Beach Energy tops ASX leaders board on good result (BPT, LLC, KGN, JBH)

WHAT MATTERED TODAY

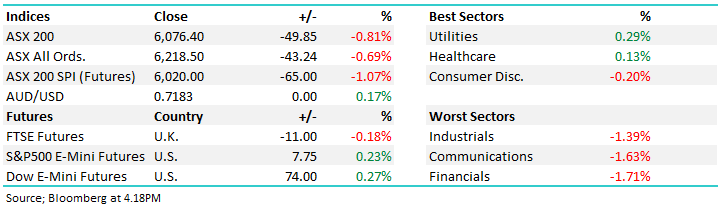

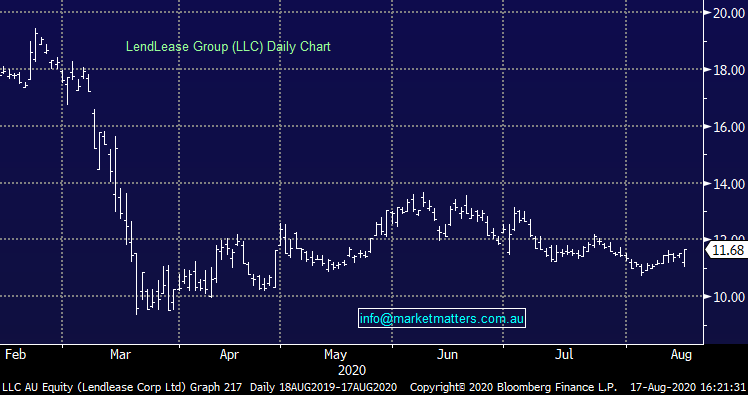

The market started a big week of reporting on the back foot today thanks largely to weakness amongst the banks, a weak result from Bendigo (BEN) the likely catalyst dragging the seven banking constituents down an average of 2.90% on the session. It was a choppy session today despite the market ending pretty close to where it started, some fits and starts but overall weakness at the index level. Beach Energy (BPT), which is our preferred energy exposure had a day in the sun today topping the ASX 200 leader board while Lend Lease (LLC), also held in the growth portfolio reported a weak scorecard but talked up a strong order book for the year ahead – more on these and other results below.

While we ended down today, Asian markets were mostly higher while US Futures were in the green all day.

Overall, the ASX 200 lost -49pts / -0.81% to close at 6076. Dow Futures are trading up +74pts / +0.27%

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

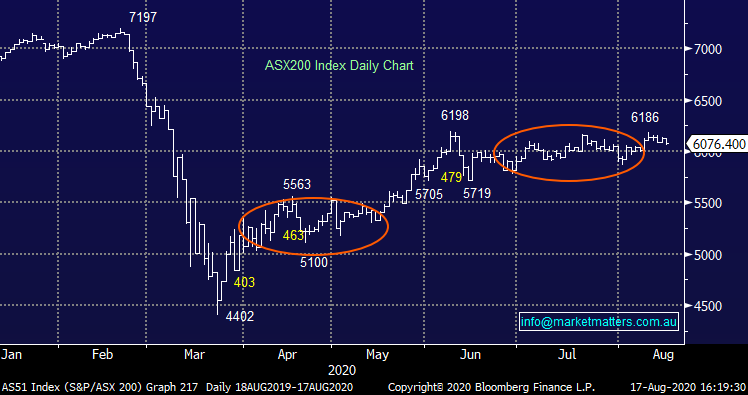

Beach Energy (BPT) +7.12%: A strong FY20 result from BPT today with our medium-term thesis for owning intact. We’ve got a new energy analyst at Shaw (Michael Clark) and today BPT beat his expectations reporting underlying NPAT of $461m v his expectations for $442m. Operating cash flow of $874m is down 15% on FY19 due to realised pricing effects but ahead of estimates – that weaker operating cash flow fed into slightly decreased net cash of A$50m (from A$60m 1H20). Guidance has been released for FY21 for the first time and is broadly in line with consensus estimates. They also provided an update to their 5-year outlook (post COVID-19) - it’s more conservative in the short term (reflecting a COVID-19 response), however in line with long term estimates for production and capex. We remain bullish on BPT

