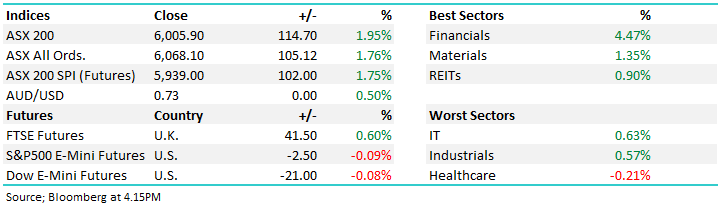

Banks push ASX 200 back up through 6000 (JHG, CIM, JHX, Banks)

WHAT MATTERED TODAY

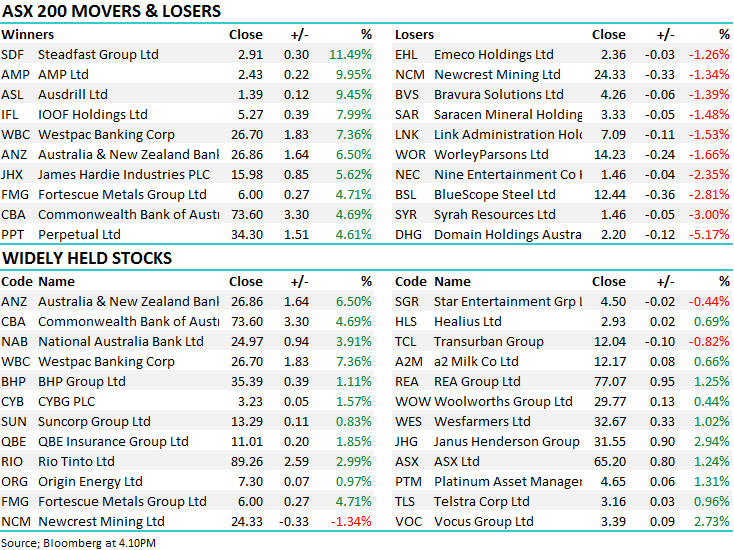

Bang…some massive pent up buying / or short covering, probably both playing out in the banking space today as the market clearly voted with its feet, jumping boots and all back into the banks. Of the ~114pts added to the market today, ~67pts came from the banking complex. While the recommendations from the RC were less onerous than perhaps some in the mkt were expecting, ANZ up +6.5%, CBA +4.69%, NAB +3.91% & WBC +7.36% is clearly a big reaction.

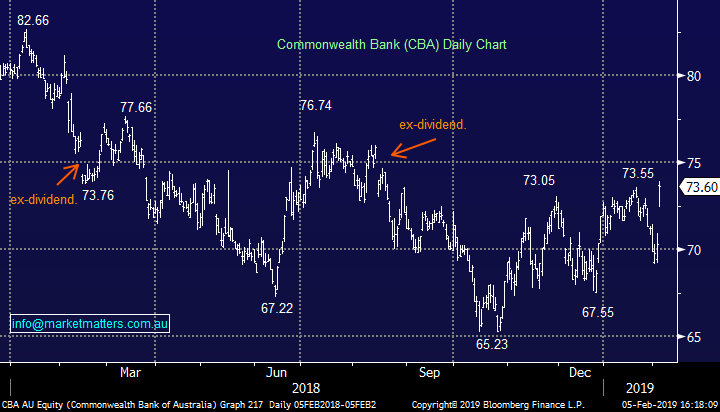

Short interest had been building steadily in the banks for a while - WBC for instance had around ~40m shares short in October rising to around ~70m shares at the end of January. The value of trade in the banks today was simply massive, CBA & WBC traded nearly $600m, NAB and ANZ nearly $350m a piece. So, shorts being the highest in around 2 years, less bad news from the banking RC got buying in early today and as you can see from the chart below, it was sustained for most of the session.

The RBA was out at 2.30pm and kept rates on hold as expected + downgraded their outlook for economic growth, however was less dovish around rates than they could have been – which was ultimately good for the AUD which rallied from sub 72c to 72.65c at time of writing. The short banks, short the AUD trade would have taken the face off some today…

While we’re overweight the banks and have been for a while, our base case being that the negativity around the RC was baked in, the rally today was massive and I think disproportionate to what has changed. The short thesis on the banks (I thought) was around real-estate prices and loan growth – not much has changed there. While vertical integration stays under the new regime, that’s really only relevant for WBC now. Our incoming PM Bill Shorten has made it abundantly clear his focus remains to go hard on the banks as an election issue and that will still be a headwind for them. Ultimately, I think we’ve now seen the lows in the banks, they’ll grind up from here, however it’s not all clear air as todays price action implies. Higher lows should be bought, but buying such extreme strength as we saw today should be avoided.

Overall, the ASX 200 closed up +114points or +1.95% to 6005. Dow Futures are currently trading down -4pts, they’ve been muted during our time zone

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Banks; Hard to go past them today and they totally overshadowed the few earnings results that came across the ticker – here’s charts of the BIG 4 – which have just gotten bigger.

