Banks lead the market higher for the week (CCP, ANZ)

WHAT MATTERED TODAY

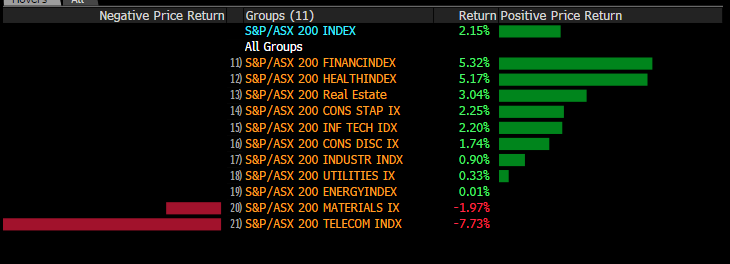

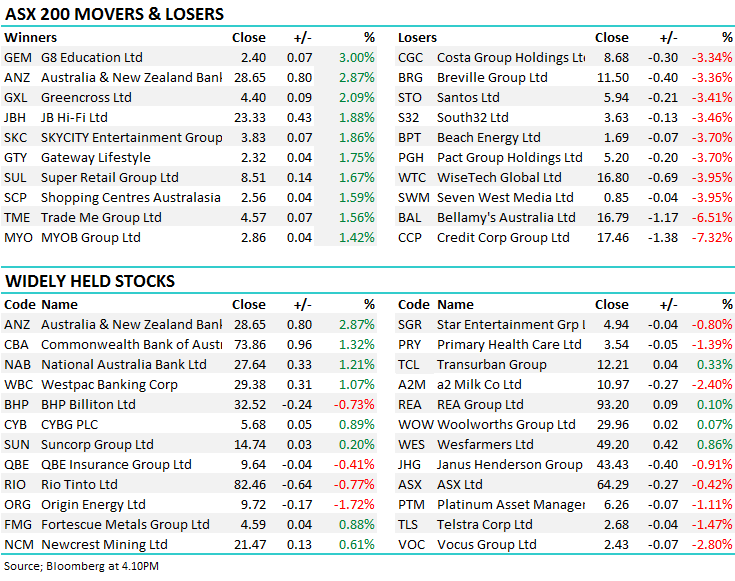

A strong week for Aussie stocks (+2%) with the banks finally finding some form and bouncing from oversold levels while the resources chopped around par, however we continue to target another leg down before they present attractive buying.

Ramsay Healthcare (RHC) and Telstra (TLS) were big movers on the week (to the downside), earnings misses for both, while we’ve seen some corporate activity heat up with another bid for Gateway Lifestyle (GTY) - Brookfield now entering the battle with a $700m proposal. Meanwhile, there’s a lot happening around the outdoor advertising space - APN Outdoor (APO) has been bid for by French outdoor advertising company JCDecaux ( $1.1 billion) while APN itself is trying to acquire Here, There & Everywhere's Adshel with a revised bid of $540 million! A few corporate advisers earning good money out of this tussle!

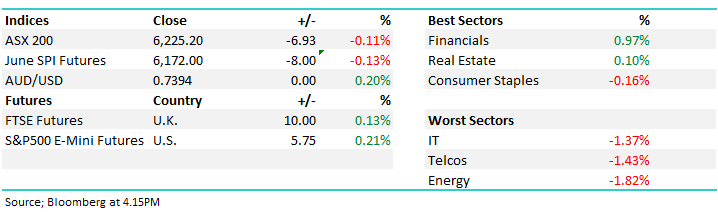

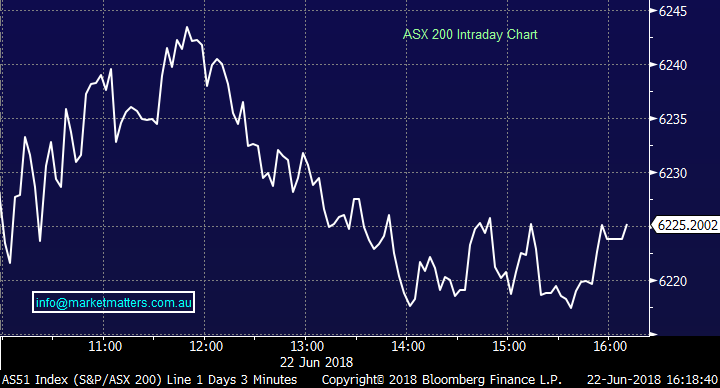

Overall the ASX 200 lost -7 points today or (-0.11%) to 6225. After once again flirting with the 6250 region

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Credit Corp (CCP) $17.46 / -7.32%; The debt collection company was reinstated today after responding to a (sort of) random report that attacked their business model and accounting standards, initially falling ~20% before recovering to now trade ~6% below Wednesday’s close price. The report by Checkmate Research questioned the earnings history of Credit Corp, saying the company’s earnings have been too stable for such a high risk and volatile business. The report also questioned Credit Corps lending arm, considering it a ‘payday lender’ and using loopholes in legislation to avoid such a classification which would greatly increase regulatory oversight and funding costs – Westpac is just one of many lenders that refuse to provide capital to payday lenders. Credit Corp has since refuted all of the claims made against them from the report and reaffirmed guidance for the 2018 financial year.

Although the report has been refuted and doesn’t show clear evidence for many claims, no doubt many will start to question whether or not there is a soft underbelly to CCP, particularly relevant after the Glaucus’ attack on Blue Sky recently that has seen the stock price fall over 80%.

Credit Corp (CCP) Chart

ANZ Bank (ANZ) $28.65/ 2.87%; Was the outperformer today after they announced that they would double the size of their share buyback to A$3 billion after a series of asset sales has them flush with cash. Most analysts had that number already baked in + more again next year as they reward shareholders for patience. We think it’s the right move given shares are such a depressed level… ANZ saying “The progress of our transformation means we are able to return this surplus capital to shareholders while retaining appropriate flexibility to invest in our business and maintain unquestionably strong capital levels.”

ANZ Bank (ANZ) Chart

Weekly Moves – Stocks & Sectors;. The banks enjoying a rare week in the sun while the Materials lagged – a theme we covered last week which has started to play out nicely. As suggested before, another leg down in the miners and we may step up to the plate.

In terms of stocks, APN the star while TLS made new lows…

Stock moves over the week

Broker calls; a lot happening on the corporate front this week + a busy week for analysts…Morgans very quick to downgrade Credit Corp(CCP) after the Bluesky debacle!

· Sydney Airport Downgraded to Neutral at UBS; PT A$7.30

· Origin Energy Resumed Outperform at Credit Suisse; PT A$10.50

· Metcash Downgraded to Sell at Citi; PT A$2.50

· Precinct Properties Raised to Neutral at Forsyth Barr

· Costa Downgraded to Sell at Wilsons; PT A$6.80

· LendLease Upgraded to Neutral at JPMorgan; PT A$20

· Redbubble Rated New Buy at Goldman; PT A$1.90

· Fletcher Building Downgraded to Equal-weight at Morgan Stanley

· Credit Corp Cut to Hold at Morgans Financial; Price Target A$23

· Bellamy’s Downgraded to Hold at Morgans Financial; PT A$18.50

OUR CALLS

No trades in the MM Portfolio’s today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/06/2018.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here