Author: james Carter

Do We Buy Commodities as they make multi year lows?

• The ASX 200 was very quiet today after a mixed bag of results from overseas markets at the weekend. The ASX 200 finished up 17 points (+0.3%) to 5,687.

• The major movement came from the gold sector after the metal was sold down heavily over the weekend. Newcrest Mining (NCM) was down $1.30 (10.0%) to $11.87. Regis Resources (RRL) dropped 10c (7.30%) to $1.34 (we remain trade buyers of RRL).

• Speculation has been rife for a long time concerning gold and how much had been bought by China. On Friday the Chinese Central Bank disclosed its reserves were 1,658 tonnes at the end of June, an increase of 57% from the last time it publish its reserves in 2009. Despite the tonnage increase, gold now accounts for 1.65 per cent of China’s total forex reserves, against 1.8 per cent in June 2009

• On the stronger side of the market the banks were generally up across the board, albeit to varying degrees. Commonwealth Bank (CBA) was up 38c (0.4%) to $88.36 and Australia New Zealand Bank (ANZ) up 41c (1.4%) to $32.85, whilst Westpac Bank (WBC) finished Westpac Bank (WBC) was only up 3c to $34.60.

Gold and Respective Stocks are Becoming Very Exciting!

The gold price and major related stocks have traded in an uncanny fashion lately, exactly as we have been forecasting. This happened at the end of 2014 enabling us to enjoy significant gains from both Regis Resources (RRL) and Newcrest Mining (NCM), hence our excitement as markets unfold again. – Remember we won a “steak at Rockpool” from a trader on Livewire by forecasting that NCM would outperform CBA from December 2014 until March 2015 – https://www.livewiremarkets.com/ . Generally gold stocks pay little or no dividend, hence when purchasing, timing is vital to potentially achieve capital gain.

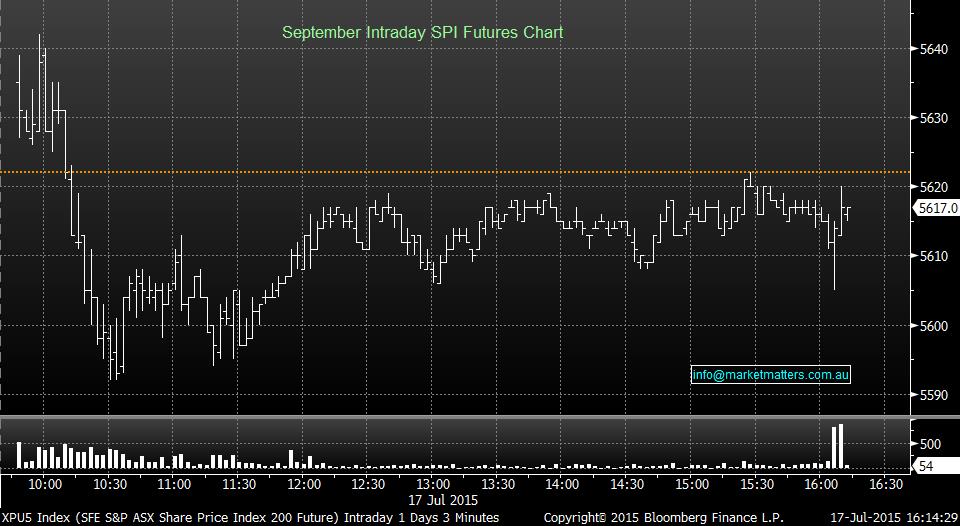

• It was a dull and choppy session in the ASX200 today, ending only 2 points higher at 5,671.

• Much of the action was witnessed in the first hour of today, trading as high as 5,689 to a low of 5,647.

• Macquarie Group (MQG) continues to dominate the Financials Sector, up 0.5% at $83.51, ending the week up 3.6% as investors see positive earnings in the US financials.

• The Gold sector had a great day (see this morning’s report), with Regis Resources (RRL) roaring 26% higher at $1.45 and Newcrest Mining (NCM) up 1.4% at $13.20. Subscribers would have received a live alert when we entered into the gold trade today.

• In the telco sector, Vocus (VOC) conquered the sector and closed 2.5% higher at $5.70.

