Banks offset weakness amongst the miners (CBA, A2M, DHG)

WHAT MATTERED TODAY

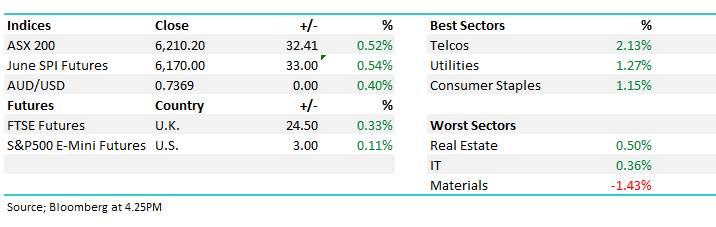

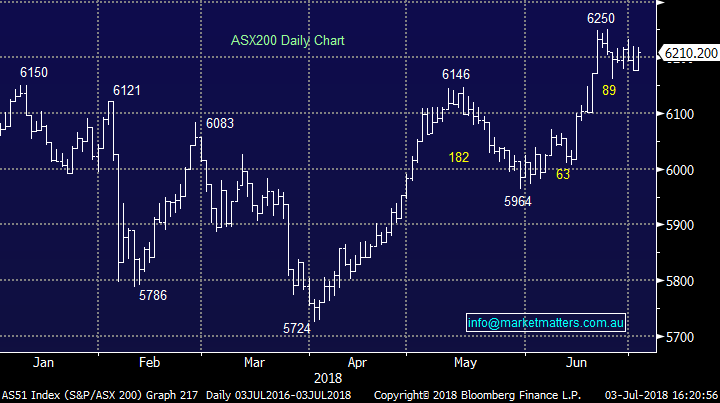

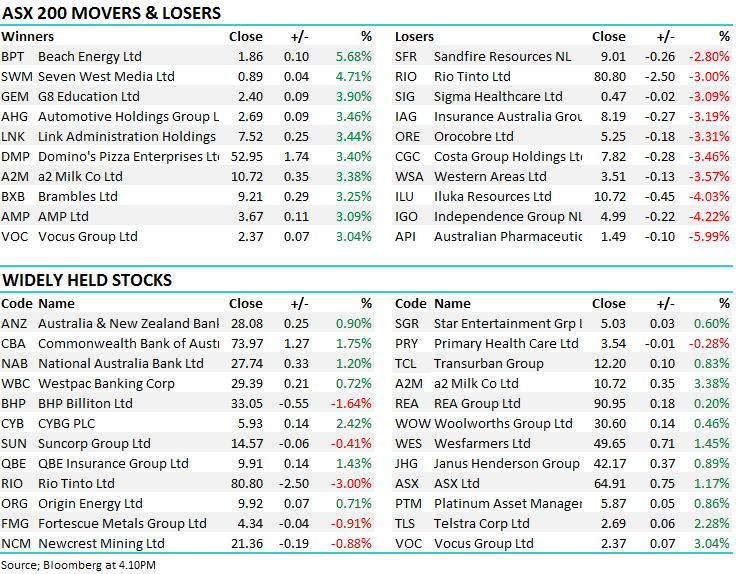

We often say for the market to perform we need the banks to fire and today they certainly did, more than offsetting the weakness that played out across the commodity stocks. The 4 majors added ~14points to the ASX 200 today while BHP and RIO between them detracted ~10 index points – some clear rotation out of the hot resources and into the unloved banks – a theme we think has further legs. Asian markets were again weak today while US Futures were down early but recovered throughout the day dragging our market up with them – Telstra also did well today adding 2.28% to close at $2.69

A lot of company news across the ticker particularly in the financial services space with Macquarie banning ‘grandfathered commissions’ across its adviser network – a good thing. We spoke about growing momentum against these commissions specifically in terms of IOOF (IFL) which if they go down the same path, would be a big hit to earnings - UBS subsequently ut a note out yesterday on this topic and IFL specifically highlighting the current risk to their model post the ANZ acquisition. Still in the financial space, Perpetual (PPT) continued to run today adding 1.99% to close at $43.46, the stock now up ~14% from a low base while the London based CYBG (CYB) put on 2.42% today to close at $5.93 – we have CYB on the radar as a potential sell in the Growth Portfolio into strength around $6.

