BHP to get big windfall for US shale assets

Stock

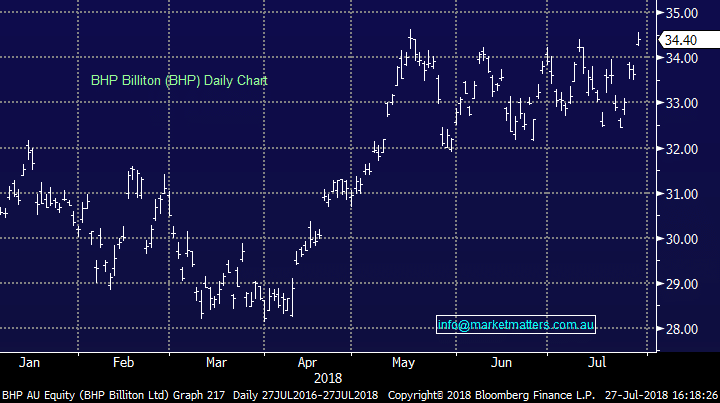

BHP Billiton (BHP) $34.40 as at 27/07/2018Event

This morning BHP announced the sale of US shale assets to BP and Merit Energy for an all cash total of $US 10.8bil. It’s a great result for BHP, with the market expecting a number closer to the $US 10bil mark. Half of the cash will be paid in October, with the remaining coming in 6 equal monthly instalments. BP picked up the bulk – paying $US 10.5bil for the Petrohawk Energy Company while Merit paid $US 300mil for the Fayetteville assets. Management had previously flagged that the proceeds for this transaction would go straight to shareholders, so we can expect special dividends and/or buybacks to occur, although the timeframe for this will now depend on whether BHP will wait until all cash has been received. View our afternoon report covering AMP as well - 'Market cruises into the weekend after a solid week' BHP Billiton (BHP) Chart