Bingo (BIN) ends FY20 strong to beat expectations

Bingo (BIN) +13.49%

The result I was most concerned about this reporting season dropped today and it beat on all metrics. The bearish thesis was around weak construction hurting earnings, reduced earnings putting pressure on the balance sheet and a forced equity raise the obvious consequence….well, that didn’t happen with revenue holding up while earnings were driven by better synergies coming through from the DADI acquisition. This was a very strong result given the complexities in the current operating environment – they even grew margins. There were a lot who were short / negative this stock hence the pop in share price today.

Here’s their guidance – weak construction, strong infrastructure (no surprises there) “Due to the impacts of COVID-19 we anticipate non-residential commencements may fall by ~20% in FY21 and residential commencements are forecast to reduce by ~15%. However, we anticipate the backlog of projects this will cause will result in a surge of activity towards the end of FY21 and into FY22 and beyond. Infrastructure activity is expected to increase by ~10%. Infrastructure is expected to remain strong for the foreseeable future and for BINGO will partially off-set the softness in the building sector.”

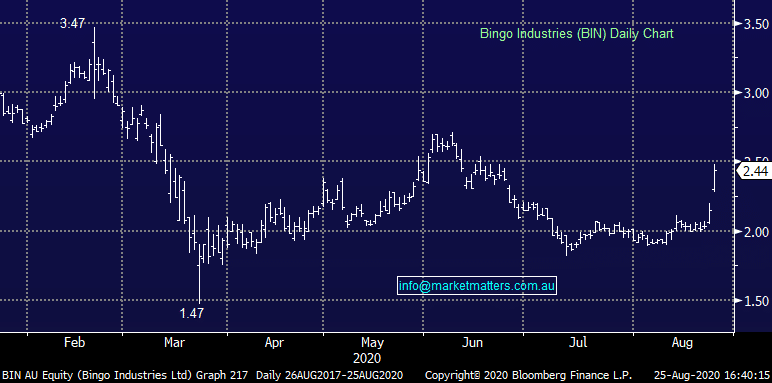

Bingo Industries (BIN) Chart