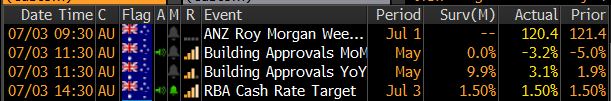

As expected the RBA kept official interest rates on hold at 1.5% today at the first meeting for the financial year, the market now pricing no change in rate until well into 2019. We also had a stronger than expected building approvals numbers out this morning and that helped to support the Aussie Dollar after weakness overnight.

Overall today, the index finished up +32 points, or +0.52%, to close at 6210. Dow Jones FUTURES are current trading up 23 points

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; One of the smaller cap technology companies we spoke about on Friday, Zip Co (Z1P) saw a broker upgrade and rallied on the back of it – up by 2.86% to 90c today. While the technical picture on this stock looks opaque, it’s a good story and the share price has clearly lagged other listed competitors over the past 12 months.

Zip Co (Z1P) Chart

Elsewhere, Credit Suisse was active in the lithium space with notes out on ORE, GXY, PLS.

· EBOS Upgraded to Buy at Deutsche Bank; PT Set to NZ$22

· EBOS Reinstated at Morgans Financial With Add; PT NZ$20.25

· Costa Downgraded to Neutral at UBS; PT A$8.40

· Orocobre Rated New Outperform at Credit Suisse; PT A$5.70

· Galaxy Resources Rated New Neutral at Credit Suisse; PT A$3.15

· Pilbara Minerals Rated New Outperform at Credit Suisse

· Perpetual Downgraded to Hold at Morningstar

· FlexiGroup Upgraded to Outperform at Credit Suisse; PT A$2.45

· Beach Energy Upgraded to Neutral at JPMorgan; PT A$1.80

· Zip Co. Rated New Add at Morgans Financial; PT A$1.06

Commonwealth Bank (CBA) $73.97 / +1.75%; CBA led the banks higher today with sustained buying throughout the session on no real news – simply looks like underweight fund managers are buying value as the level of negative news flow towards the sector dies down. While the banks are supported, the index will struggle to sell off…CBA tested $74 resistance again today – the biggest contributor to today’s gains…

Commonwealth Bank (CBA) Chart

A2 Milk (A2M) $10.72 / 3.38%; A2 Milk and Synlait (ASX:SM1) announced the extension of a supply agreement between the two companies lengthening the current agreement by 2 years out to 2023. The deal also increases the product capacity that A2 can derive from Synlait’s supply of baby formula and other milk products over and above the agreement that is already in place. In doing so, the new agreement further increase the ability of A2 Milk to fill the growing demand for their products, particularly in the Chinese market. We like A2 Milk, and believe the valuation is currently justified. There remains a significant level of growth in both market size and market share for A2, and we now hold a more comfortable weighting in the stock.

A2 Milk (A2M) Chart

Domain Holdings (DHG) $3.15 / -0.63%; Not a lot of love from the market today however some reasonably good news today for the Fairfax News spin off after they poached Google Australia Managing Director Jason Pellegrino to fill the Chief Executive role left vacant by Antony Catalano in January. The appointment is a massive coup for the real estate classifieds business which had struggled to replace Catalano who was instrumental in the development of Domain in his second stint at Fairfax. Pellegrino brings a wealth of experience in the online advertising space, having worked in the Asian management team for Google for 10 years and looks poised to take Domain into a new era of development.

Domain is linked to both the online advertising space and the housing market, both of which are coming under increasing pressure. Although DHG may benefit from lower housing clearance rates, we feel peak operating conditions have passed, and despite the promising hire of Pellegrino, are reasonably happy on the sidelines here.

Domain (DHG) Chart

OUR CALLS

No trades in the MM Portfolios today, however we are watching CYBG closely for an exit around $6.00, currently $5.93

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/7/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here