Author: james Carter

- In contrast to yesterday’s report, the ASX 200 managed to finish in positive territory today, but it felt like it was a hard slog to get there. The ASX 200 closed up 23 points to 5,122.

- China’s industrial output matched the weakest gain since the global credit crisis last month, while retail sales accelerated, underscoring a gradual shift in the economy towards greater reliance on consumer spending as old growth engines falter.

- The bad news: China began the fourth quarter with little change in momentum from the end of the previous one, signalling that monetary and fiscal easing have yet to spur an acceleration in growth. Goldman Sachs analysts are among those that predict the central bank will take further actions as a result. Industrial output rose 5.6 per cent in October from a year earlier, matching January through March’s reading which was the weakest since 2008. Fixed-asset investment increased 10.2 per cent in the first 10 months – the slowest pace since 2000 – while retail sales climbed 11 per cent in October, the quickest gain this year.

- The resources were a drag on the market, with BHP Billiton (BHP) down 62c (-2.9%) to $20.95 after hitting a low of $20.88. RIO Tinto (RIO) tried hard to remain positive and edged 1c higher to $49.40. BHP, the world’s largest miner, saw its shares fall to their lowest intraday level since 2008 after a dam burst at a mine it partly owns, resulting in at least six deaths and dozens more missing. We did emphasise that BHP is a volatile investment but are still predicting a bounce over the short term.

- It was reported today that TPG Telecom (TPM) are going to the market to raise $300 million through an institutional placement. It is expected that the funds will be used to pay down debts associated with its purchase of iiNet in July this year. TPM were in a trading halt today.

- Fortescue Metals (FMG) reported today that it was repaying US$750m ($1.07b) in an effort to reduce interest costs. FMG closed 3% higher at $2.37.

- ANZ shares enjoyed a rare break from the recent gloom surrounding bank stocks, rising by 2.9 per cent to $26.29, the biggest increase of the big four today.The increase comes hot on the heels of a change in view from, UBS. We at Market Matters think ANZ has got to a point where it is heavily oversold.

Best Sector – Energy

Worst Sector – Materials

Winners

Qube Holdings Ltd (QUB) +$0.13, or (+6.0%) to $2.31

Regis Resources Ltd (RRL) +$0.115, or (+5.9%) to $2.05

Mayne Pharma Group Ltd (MYX) +$0.05, or (+4.7%) to $1.11

APN News & Media Ltd (APN) +$0.02, or (+4.0%) to $0.515

When the US starts raising rates what usually happens?

- The ASX 200 finished down 20 points at 5,099, and it feels like we had a good day! At its worst the index was down 85 points, but from ~2.30pm the buyers started in and the market looked a whole lot better. The market bounced off our ABC target recently referenced in the reports of 5050.

- The resource sector held the very well with BHP Billiton (BHP) finished up 15c to $21.57, whilst RIO Tinto (RIO) was positive for 90% of the day, finishing up 39c to $49.39.

- The worst sector today seen was in the IT sector, with Computershare (CPU) shedding 23c (-2.1%) to $10.58 and IRESS (IRE) down 26c (-2.8%) to $9.16.

- As mentioned this morning, AIO was in the middle of a ‘bidding war’ between QUB and Brookfield. AIO rallied 3% to $8.99.

- Qantas (QAN) continues to lose its lustre, down 1.4% to $3.66, despite Crude Oil plummeting lately. The weakness is thought to be due to the prospect of US interest rates rising in the near term, where their funding is offshore.

