Banks offset miners on a flat day (RRL, TPM)

WHAT MATTERED TODAY

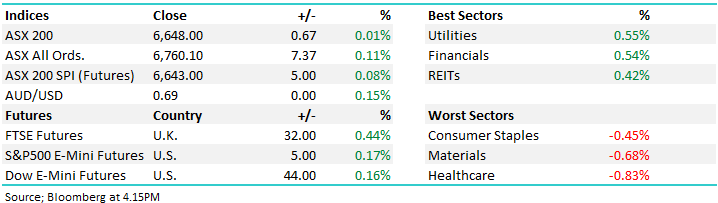

Very little to say about the local session today – unsurprising given the market closed less than a point higher than Friday’s close and traded in a tight 28pt range for the day. Banks marginal gains offset miners marginally loses. Healthcare was dragged by the heavyweight CSL which eased off all-time highs set on Friday. Gold names were hit hard across the board following a soft gold price as well as a stronger Aussie dollar – the Aussie battler is up 2.5% in the past few sessions to test the 69USc area again.

Household lending data out today was better than expected showing a 5% jump in home loans approved in July. The delayed data shows the impact of easing lending standards as well as cuts to interest rates, however business growth was negative in the period.

Overall, the ASX 200 put on +1pt today or 0.01% to 6548, Dow Futures are now trading up 44pts /0.16%.

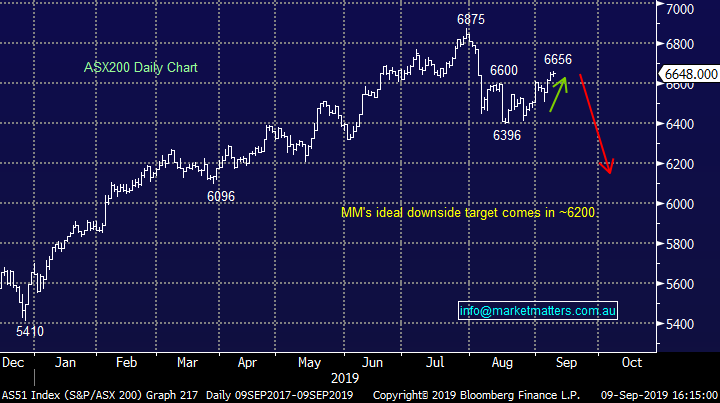

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Regis Resources (RRL) -6.92%; an investor day from the gold miner today was not enough for the stock to offset the gold price tumble. The precious metal fell more than 3% and support in the AUD combined to send the gold stocks lower today. Regis was the worst hit hover with the investor day failing to give the market any catalyst to help the stock higher. The company talked up its reserves & its low costs base but less than a month after the full year results, the bulk of today’s presentations was a repeat. Regis guided to 340-370koz of gold at between $1,125-$1,195/oz all in sustaining costs – costs being almost 13% higher than last year to the midpoint. We are not holding any gold exposure currently and have other names we prefer into a pull back.

Regis Resources (RRL) Chart

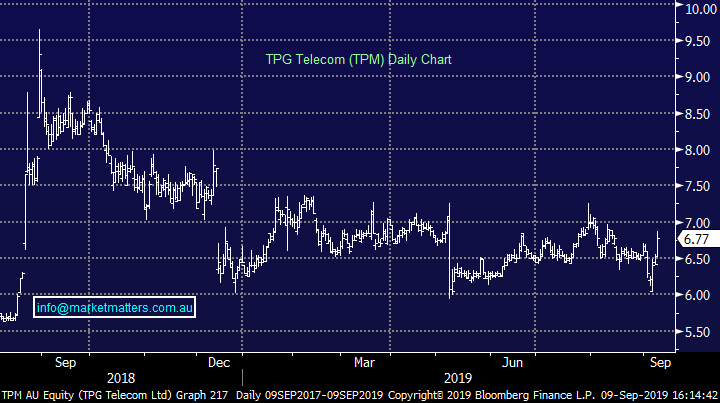

Broker moves; TPG (TPM) was one of the better performers on the market today on a UBS upgrade. The broker is calling for NBN headwinds to peak in FY20 while the share price had pulled back on fears the proposed merger with Vodafone would impact performance. TPG and Vodafone will take the stand in the Federal Court this week to argue the benefits of the merger on competition – somewhat of an oxymoron, however the argument lies with the strength of another nationwide mobile network. The broker noted that it appears the market was pricing in just a 25% probability of the deal going forward and called this fair but noted the upside to TPM if the deal proceeds.

TPG Telecom (TPM) chart

Elsewhere;

- TPG Telecom Upgraded to Neutral at UBS; PT A$6.60

- Senex Downgraded to Neutral at Citi; PT A$0.46

- Beach Energy Downgraded to Neutral at Citi; PT A$2.48

- Sims Metal Downgraded to Sell at Morningstar

OUR CALLS

No changes to the portfolios today.

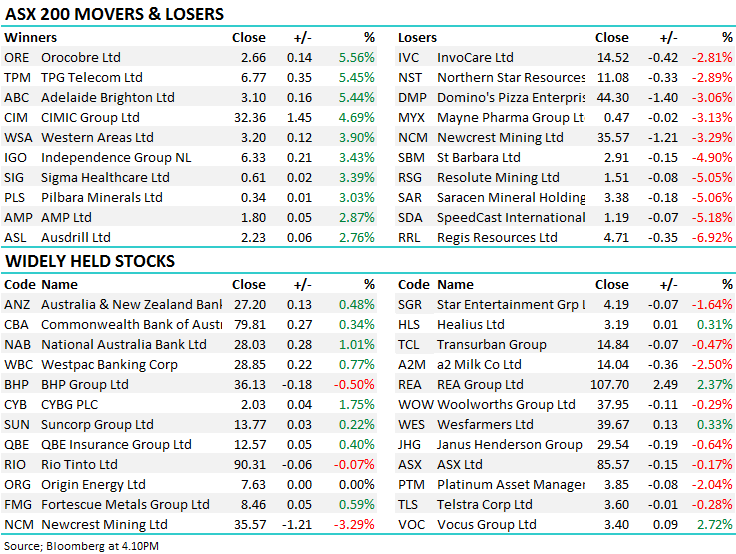

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.