Betting on Tabcorp

Stock

Tabcorp (TAH) $4.82 as at 08/08/2018Event

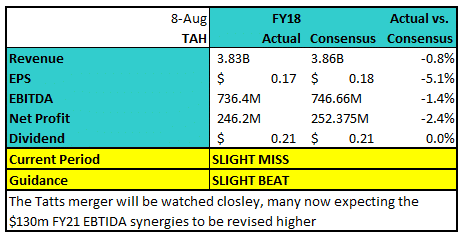

Betting agency Tabcorp has rallied on what looks at first glance a poor result. The stock was sold off yesterday prior to the result but has bounced back strongly today despite missing consensus earnings by ~2% at $246.2m. The key to the market’s reaction has been the focus on the integration of Tatts post the merger completed earlier this year – it seems the market is starting to believe the purported $130m in EBITDA synergies expected in FY21, although only $8m has been delivered thus far. The result is somewhat messy, it includes costs associated with the merger as well as a $91m loss to close the Sun Bets UK joint venture with News Corp. Some of these impacts were offset by a highly successful Soccer World Cup in which Tabcorp realized $26m revenue and also saw active users rise and remain elevated after the event. It seems those with the inside tip focused on a near-term miss while the market is optimistic around future integration & growth

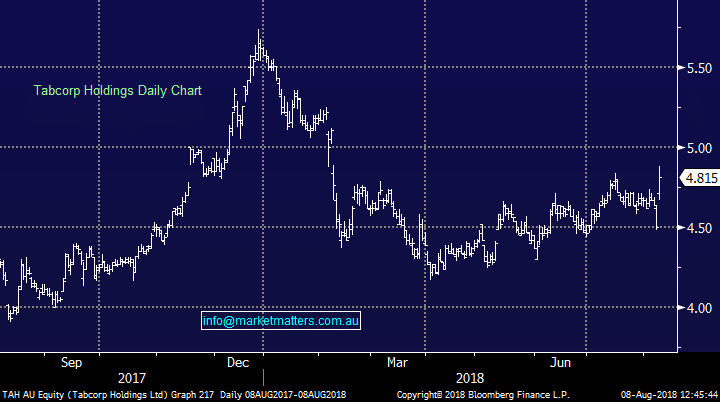

Tabcorp (TAH) Chart

It seems those with the inside tip focused on a near-term miss while the market is optimistic around future integration & growth

Tabcorp (TAH) Chart