Author: james Carter

Both Brent and Crude Oil fell to 5-month lows last night, as markets remain very concerned over increasing supply, with Iran about to turn on the taps. In the US the main energy stocks are now down over 30% from their highs of June 2014 and the sector is actually becoming a dividend play ranking 3rd in the top 10 sectors (assuming earnings can be maintained). Australian energy stocks have also been battered, not surprisingly, even though they benefit from the falling $A with Oil Search (OSH) -26.5%, Santos (STO) -52% and Woodside Petroleum (WPL) -20%, in the comparable period. The obvious question is, are we near a buy point, or should we run away from the energy sector?

• The ASX 200 finished the first day of the month on a weak note, down 20 points to 5,679 note it is Bank Holiday today.

• With the holiday today, the market was extremely quiet, with the banks and resource stock down.

• Commonwealth Bank (CBA) finished down 19c (-0.2%) to $87.37, Australia New Zealand Bank (ANZ) unchanged at $32.68, Westpac Bank (WBC) down 1c to $34.85 and finally National Australia Banks (NAB) down 18c (-0.5%) $34.59.

• BHP Billiton (BHP) finished down 27c (-1.0%) to $27.18, RIO Tinto (RIO) down 66c (-1.3%)to $52.20.

• G8 Education (GEM) rose 2.9% higher at $3.50 as shareholders welcomed its increased bid for Affinity Education to $0.80.

• All eyes will now be on whether the RBA reduces its interest rate tomorrow. Currently there is 93% consensus that rates will be on hold at 2%.

How are the local IT companies faring as the NASDAQ surges?

• The ASX200 had a quiet, yet positive session today, edging 20 points higher (+0.4%) at 5,689 and 2.2% higher for the week.

Happy Friday all, sorry about the delayed report this morning.

• The ASX200 continued its positive run for the week, with the session ending 45 points higher (+0.8%) at 5,669.

• It was a pleasant, yet quiet day, with the Major Iron Ore players contributing in today’s strength. BHP Billiton (BHP) and RIO Tinto (RIO) rallied 2.4% at $26.50 and $53.00 respectively, whilst Fortescue Metals (FMG) closed 1% higher at $1.89.

• The Health Care sector experienced quite the opposite, with CSL losing 1.4% at $96.35 and Resmed (RMD) down 1.6% at $7.52.

The Fed Signals Rate Rises are Approaching and Markets Remain Relaxed

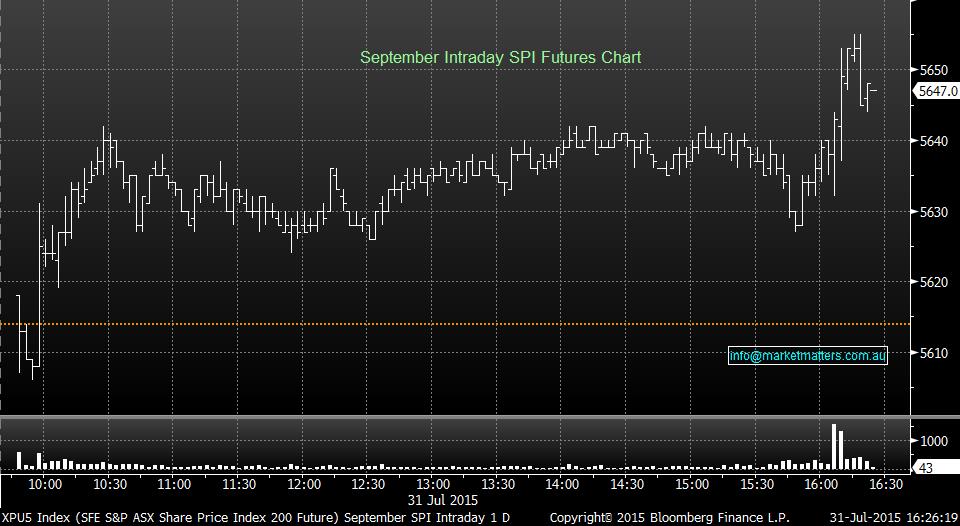

• It felt like a sombre and quiet day in Australia, however the rally unnoticeably continued in the ASX 200 today, trading as high as 5,650 in the morning and ending its session up 47 points (+0.7%) at 5,624.

• The Resource sector was seen as the strongest link in the market today. BHP Billiton (BHP) roared 2.1% higher at $25.89 and Fortescue Metals (FMG), a stock we currently own via call options, rallied 7.4% at $1.88.

• ‘Black Gold’, Oil Sector also experienced a positive day, Woodside Petroleum (WPL) closed 1.5% higher at $34.95.

• Financial Services, AMP Group closed 2% higher at $6.52 after it followed some of the recent banks’ suit and stated it won’t accept new investor property loans as well as raise its interest rates on its investor property loan holders.

With our positions growing and the market remaining volatile, we believe it’s extremely important to keep our fingers on the pulse with a special thought to what comes next.

• The ASX 200 followed global equities’ sentiment from overnight and traded on its lows early this morning, as low as 59 points, until the Chinese Government reiterated its intention to support its market helping our domestic market to claw back most of its losses and close only 5 points lower from previous at 5584.

• The banking sector closed mixed, with Westpac (WBC) being the weakest link, down 0.4% at $34.21 after reports of a computer glitch not allowing to charge different interest rates to its owner occupier customers and its property investors, losing an estimated cost of ~$1m a day.

• Origin Energy (ORG) rallied 2.7% higher after announcing its LNG project is on track with its current export target. ORG closed 30c higher at $11.45.

• Today, subscribers received a live alert reducing half of one of our current holdings, into the energy sector.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.