• Watch out for the weekend report.

*Greek Parliament votes in favour of bailout plan – no great surprise.

• A choppy session was witnessed today in the ASX 200, ending 33 points higher (+0.6%) at 5,669 with a range of 47 points.

• With our Resource rich brethren, Canada reducing its interest rate to 0.5% overnight, there would be no surprise if we saw global investors switching from Canada into Australia with a current interest rate of 2%.

• The Banking sector again did the heavy lifting – National Australia Bank (NAB) rallied 1.6% at $34.32 and Westpac (WBC) up 1.9% at $34.63.

• QBE Insurance rose 2% at $14.67 after investors welcomed their announcement of selling its North American mortgage and lending business for ~$90m.

This week we have witnessed Facebook (FB.US) become a $US250bn company. The fastest company to reach this milestone, amazingly now larger than BHP, CBA and Woolworths (WOW) combined. Mark Zuckerberg’s social network company, as illustrated in the movie “The Social Network”, was born only 11 years ago in a Harvard student room. Facebook has achieved so much in just over 10 years compared to what the 3 iconic Australian companies have in recent decades. This is a clear lesson for investors to move with the times, a great company for investors last decade, is not necessarily a great company for the next decade. One exciting aspect of the booming IT industry is the ease / cost of entry, for example no large deposit of Iron Ore is required – come on Australia, time to catch up on the innovation! Today we have focused on 4 pioneering IT companies in the US to identify the short term direction of the broader index.

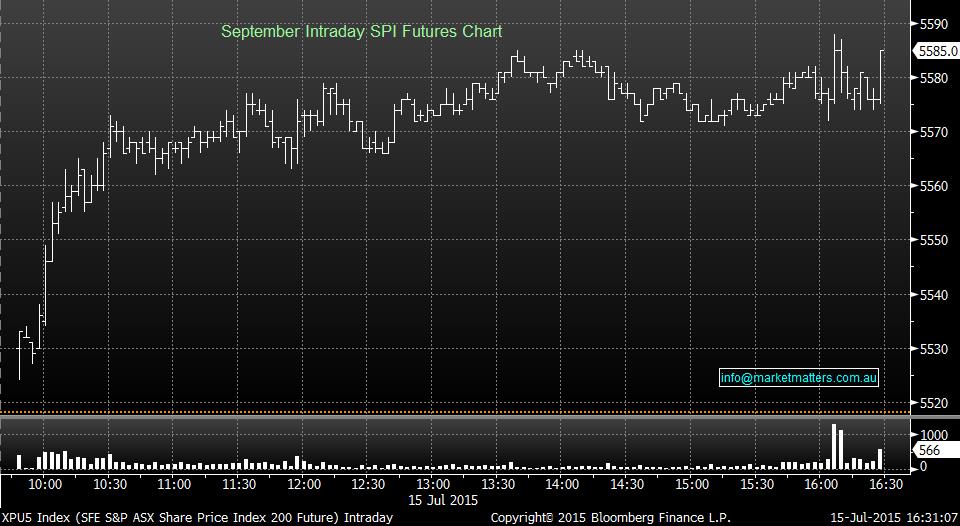

• The ASX200 rallied 59 points (+1.1%) at 5,636, closing on its highest level in over 6 weeks.

• The banking sector contributed to ~20% of the broader market’s gain, with Commonwealth Bank (CBA) ending the day 1% higher at $87.12 and Westpac (WBC) up 1% at $34.00.

• Resources mining giant, BHP Billiton (BHP) lost 0.7% at $26.90 after announcing an impairment charge of ~US$2bn on one of its gas project. The write off as not a surprise, however it was announced earlier than anticipated.

• Telco, Amaysim (AYS) debuted with a slow start, only to rally towards the last hour of the session and end 5.6% higher from its IPO price of $1.80 to $1.90.

• Diversified Financials, Perpetual (PPT) lost 6.6% at $45.60 after announcing it had lost ~$1.6b of fund outflows in the last 3 months ending June 2015, with market conditions being the culprit.

The US Looks Good For Now, but The ASX200 Has Headwinds

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.