Beach Energy (BPT) Chart

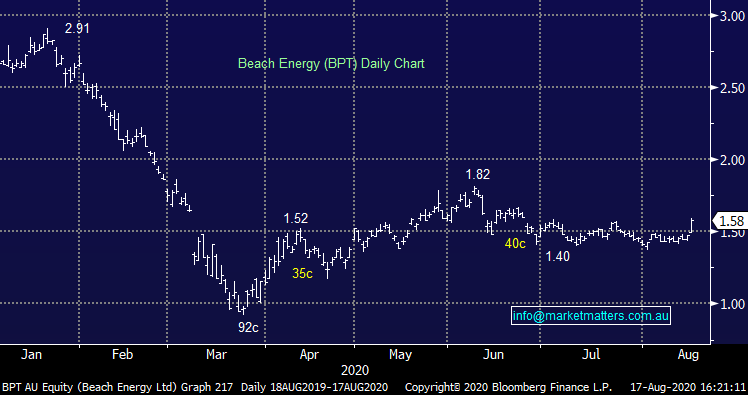

Lend Lease (LLC) +1.39%: a particularly messy result even to LLC standard given they’re in the middle of offloading their engineering business. The core business posted a $96m profit for the year however they also realised a $406m loss on the outgoing business which included $368m in exit costs. Those figures were largely pre-guided in an update to the market in July, so the focus of the market today was on the outlook and progress on the sale. COVID has certainly had an impact on the business in the 2H20 – focussing on the core business, EBITDA took a 62% hit, posting a $65m loss in the second half as COVID delayed transactions and productivity. While the impact is ongoing, the development pipeline grew to $113b as governments look to invest in construction to reboot economies – the main reason we own the stock. The balance sheet is in good nick with gearing under 6%. As for the engineering business, the deal is set to be completed in the current period with the proceeds split into multiple payments over the 12 months. The recovery from early weakness today encouraging.

Lend Lease (LLC) Chart

Kogan (KGN) -6.09%: Stock was down today however the result was strong, just not as strong as the market was expecting. Revenue for FY20 was $497.9m v $512.2m expected and that dropped down to net profit after tax of $26.8m, up 56% on FY19 ($17.2m) however slightly behind the $28.72m expected by the market. They talked about acceleration in the 2H of 2020 and like all Kogan updates, the glass was very much half full. They now have 2.183m active users and continue to see good growth opportunities into FY21. Clearly KGN are a big beneficiary of COVID-19 however the move towards online purchasing seems to be structural rather than cyclical. It was miss but momentum in the business in strong – it’s just bloody expensive!

Kogan (KGN) Chart

JB Hi-Fi (JBH) +4.8%: Another strong result for JBH – without the benefit of a strong online offering (only 8% of sales). Top line sales beat expectations for FY20 coming in at $7.92bn v $7.88bn while underlying NPAT was $332.7 versus $328m expected (not $302m as suggested in the recording this morning – that was statutory profit). They spoke to strength in the first part of FY21, particularly in online (coming from a low base) with total sales growth in July 21 of 42.1% year on year which is clearly strong and the reason why the SP popped today. A really strong performance from JB as the run on the retailers continues. Here’s comments from Danny Younis (our analyst) on the broader sector: Online is where it’s at for retailers atm, notably the pure online leaders KGN, RBL, MMM, TPW and those accelerating their presence (SSG, ADH, CCX, AX1, etc) – with anticipated upside to BNPL players too: APT, Z1P, OPY, SPT, SZL. Even the laggards who have long resisted online have finally succumbed (COL/WOW/Bunnings/NCK/LOV) and those with exceptional business models (solid LFL sales growth, strong margins, low CODB, high sales per sqm, optimal inventory control, prudent cost control, online acceleration model, etc) with low online penetration (like NCK and JBH) continue to outperform with stellar results.

