BHP on track after 3 quarters, talks global impact of corona

BHP Group (BHP) -2.5%: traded largely in line with peers and the broader index today after posting a reasonable set of 3rd quarter production numbers. Production was down on the second quarter across the commodity deck as is normally the case given the seasonal headwinds faced, though numbers seemed a tad light on for petroleum & coal in particular while iron ore & copper were better than the same quarter last year. Costs were all within guidance.

BHP also provided some commentary on what they are seeing from the demand side noting the various impacts of COVID-19. According to the miner, China is back to running near full pace,supporting iron ore demand while copper has seemed less of an impact ex-China. They noted oil storage capacity would likely become an issue, as it did overnight. BHP has softened its approach to its growth projects, pinning CAPEX back and is likely to guide spending lower into next year. Mostly though the company is in good shape and has plenty of liquidity across its balance sheet. Two factors remain key though, ensuring mines continue to run and demand starts to pick up again. We like & own BHP.

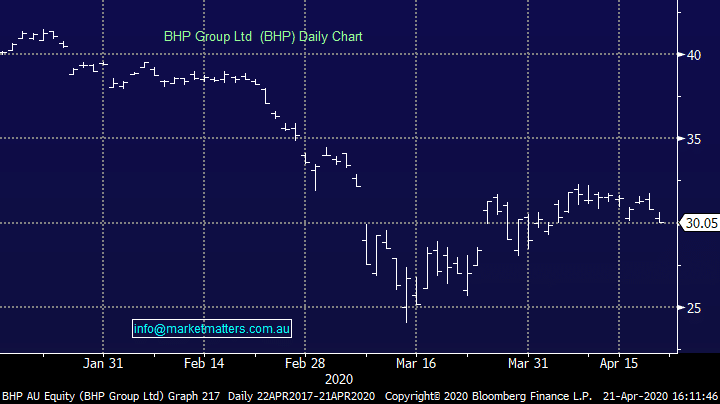

BHP Chart