Banks support an otherwise soft market (ASX:CSL, ASX:FBU, ASX:A2M)

WHAT MATTERED TODAY

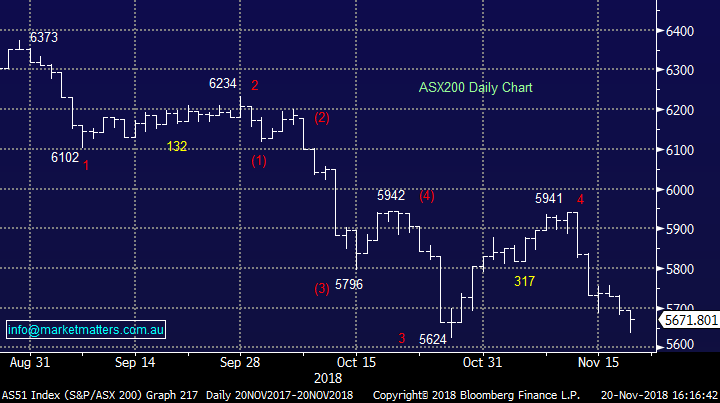

We often say the market can’t rally without the banks, and the flipside is obviously true on the downside, today was a great example of that with the market suffering decent losses early, only to have buying across the banking sector underpin a strong rebound late in the session – the index closing down 22pts but up +36pts from the daily low. Our ‘gut’ feel after today is the market wants to rally, the banks are a big part of that and the rhetoric from the Royal Commission this week, specifically Matt Comyn from CBA has net positive.

While we acknowledge the banks poor behaviour in the past, we’re investors and need to look towards the future and that’s certainly the angle that Matt Comyn seems to have worked successfully over the past two days. He’s effectively blamed the old while promising the new will be better - which is a hard call given he was part of the old.

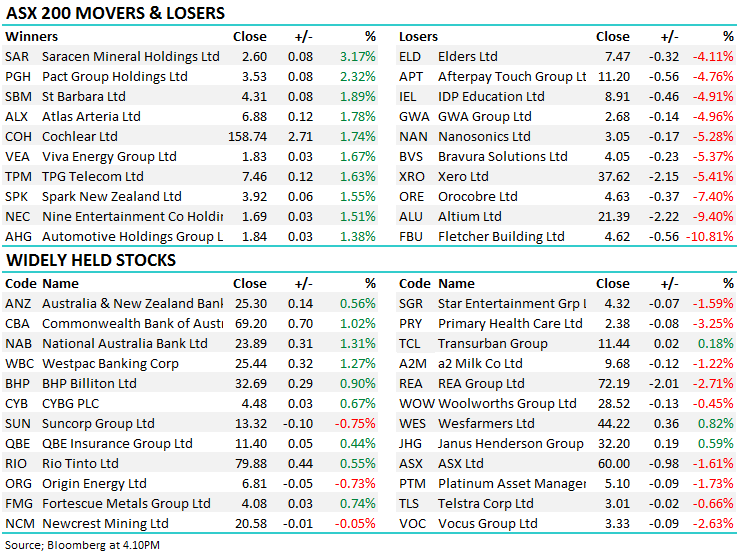

He’s message has had more cut through though given he questioned some of the questionable products and has evidence to back that up. On a day where US markets were down ~400pts and markets in Asia were off around 1-2%, we saw ASX:ANZ +0.56% ASX:CBA +1.02%, ASX:NAB +1.31% & ASX:WBC 1.27% , as a group the big 4 added more than 11points towards the ASX 200, more than offsetting the 9.54points taken from the index thanks to weakness in ASX:CSL which was down -3.59% to $175.75

A big block trade of 1.43m shares transacted representing a ~0.32% stake in the Aussie healthcare behemoth, or ~$250m with UBS handling the flow I hear. The line was done at $175.50 versus the market price at the time of $177.30. It’s a difficult stock to trade and getting away that line at that discount is probably not a bad effort.

CSL Chart

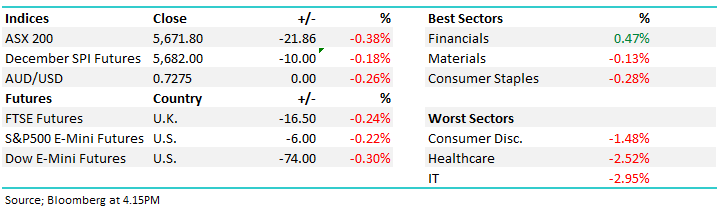

Overall, the ASX 200 closed down -22points or -0.38% at 5671. Dow Futures are currently down -58points or -0.38%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Macquarie Group (ASX: MQG) upgraded to a buy a few days before they go to the Royal Commission…A big call from Morningstar given (from my recollection) MQG are yet to appear.

