Axcesstoday (AXL) ASX listed Bond – expected to pay ~7% floating

Stock

Axcesstoday (AXL) $2.22 as at 27/06/2018Event

Axcesstoday (AXL) is an ASX listed equipment finance business that offers financing for hospitality, catering, material handling, transport and logistics leasing – they have a market capitalisation of around $146m on forecast revenue in FY18 of $51m with the expectation of doing $86m in FY19. They’re likely to make a net profit after tax in FY18 of $7.3m jumping to $12.4m in FY19 and $23m in FY20 according to the Shaw Analysts Jono Higgins (I’m doing a video with Jono next week I hope). Yesterday they launched a bond offer that will be listed on the ASX under code AXLHA and will pay a floating rate of between 7.02% and 7.32% based on the 90 day bank bill rate of 2.12% - or in other words, they’ll pay a margin of between 4.90% and 5.20% over the 90 day bank bill rate depending on demand for the issue. It’s only early days however demand has been strong to date and we’d expect the lower end of the range.Some key points

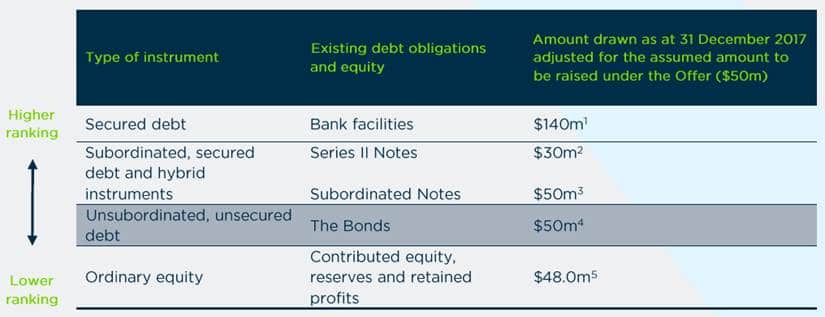

Given the size of this company this is a higher risk bond, however being listed on the ASX means disclosure and transparency is high. They’re expecting to raise a minimum of $50m however we’d expect them to print slightly more if demand is there – somewhere around the $70m would be our expectation. We like the simplicity of this instrument and believe the yield compensates for the risks involved. The bond is unsubordinated and unsecured meaning that it sits below secured debt in the capital structure as shown below. One of the risks is that if this issue is a successful one they may do more in the future to support growth, and more debt theoretically makes this current issue more risky. To offset that risk the company must maintain a debt to receivables ratio of no greater than 85% and a cover ratio not less than 2.0x so those will work to ensure that there is not a huge uptick in future debt of the company, unless they have the financial metrics to back it up. Capital structure The other aspect that is appealing is the spread of customers (or borrowers). They have over 10,000 equipment finance customers which spreads the default risk and that is shown through a very low 1.6% portfolio credit loss figure in 1H18.

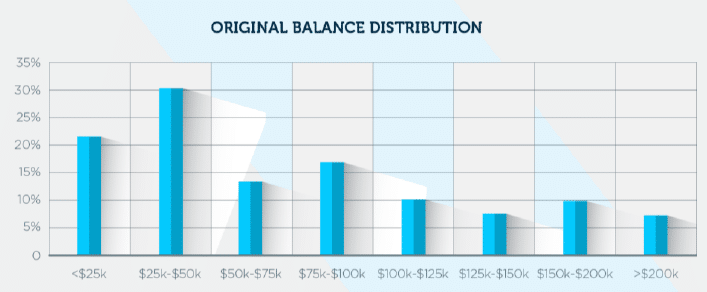

More than 50% of the loan book is initiated with balances less than 50k

The other aspect that is appealing is the spread of customers (or borrowers). They have over 10,000 equipment finance customers which spreads the default risk and that is shown through a very low 1.6% portfolio credit loss figure in 1H18.

More than 50% of the loan book is initiated with balances less than 50k

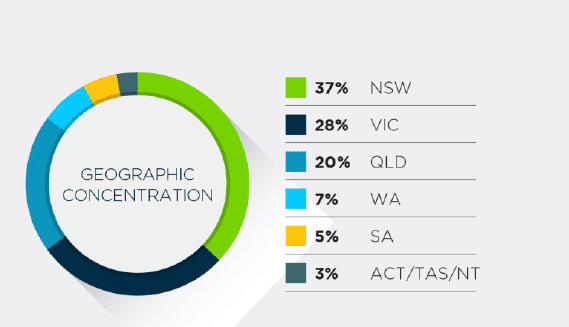

When lending money, which is essentially what bond holders do, we want diversification in customers in terms of number, but also geography. For instance, if we were providing finance to one area the risk that some economic factor could impact that region is high. In this case, they are skewed to NSW (37% of book) which is performing well, however they do have diversification across the country.

When lending money, which is essentially what bond holders do, we want diversification in customers in terms of number, but also geography. For instance, if we were providing finance to one area the risk that some economic factor could impact that region is high. In this case, they are skewed to NSW (37% of book) which is performing well, however they do have diversification across the country.

We also want enough ‘fat’ in the operation so that if things turn sour, the equipment being financed plus the equity in the business is enough to cover the lenders, both secured and unsecured (bond holders). This is always a moving thought however at this stage, we believe that’s the case.

Details

Duration; 5 years maturing 20th July 2023

Listed; under code AXLHA

Margin; Floating interest rate with the margin to be determined in the bookbuild, interest payable quarterly in arrears

Face Value; $100 per bond

More information; Review the presentation by clicking here

Please note; Shaw and Partners, a shareholder in Market Matters has been appointed Joint Lead Manager to the offer along with Evans Dixon.

We also want enough ‘fat’ in the operation so that if things turn sour, the equipment being financed plus the equity in the business is enough to cover the lenders, both secured and unsecured (bond holders). This is always a moving thought however at this stage, we believe that’s the case.

Details

Duration; 5 years maturing 20th July 2023

Listed; under code AXLHA

Margin; Floating interest rate with the margin to be determined in the bookbuild, interest payable quarterly in arrears

Face Value; $100 per bond

More information; Review the presentation by clicking here

Please note; Shaw and Partners, a shareholder in Market Matters has been appointed Joint Lead Manager to the offer along with Evans Dixon.