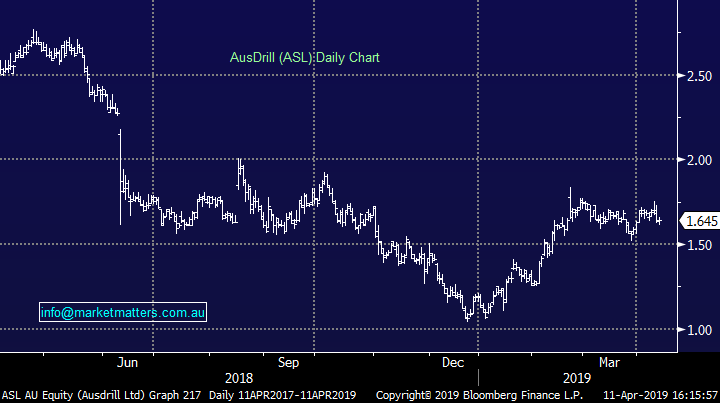

Bank of Queensland (QLD), -4.89%, was sold off today on a soft 1st half report from the company posted prior to the market open. The regional bank saw profit slip 10% from the same period in 2018, despite growing the loan book by 3%. The net interest margin (NIM) fell 4bps over the 6 months to an extremely tight 1.94% due to rising funding costs and increasing competition. Although they still remain at low levels, bad debts did start to creep higher in the quarter – an area which has helped support bank earnings over the past few years.

The bank will pay a 34cps dividend for the half, about 10% below each of last year’s dividends, and below expectations of 38cps. It does still trade on a yield of over 7%, grossed up to over 10%. The company guided to a flat second half, likely coming in below current consensus expectations. We own BOQ in the income portfolio

Bank of Queensland (BOQ) Chart

Broker Moves:

- Asaleo Care Reinstated at Macquarie With Neutral; PT A$0.84

- InvoCare Downgraded to Hold at Morningstar

- Sandfire Downgraded to Sell at Morningstar

- Flight Centre Downgraded to Sell at Morningstar

- Beach Energy Downgraded to Sell at Morningstar

- Beach Energy Downgraded to Neutral at Credit Suisse; PT A$2.02

- Rio Tinto Downgraded to Underperform at Exane

- Santos Downgraded to Underperform at Credit Suisse; PT A$6.40

OUR CALLS

We sold Sims Metals (SGM) in the growth portfolio today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.