- ANZ Bank (ANZ AU): Upgraded to Buy at Morningstar

- Cochlear (COH AU): Upgraded to Buy at Morningstar

- Collins Foods (CKF AU): Downgraded to Hold at Morgans Financial; PT A$6.92

- Growthpoint (GOZ AU): Upgraded to Neutral at JPMorgan; PT A$3.50

- Iluka (ILU AU): Upgraded to Overweight at JPMorgan; PT A$9.80

- Macquarie Group (MQG AU): Upgraded to Buy at Morningstar

- Primary Health (PRY AU): Reinstated at Goldman With Sell; PT A$2.23

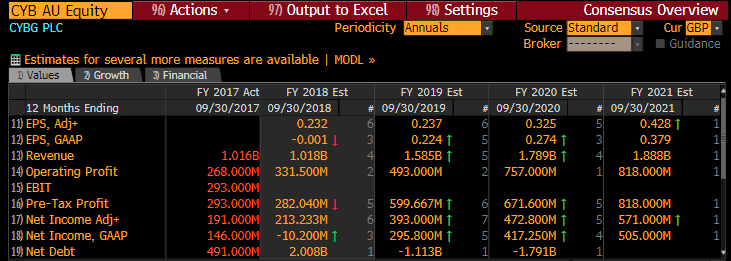

CYBG (ASX: CYB) $4.48 / +0.67%; A stock we discussed this AM and are due to report tonight. They were sold early but bid up into the close – perhaps a sniff of a good result is doing the rounds. We like this stock into current weakness however taking the safer view and waiting till they report given the extreme weakness we’ve seen recently.

Here’s what consensus is…EPS 23.2p on revenue of 1.018B GBP

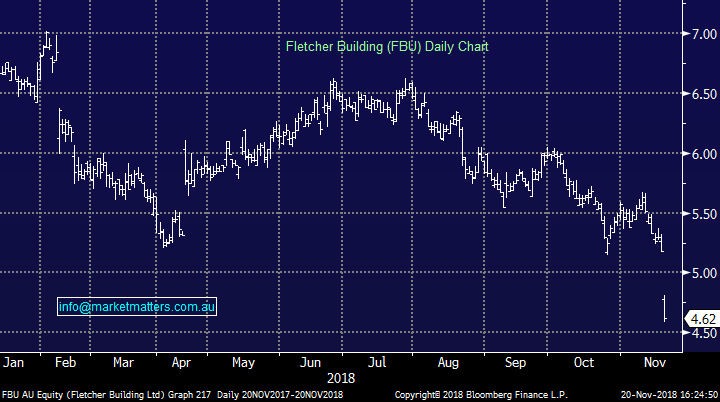

Fletcher Building (ASX: FBU) $4.62 / -10.81%; The building materials manufacturer was the worst performing company on the index today after the company released disappointing FY19 guidance before the market opened, continuing the recent weak commentary coming from a number of construction leveraged names. Guidance for full year EBIT (before one off charges) was $630m - $680m, with the top end below the consensus estimate of $692m.

The commentary provided by the company focussed on a weak housing outlook in both New Zealand & Australia – the company’s main markets. In the Australian residential market, the biggest contributor to the company’s result, trading conditions have come under pressure as input prices rise and the housing market cools squeezing margins and volumes.

Today’s poor guidance from Fletcher follows a number of construction & real estate companies giving soft commentary around the currently soft market conditions. LendLease (ASX: LLC) took a huge hit to their engineering business recently, citing input costs, delays and productivity as reasons for the $350m impairment. Similarly, Boral (ASX: BLD) was extremely downbeat in their recent commentary and the market hasn’t reacted kindly.

Fletcher Building (ASX: FBU)Chart

A2 Milk (ASX: A2M) $9.68 / -1.22%; despite a huge uplift in revenue and an early rally, a2 Milk finished lower this afternoon. A2M was quick out of the box, reaching 6-week highs before selling took hold and the stock rolled over. Holding their AGM today, a2 had solid updates for the market, showing a 65% jump in profit for the first four months compared to last year – although this is below the they huge 68% growth achieved over FY18, and the company was downplaying expectations for the rest of the year. Much of the number was driven by cost cutting efforts – revenue up 40% vs earnings up 65% - while another impressive “Singles day” in China also contributed.

a2 Milk (ASX: A2M) Chart

OUR CALLS

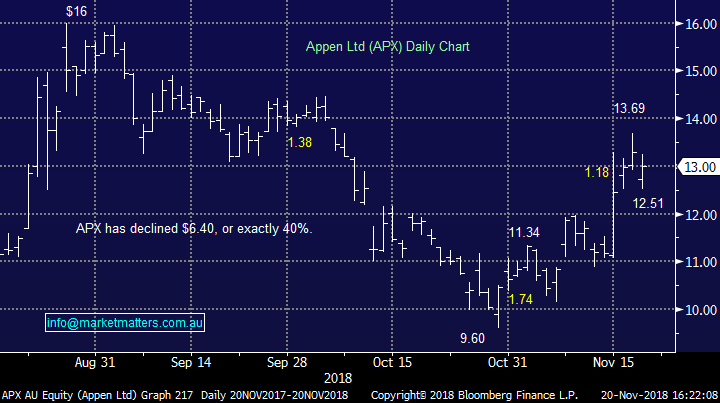

We called a buy on Appen (ASX:APX) this morning at $12.50 or better and that seemed to support the market, the stock trading to a $12.51 low – which is frustrating. We try to set prices that we believe represent good risk v reward buying, however being too pedantic on limits can ultimately be a hindrance. The fact we publish a price ahead of time and that can support the market is not lost on us, particularly in a stock where our orders may be a reasonable part of the daily turnover. Expect to see the term ‘around’ a certain price more frequently – apologies if this is too vague however generally to us, the term around means +/-1% from the written level. If unsure, email [email protected] and we’ll do our best to respond in a timely way.

Rightly or wrongly, we did not chase APX today. I’ll update our view on the stock in the morning.

RE Cimic (CIM). This was closed at $42.50

Appen (APX) Chart

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.