JB Hi-Fi (JBH) Chart

Bendigo Bank (BEN) -6.57%: A tough session for BEN coming off a tough year for the regional bank. They booked cash earnings for FY20 of $302M vs our analysts (Brett Le Mesurier) forecast of $305m. No final dividend was declared which was widely expected – they’ll revisit again later however we’d be surprised if they paid one. Income increased by 1% from FY19 to FY20 but fell by 2% from 1H20 to 2H20. Net interest margin (NIM) fell by 6 bps from 1H20 to 2H20 as expected, the big surprise was expense growth and it wasn’t a pleasant one. This is the reason for today’s negative share price reaction. Expense growth was 10% on a cash earnings basis from 1H20 to 2H20. All too hard for BEN at the moment.

Altium (ALU) +1.34%: managed to edge out a small gain on the day of reporting although it was a choppy one for the software developer for electronic hardware. Top line was as expected given they pre-released some figures last month however the growth of 10% was well below the previous year’s 23% expansion. The company had set a goal for revenue to hit $US200m in FY20, falling short given the impact of COVID which also resulted in pushing out the longer-term target of $US500m by 2025 by 12 months. Statutory numbers came in lower as Altium extended payment relief to customers most impacted by the pandemic, they also brought forward the full release of new cloud based Altium 365 targeting a fully online product for designing printed circuit boards. The new offering is driving further market share gains for Altium. Outlook remains pretty positive with Altium’s key printable circuit board market continuing to grow.

Bluescope Steel (BSL) +2.32%: ended the day higher despite the drop in profits, with the full year posting an underlying figure of $353m, down 63% on last year but inline with expectations of $354m. Earnings were weighed by a drop in demand for building products, while shut downs at car making factories also took their toll. The company had previously noted it would recognize an impairment of around $200m on its NZ & Pacific operations as a result of the structural shift in the steel market which weighed on margins. It is currently reviewing these operations, targeting $50m in savings. The company didn’t provide any guidance given the uncertainty, though was pleased to say that the US North Star Mill was operating near capacity. The market wasn’t expecting much and BSL met expectations!

BROKER MOVES

· Harvey Norman Raised to Overweight at JPMorgan; PT A$4.75

· NAB Cut to Underperform at Jefferies; PT A$15.13

· Navigator Global Raised to Buy at Ord Minnett; PT A$2.30

· Telstra Cut to Neutral at JPMorgan; PT A$3.40

· Metcash Raised to Outperform at Credit Suisse; PT A$3.47

OUR CALLS

No changes today

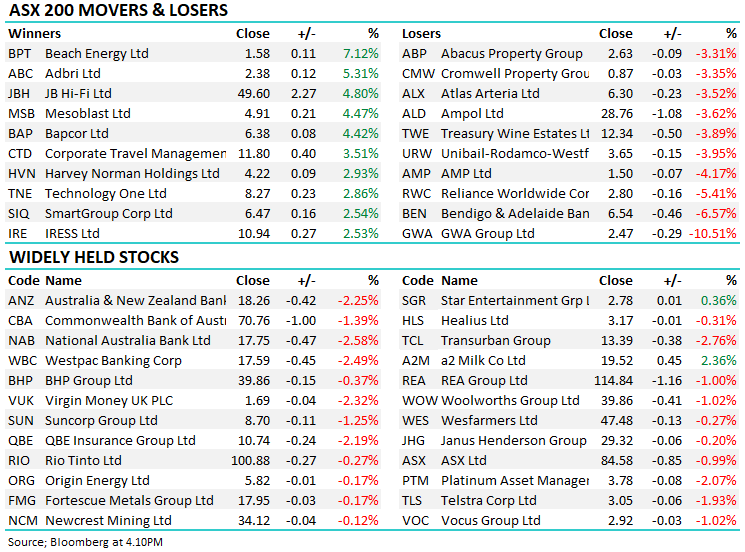

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.