Bank bashing returns, big miners soften losses (GMA)

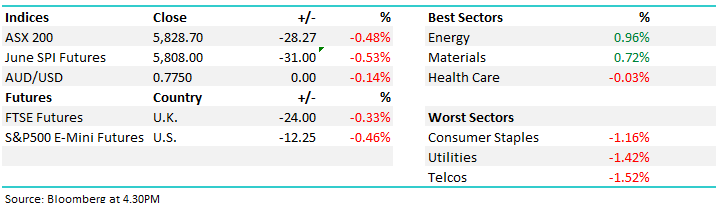

WHAT MATTERED TODAY

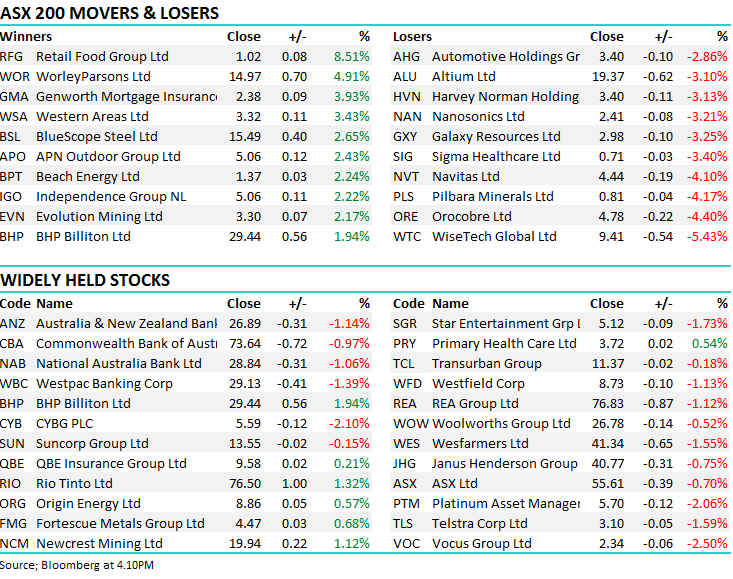

Anyone expecting a quiet session today was promptly proven wrong – with US futures copping some early selling which dragged out market down with it - any attempt to recover was sold in to resulting in a poor session. Banks were particularly weak, with 3 of the big 4 closing more than a percent lower to yesterdays close while CBA ‘outperformed’ with a loss of -0.97%. It was the materials and energy sectors that provided most support to the index today, with heavy weights BHP and RIO rising 1.94% and 1.32% respectively – a good effort in a soggy market. Our friend Alumina (AWC) opened higher but one again saw decent selling from the highs – closing down on the day – a disappointment.

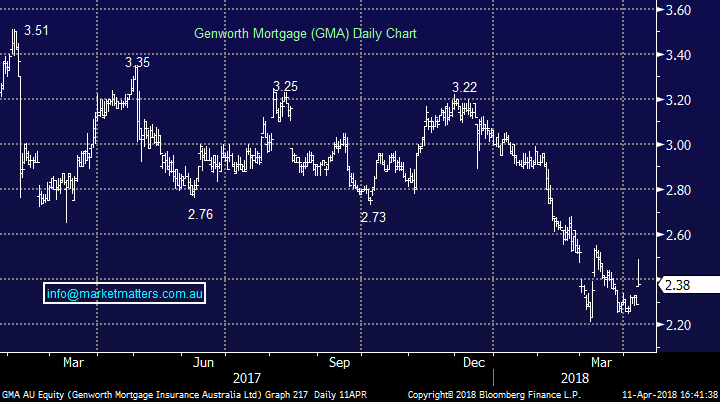

Some kind words (or at least less negative ones) + a rating upgrade from UBS has helped the fortunes of GMA, one of the best performers today at a 3.9% gain, while Wisetech (WTC), which we discussed in Monday’s report, was the worst in the top 200, falling over 5%.

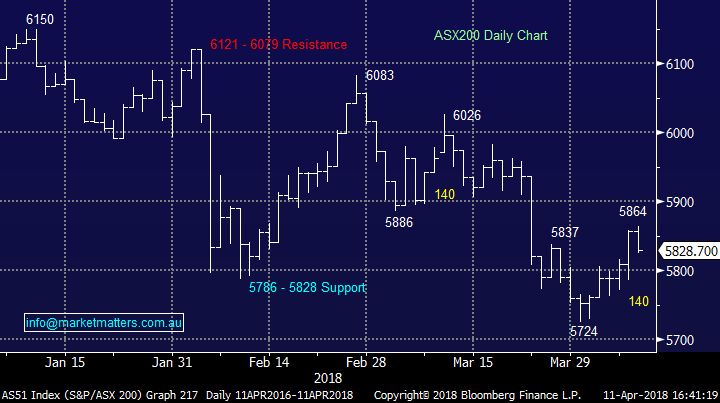

Overall, the market had a range of 39points, a high of 5864 and a low of 5829, slumping 38pts/-0.48% to 5829. A soft day today after such a strong performance from overseas markets overnight.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; the analysts had a bit to say today:

* Freedom Foods initiated with a Buy at Citi; PT A$6.70 – the health food company jumped 8.7% on the report

* Genworth Australia Upgraded to Neutral at UBS; PT A$2.30 – more on GMA later

* Cooper Energy Rated initiated with Add at Morgans Financial; PT A$0.44 – jumping over 3% on the news

* BHP Upgraded to Buy at Deutsche Bank – more upgrades for BHP, outperforming Rio today with a 1.94% move higher

Genworth (GMA) $2.38 / 3.93%; The stock did ok today adding nearly 4% on the back of a ‘less negative’ note from UBS, who’s been negative the stock (and rightly so) over recent months. UBS now saying that they think GMA will launch a 75m share buyback at their annual meeting in May and could add $150m buyback in 2H to avoid capital build. They went on to say that recent declines in net earned premium have now been priced in, while the increase in short interest has made their sell call “less compelling”. The short interest in GMA is high – around ~17% so as we suggested in the income report today, the hint of more optimistic news – todays upgrade from sell to hold by UBS an example – will see the stock do well. They have their AGM on the 10th May which is the next catalyst for the stock.

Genworth (GMA) Chart

OUR CALLS

No changes to the portfolios today. Alumina (AWC) fell 2.7% today, if we were still holding we’d not chase this down still targeting the ~$2.65 level as a sell.

Have a great night

Harry and the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/04/2018. 4.40PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here