ANZ Bank (ASX:ANZ) Chart

Commonwealth Bank (ASX:CBA) Chart

NAB (ASX:NAB) Chart

Westpac (ASX:WBC) Chart

Other stocks impacted by the Royal Commission (RC); Mortgage Choice (ASX:MOC) hit hard -25% on the RC news was the big casualty here – the stock has traded down from ~$3 to close today at 78.5c. others to feel the pinch in the smaller space were GMY (-12.8%) & RMC (-7.7%) while freedom insurance (ASX:FIG) went into a trading halt which is scary. AMP and IFL rallied hard +9.95% and +7.99% respectively, mainly a consequence of vertical integration recommendations, however we’d still be a seller of any strength here.

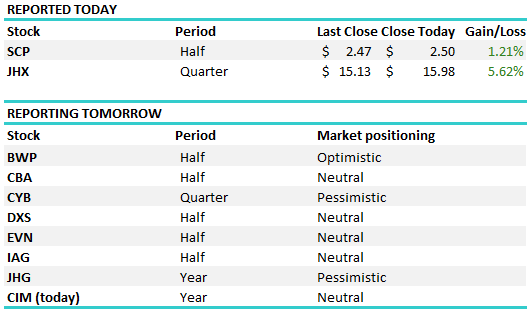

Reporting; JHX reported less bad numbers today and rallied. I think mainly around their guidance which was smack on the midpoint of analyst expectations – the stock trading on a decade low PE means a meet is a beat. Harry covered below while SCA Property was also out and okay, I thought light on in terms of dividend guidance + they revalued their book down by 1.3%. NTA now sits a $2.27 v $2.50 close today – it’s too expensive here. A bigger day tomorrow with CBA headlining – the market looking for half year profit of ~$4.79bn, EPS of $2.73 and a final dividend of $2.01

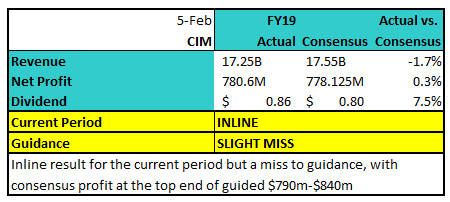

Janus (ASX:JHG) is set to report tonight in the US. We will be watching the reaction closely - the market has become so downbeat on the stock and won’t be asking a lot - it’s on an PE of 7.5x! The profit figure won’t be watched so much as costs, performance & fund flows data with any sign of a turnaround in outflow to be welcomed. It’s a self-help story that investors have lost faith in with this result being the next opportunity to show the market the ship is turning. Bond King Bill Gross retired from JHG last night, however his performance was weak in recent times – he was effectively managing the $700m of his own capital.

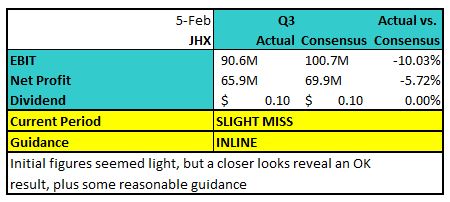

James Hardie (ASX: JHX) +5.62%; the construction material company’s 3rd quarter result was watched closely this morning following the downgrade by peer player Boral (ASX: BLD) yesterday, and it appears Hardies has been less impacted by the issues that face Boral. The result was slightly below the same quarter of last year, but it showed the company performing well while the US housing market struggled. The market was not asking much at this result, trading on around 14x PE, the cheapest level in almost a decade and the numbers did enough to impress.

Guidance for the full year was in line with expectations, with management guiding to $US295m to $US315m vs the market at $US306m for the March year end. Perhaps investors were just pleased it didn’t follow Boral’s lead. The company did note an accelerating squeeze in margins, which fell 3.5% points over the quarter. This was driven by input costs however it continues to experience above market growth rates across its segments, with price increases helping to offset some of the added costs. Still, a decent final quarter will be required to hit their full year guidance.

James Hardie (ASX: JHX) Chart

Cimic (ASX: CIM) $45.90; Just out after market with an inline result for their full year. No real surprises, top line was shy of expectations however margins clearly made up for the shortfall. Investors will be treated to a better than expected $0.86 fully franked final dividend. Guidance will be an issue when the stock opens up tomorrow, with FY19 profit looking a little light.

Broker Moves;

· Ardent Leisure Rated New Neutral at Macquarie; PT A$1.90

· IOOF Holdings Upgraded to Buy at Baillieu Holst Ltd; PT A$6

· ClearView Downgraded to Neutral at Macquarie; PT A$0.91

· Australian Finance Downgraded to Neutral at Macquarie; PT A$1.17

· NAB Cut to Neutral at Evans and Partners; Price Target A$32.21

· Alliance Aviation Cut to Hold at Wilsons; Price Target A$2.48

· Technology One Downgraded to Sell at Morningstar

· APA Group Downgraded to Sell at Morningstar

· OZ Minerals Downgraded to Sell at Morningstar

· Sundance Energy ADRs Rated New Strong Buy at IFS Securities

· IPH Rated New Buy at Goldman; PT A$6.50

· Rio Tinto Downgraded to Neutral at JPMorgan; PT A$92

OUR CALLS

No amendments today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/02/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.