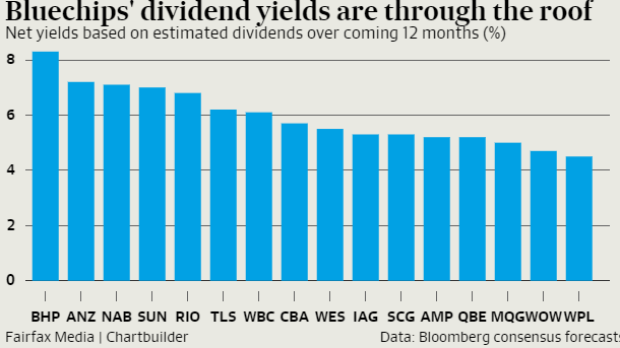

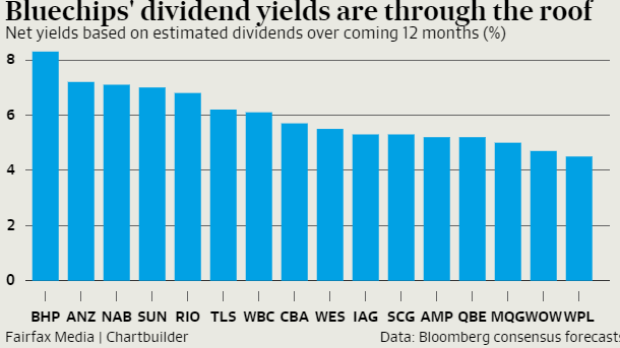

- The chart below (source www.smh.com.au) shows dividends of some of the ASX’s biggest names. BHP promises a net yield of 8.3 per cent, while other names like ANZ, NAB and Suncorp are trading on yields of around 7%. Once franking is added it’s closer to 10%. The question moving forward is how sustainable are these? Market Matters has bought BHP for a bounce, own ANZ for yield and a small amount of growth, like SUN technically and fundamentally, but are the least confident in NAB moving forward. It will be interesting to watch the performance of these stocks over the next 12 months.

Most local investors are aware of the extremely tough year BHP has experienced falling approx. 30% compared to the index falling around 6% – see chart 1. Obviously BHP has had the proverbial kitchen sink thrown at it this year with the collapse in both iron ore and crude oil prices combined with a weak showing from copper – see charts 4-6.

- The ASX 200 sold off heavily today, with the index finishing down 96 points after hitting its low of 113 points at around 2.30pm.

- The market got hit hard at 11:30 a.m, when selling concentrated to Bluechip’s, such as banks, Telstra and the supermarket owners, plus gold stocks. The selling mainly due to an impending US rate rise and weak Chinese trade data.

- The sea of red was dominated by the resources, as fund managers look to raise funds for the Santos placement, BHP Billiton (BHP) was sold down, hitting a low of $21.42 on the close. These low’s have not been seen since November 2008. RIO Tinto (RIO) surprisingly held up from its low on Friday ($48.89) finishing the day at $49.00, down $1.80.

- The banks were also weak, but not to the same extent. Commonwealth Bank (CBA) had a low today of $75.02 and closed down 75c to $75.58, down $1.32. Australia New Zealand Bank (ANZ) closed down 61c to $25.36, National Australia Bank (NAB) closed down 57c to $28.08 and Westpac Bank (WBC) down 36c to $31.29.

- Gold miners were hit particularly hard after the precious metal’s price slid nearly 2 per cent to below $US1100 an ounce on Friday in the wake of strong US jobs numbers, which strengthened the case for a Fed rate hike in December. Newcrest (NCM) down 5.5% to $11.29, Regis Resources (RRL) down 7.3% to $1.85 and Oceanagold (OGC) down 4.6 % to finish at $2.50. We are watching this space closely for future opportunities.

- As mentioned above, the big corporate news is Santos who announced the appointment of a new CEO alongside $3.5 billion of capital initiatives, including an asset sale, a $500 million private placement, and a $2.5 billion capital raising. Santos will use the proceeds to reduce its heavy debt burden that has exposed the company to predators following a collapse in the oil price. The new Santos boss will be Kevin Gallagher, who currently heads up engineering services group Clough. Gallagher will start in “early 2016” the company said. The cash call is in the form of a fully underwritten accelerated pro-rata renounceable entitlement offer with retail entitlements trading and is priced at $3.85, well below the last trading price of $5.91. The company also announced a $500 million private placement at a 15 per cent premium to last close to an affiliate of the China-based international private equity firm, Hony Capital. Finally, the Adelaide-based gas company has announced it has earned $520 million from the sale of an interest in Kipper gas field to Mitsui E&P Australia. Santos also announced a new dividend framework, setting the payout ratio at a minimum of 40 per cent of underlying net profit. The company said it will target a payment of 5 cents per share for the 2015 final dividend. Market Matters are watching this all very closely with an option position currently on this stock.

Best Sector – Health Care

Worst Sector – Materials

Three interesting charts generating very different signals / ideasGood morning everyone and welcome to a glorious Friday morning here in Sydney

- The ASX200 finished the week on a better note with the index finishing up 22 points to 5,215 after being sold off in the morning to intraday lows of 5152. For the week though it finished down 24 points or 0.5%.

