Bingo (BIN) steps back from guidance amid COVID-19 potential impacts

Bingo (BIN) -4.96%: fell on their sword today as they walked away from FY20 guidance that was reiterated just 4 weeks ago - a sign of the fluidity of the evolving situation however its becoming the norm across the ASX.

Despite pulling guidance, the company did say that the 3rd quarter was on track to hit expectations however given the impending shut down in NSW & Vic, visibility in earnings was too murky to stand by guidance. Bingo estimates that around 15% of revenue falls in the Commercial & Industrial (C&I) category which will be most impacted by the shutdown. Although volumes in construction remain firm, Bingo also noted potential disruption of projects could impact volumes in Building & Demolition (B&D) in the final quarter of the year, although government stimulus packages targeted at these industries may mean a strong rebound.

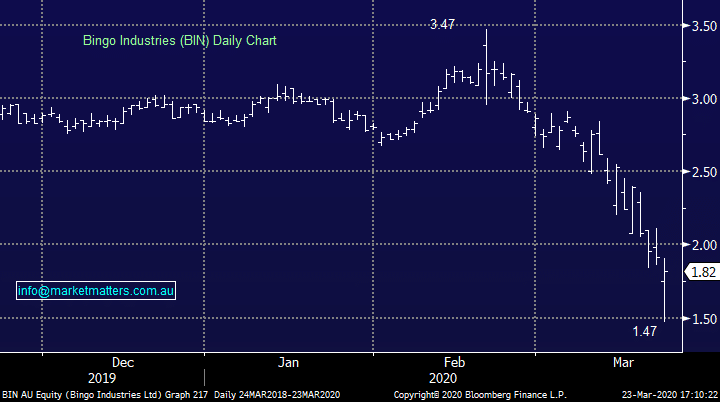

The show must go on for Bingo, and MD David Tartak was keen to point out the company's strong balance sheet. Tartak has acted quickly to cut costs with "the deferral of all non-essential capital expenditure and reduction of operating costs" in an effort to protect the business if the situation deteriorates further. Bingo shares fell less than the market, a sign a lot of the comments were expected by the market. BIN hit a $1.47 today before closing at $1.82, I know it doesn’t feel like but that’s a bullish move on the day.

Bingo (BIN) Chart