Bega Cheese (ASX: BGA) plummets on off guidance

Stock

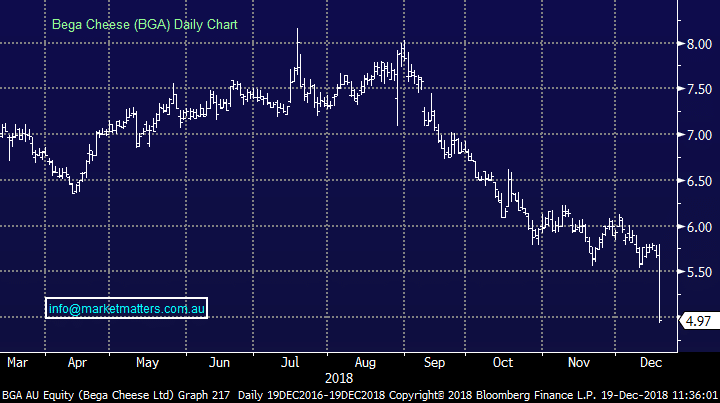

Bega Cheese (ASX: BGA) $4.97 as at 19/12/2018Event

Cheese maker Bega is the worst performer in the ASX200 this morning after updating the market with soft guidance for FY19 half way through the year. As with many companies with leverage to the agriculture sector, Bega has blamed the drought for its woes sending the stock tumbling over -10%. A lack of rainfall has seen milk production fall and costs increase, eating away at Bega’s production and margins, with milk supply across the industry expected to fall 5% over FY19. The company guided to $123m-$130m EBITDA in the current financial year, which translates to a net profit of $44m-$48m. EBITDA guidance suggests growth of 12-19% over the year, but this impressive number falls short of market expectations. Analysts’ EBITDA consensus was set at $135.3m for the year, along with a $55.75m net profit number, meaning new guidance has missed EBITDA by 6.5% and profit by over 17%. The company has been working to secure milk supply to sure up inventory levels, noting that their intake is expected to increase 30% year on year.Bega Cheese (ASX: BGA) Chart