Banks find their mojo, Eclipx and McMillan join forces (APT, ECX, MMS, REA, XRO)

WHAT MATTERED TODAY

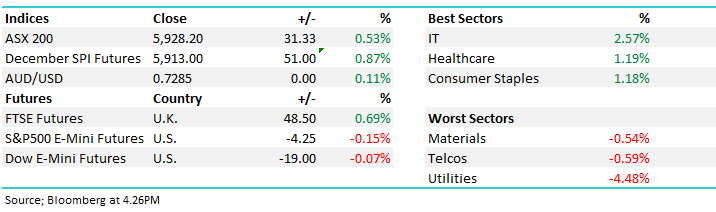

Another decent session for Australian stocks with the market now trading up ~300pts from the panic lows on the 26th October today hitting our ~5925 target region. From here a period of consolidation wouldn’t surprise as the midterms are digested, although the US Federal Reserve meet tonight to decide on interest rates. No change is expected (13% probably of a hike) although the decision in December is clearly a live one with the market pricing a 78.2% chance for an increase before Santa comes.

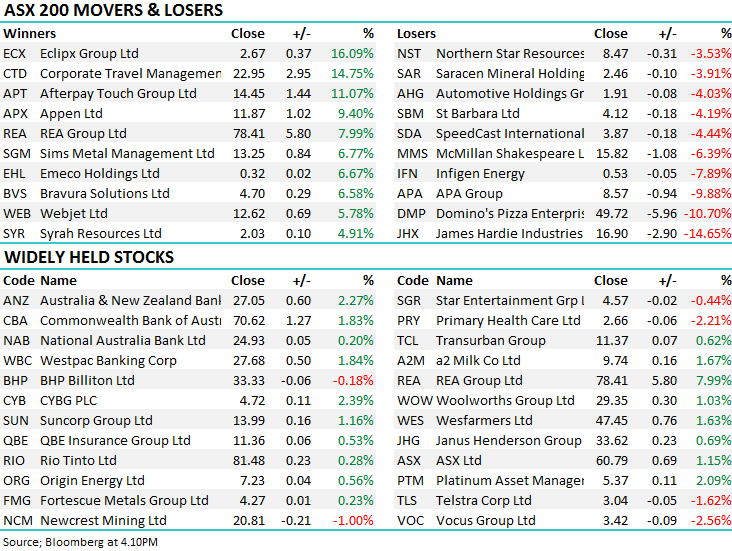

Locally, it was the IT stocks that came back into favour today, the likes of Appen (APX) which was up +9.4% to close at $11.87, AfterPay added (APT) 11.07% to $14.45 while Xero (XRO) added +1.82% after releasing a first half update – more on these below. Elsewhere, NAB traded –ex dividend today for 99cps fully franked which is worth ~$1.41, the stock closed down 94cps while the rest of the banking sector was upbeat with ANZ up +2.27%, CBA up 1.83% and WBC up 1.84%. Roll the drum…..today even the AFR published a more positive report on property, the first in a while.

Overall, ASX 200 closed up +31pts or 0.53% at 5828. Dow Futures are currently down -21points or -0.08%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Western Areas (WSA) upgraded by Bells while Dominoes (DMP) remains on the nose, the stock down around 10% today.

RATINGS CHANGES:

· Domino’s Pizza Enterprises Cut to Reduce at Morgans Financial

· Domino’s Pizza Enterprises Cut to Neutral at UBS; PT Set to A$57

· SkyCity Entertainment Upgraded to Neutral at UBS; PT NZ$3.95

· Carnarvon Rated New Outperform at RBC; PT A$0.85

· Inghams Downgraded to Sell at Morningstar

· Western Areas Upgraded to Hold at Bell Potter; PT A$2.80

A bullish take on the Mid-Terms; There’s nothing like a bullish article from an investment bank after the market has moved however JP Morgan make some valid points in an article doing just that specifically about the Trade War. In essence, they say a split Congress is the best outcome for global markets which is contrary to the majority of analysis which insisted that a Republican victory across the boards would be the most bullish outcome. Perhaps if the red team won both houses yesterday, the market would have spiked short term, but failed longer term. The fact we’ve got blue in the lower house and red in the upper house creates a more sustainable balance.

The thinking from JP Morgan goes like this. Administration policies last year were pro-business, but this year they have been “strongly anti-business” such as the trade war, protectionism and subsidies. Therefore, a “red wave” could have been seen as an endorsement of the trade war – which as we’ve seen, has been market negative. The note read…As the President cannot count on Congress or the Fed for more easing, he will need to do what is in his power to keep the economy rolling -- drop the damaging trade war and turn it into a winning deal. Seems very plausible to me.

Xero (XRO) $43.73 / 1.82%; The online accounting platform was out with first half numbers today and the growth continues to be strong. They now have total subscribers of 1.579m (which is a few more than Market Matters!), which is up 32% year on year. Breaking it down by region, ANZ 981k, up 24% y/y, UK 355k, up 40% y/y, North America 178k, up 45% y/y ex. Hubdoc, Rest of World 65k, up 38% y/y. They’re not making many $$ with 1H Ebitda A$16.8m, up 7% y/y however they lost margin which dropped from 8% to 7%. The main takeaway though besides the growth numbers was guidance that said FY19 cash outflow would reduce from a year ago and they’re managing the business to cash-flow break even within current cash balance, excluding M&A outlays.

