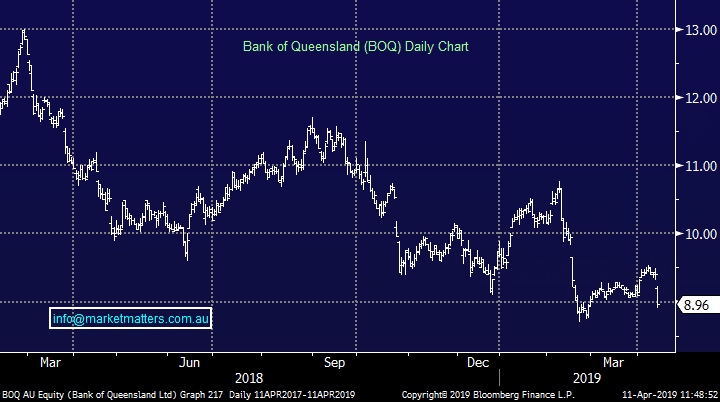

Bank of Queensland (BOQ) shares fall on first half result

Stock

Bank of Queensland (BOQ) $8.95 as at 11/04/2019

Event

The Bank of Queensland (BOQ) share price is falling today after the company posted a slightly off the mark 1st half result for the period to the end of February.

The regional bank saw profit slip 10% from the same period in 2018, despite growing the loan book by 3%. The net interest margin (NIM) fell 4bps over the 6 months to an extremely tight 1.94% due to rising funding costs and increasing competition.

Also a concern for investors was a rise in bad debts. Although it remains at relatively low levels, subdued bad debt levels have helped sustain bank earnings over the past few years despite falling interest rates.

The bank will pay a 34cps dividend for the half, about 10% below each of last year’s dividends, and below expectations of 38cps. It does still trade on a yield of over 7%, grossed up to over 10%.

The path ahead for BOQ could be shaky. The company guided to flat earnings for the first half to the second which is below market expectations. Expenses continue to rise, and loan growth is hard to come by so even flat earnings might be a little too optimistic.

Bank Of Queensland (BOQ) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook