Blackstone buys 10% of Crown (LLC, COL)

WHAT MATTERED TODAY

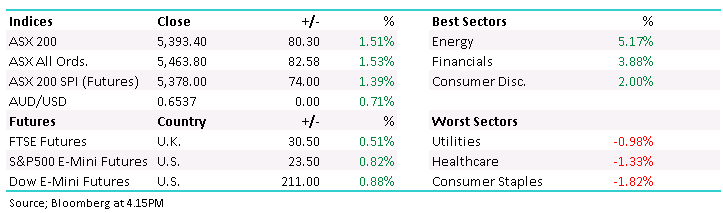

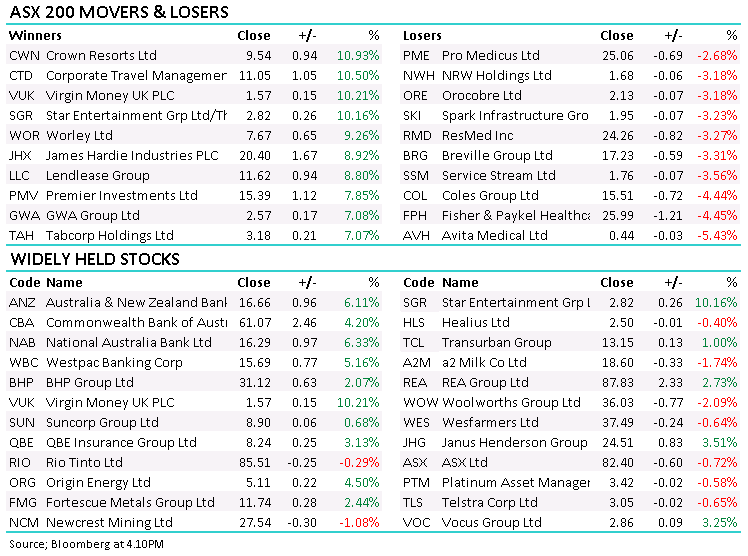

A strong session across the board today led by the banks which accounted for more than 50% of the day’s gains. When ANZ and NAB are up more than 6%, WBC up more than 5% & CBA more than 4% it’s always going to be a decent session. NAB finishing today’s session at $16.29 v $14.15 issue prices.

Casino stocks were in focus today and frustratingly, Crown (CWN) added ~11% after private equity giant Blackstone took a 10% stake thanks to a discounted sell down by Melco Crown. I talk more about this in the recording below however suffice to say its bullish for CWN, a stock we’ve been looking to add to the portfolio but have been too pedantic on price.

Elsewhere, Energy stocks were also firm as they start to look through the short-term noise around the Oil price and factor in a recovery from recent lows. We remain bullish Oil stocks.

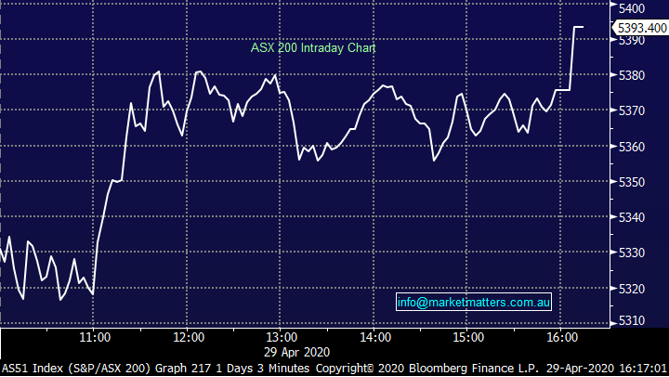

Today the ASX 200 added +80pts /+1.51% to close at 5393 - Dow Futures are trading up +211pts/+0.88%

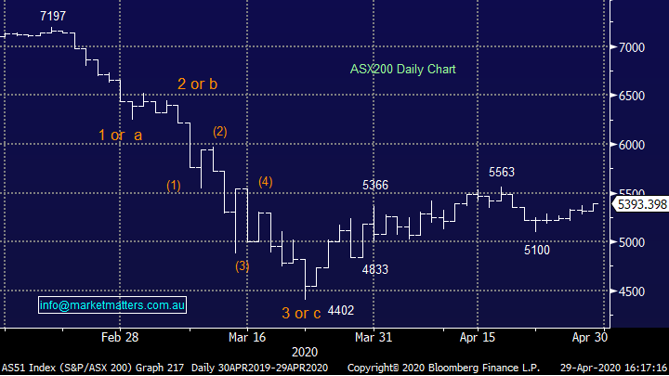

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Direct From The Desk: Recording covering Banks, Crown (CWN), Lendlease (LLC) & Coles (COL) – click here

Lendlease (LLC) +8.8%: resumed trading today after successfully getting a $950m capital raise away. At $9.80 a share, those lucky enough to land some are already 18.5% ahead with new shares offered at a 9% discount to the last price. A share purchase plan is now underway in an effort to take the total raised to $1.15b. The raise came to sure up the developer’s balance sheet with COVID-19 causing delays to projects in London, Singapore, Kuala Lumpur, Milan and across the US. The company said that their FUM business had managed to secure a $1.6b mandate which will help support earnings there despite revaluations elsewhere impacting the result.

The full year result will also be hit by delays in the development segment and a fall in productivity in construction causing Lendlease to walk from guidance. The sale of the engineering business is progressing, though it may not be in a position to complete the transaction in this half. Lendlease is cheap and was being weighed down by the need to raise capital with plenty of debt on the balance sheet. Now that this has been resolved, LLC could see a floor in place and represents decent buying.

Lendlease (LLC) Chart

Coles (COL) –4.14%: out this morning with a very strong sales update. Supermarkets experienced like for like sales growth of +13.1% on 12 months ago, with not only a strong (and expected) COVID-19-driven ‘pantrydemic’ episode but also a strong January and February by the look. They also said price inflation was +2.6% vs. +0.9% this time last year showing that they had success rising prices during this period of increased demand – something that won’t be featured in their ads!

Not surprisingly (if our household was anything to go by), Liquor sales were strong with LFL sales growth at +7.2% vs. last year and that was despite the negative impact of bushfires in January. They also saw good growth in their convenience business. In terms of current trading they said “In the first four weeks of the fourth quarter, which included the Easter period and ANZAC Day, Supermarkets comparable sales growth has broadly trended back toward the levels seen in the early part of the third quarter (pre COVID-19).”

The last line there explains why the stock is trading down 3% this morning + it also speaks to an increasing level of normality across the economy, a positive for other areas.

Coles (COL) Chart

BROKER MOVES:

- Brickworks Raised to Buy at Citi; PT A$14.20

- Northern Star Cut to Neutral at Macquarie; PT A$14

- Technology One Cut to Neutral at Macquarie; PT A$9.75

- Perseus Cut to Neutral at Macquarie; PT A$1.20

- oOh!media Resumed Outperform at Macquarie; PT A$1.25

- Mayne Pharma Rated New Buy at Canaccord; PT 75 Australian cents

- Sonic Healthcare Cut to Sell at Morningstar

- Sydney Airport Raised to Buy at Goldman; PT A$7

- Atlas Arteria Raised to Buy at Goldman; PT A$6.84

- Saracen Mineral Cut to Hold at Jefferies; PT A$4.85

- nib Raised to Neutral at Credit Suisse; PT A$4.90

- Westpac Raised to Buy at Bell Potter; PT A$17.30

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.