Xero (XRO) Chart

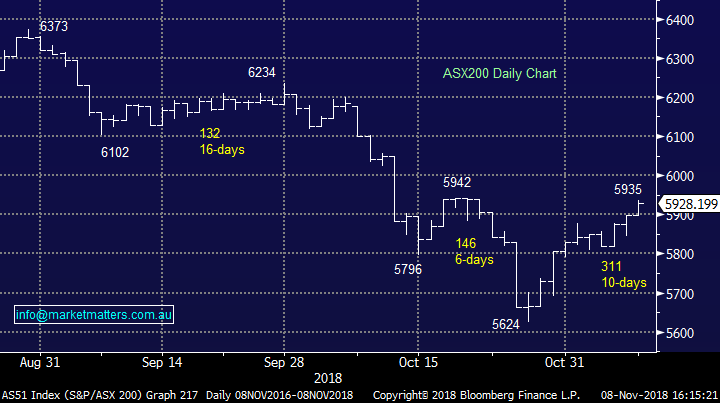

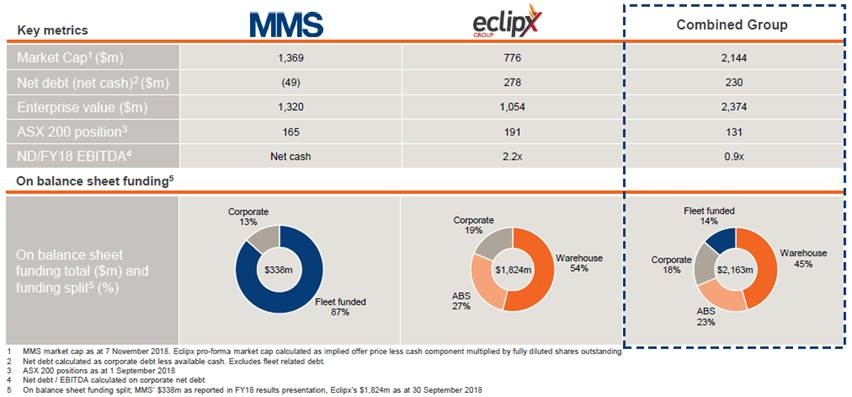

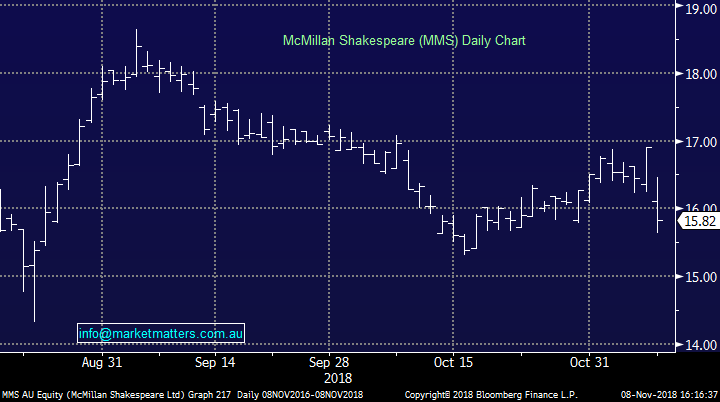

Eclipx (ECX) $2.67 / +16.09% & McMillan Shakespeare (MMS) $15.82 / -6.39%; The two vehicle leasing and fleet management companies entered trading halts before market this morning and have since released a merger proposal that has been backed by the boards of the two companies. The offer for ECX shareholders is 0.1414 MMS shares as well as a $0.46 cash component – representing $2.85 value as at yesterday’s close price, a solid 33% premium to the last ECX traded price. McMillan’s earnings are dominated by the salary package and novated leasing business, while Eclipx’s strength lies with the fleet management side.

The combined business will have the largest Fleet management and the largest novated leasing businesses by units in Australia & New Zealand, and is expected gain $50m of EBITDA synergies per year after the first three years. A merger of similar companies in tough times for the car leasing market. It makes sense on a few levels from scale, cost savings, customer base access and capital availability. The space does face some headwinds and we won’t be chasing the combined entity.

Eclpix (ECX) Chart

McMillan Shakespeare (MMS) Chart

Afterpay Touch (APT) $14.45 / +11.07%; The alternative payments company has ripped higher today thanks to success in the initial push into the US. In a business development announcement to the market this morning, APT noted over 300,000 customers and 900 retailers have used Afterpay’s product in the first 6 months of launching with a total of $A115m of transactions to the end of October. The move into the US now seems to be Afterpay’s priority with a clear addressable market, however competition is rife in the world’s biggest retail market place. Square (New York listed under SQ) and Affirm are just two names that will be tussling with APT in point of sale credit market, both also had the jump on Afterpay, although each product does have its differences.

Today’s announcement will give Afterpay a strong short term boost, but it will be some time before the US push can be fully assessed – although these are impressive numbers for 6 months, Afterpay could just be picking the low hanging fruit of the US credit market. Today’s spike sends the APT share price back to levels before the Senate inquiry fears spooked investors, but still languishing over 30% below all-time highs in August.

Afterpay (APT) Chart

Real Estate Australia Group (REA) $78.41 / +7.99%;the real estate media company jumped today on a trading update that showed solid revenue growth despite the falling volume and prices across the Australian market. REA pointed to a rise in the premium ad sales as sellers look for ways to differentiate themselves as the market eases, leading to a 23% increase in EBITDA to $130.9 million and a 17% improvement in revenue to $221.9 million for the three months to end September. Management did signal that this trend won’t last forever, even if house prices continue the slide and at some point a weak market will once again chew away at the company’s bottom line.

Real Estate Australia Group (REA) Monthly Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.