- The banks performed well, having been sold off terribly all week. Yesterday we saw National Australia Bank (NAB) hit savagely after going ex. dividend; but today Australia New Zealand Bank (ANZ) go ex. dividend 95c and the stock fell just 68c to close at $25.97. NAB closed today up 9c to $28.65. It is positive to see a day of stability with the aggressive selling we have seen of late through the big four banks.

- In corporate news, the market awoke to find that Brookfield Infrastructure; currently attempting a takeover of Asciano Ltd (AIO), had bought 14.99% of AIO yesterday at $8.80, bringing their holding to 19.99%. Qube Holdings (QUB) already holds 19% of AIO and was due to vote down the proposal from Brookfield in Tuesday’s meeting. AIO has now postponed next week’s vote. The board is still recommending the Brookfield offer of $6.94 cash plus 0.0387 shares in Brookfield – currently worth ~$9.22.

- BHP Billiton (BHP) had a poor finish to the week. News of possibly up to 16 people dying in a burst dam accident in Brazil put extra selling pressure on the stock, following on from its weak performance last night in London. BHP finished the day down $58c to $22.70; recovering from a low of $22.02. We have identified BHP as a potential trading opportunity in the coming weeks, as it has historically bounced $4 of levels just below where it closed. (see chart 2 below)

- The Reserve Bank said today in its statement that rate cuts this year and the currency’s depreciation are supporting growth, indicating interest rates are likely to remain on hold. As we have continually said rates will be lower here for longer.

- The energy sector was the weakest link today with Woodside Petroleum (WPL) down 2.1% to $29.98; Santos (STO) was down 1.7% to $5.91. Oil-search (OSH) which we hold managed to poke its head above ground, and closed 1 cent higher at $7.91.

- Traders are now heavily focusing on the latest US non-farm jobs data, due Friday night, as a key indicator for whether the US will lift rates from their zero levels. We are of the opinion that this is a healthy thing for markets, and is inevitable.

- Look out for the weekend report. Have a great weekend!

Best Sector – Food, beverage and tobacco

Worst Sector – Energy

Investors regularly make comments similar to “I am a conservative investor and only buy Blue Chip stocks” but does this make sense?

- The ASX200 slid below 5200 points, led down by NAB which was trading ex-div, after a broad sell-off on Wall street stalled on the back of Fed chair Janet Yellen talking up the chance of a December rate hike. The market is pointing to a 50% chance of a hike in December with a near-term fed fund futures contract falling to the lowest levels in a month or longer. We are leaning towards a rate hike in the US in December and feel this is a healthy thing for markets as the longer it is put off delays the inevitable.

- NAB shares hit a two-year low closing at $28.56, down 4.51%, trading ex-dividend. CBA closed 1% lower to $75.85, while ANZ closed 0.8% lower at $26.65, and WBC 0.51% lower to $31.10.

- Glenn Stevens has been quoted saying any rate move would ‘almost certainly’ be a cut, but he has also showed he is in no hurry. We think lower rates are here for longer and the cash rate could find itself below 2% over the short to medium term.

- CBA’s quarterly profit edged up as, quite surprisingly, bad debts continued to fall. CBA is well held in the Market Matters portfolio, and is something we would look at either adding to into weakness or for sophisticated investors selling calls on anticipated weakness.

- Miners weren’t much help, with BHP down 0.8 per cent and Rio 1.4 per cent. South32 managed a 1 per cent gain, however. Woodside gained 1 per cent and was the biggest single point of support for the ASX 200. Our only real exposure in this space is currently STO and OSH which both held up ok with STO up 0.33% and OSH coming back strongly intraday to be down only 1% at the close.

- The Australian Competition and Consumer Commission today approved the $3 billion merger between M2 Group, which owns Dodo and iPrimus, and Vocus Communications in a move that will create the fourth-largest telecommunications provider in Australia. Earlier this year TPG Telecom bought Perth-based rival iiNet for $1.56 billion. We used this announcement to take profit on our VOC in September.

- The gold sector closed weaker again, following the movements from its underlying commodity. Newcrest Mining (NCM) lost 3.3% to $11.89, while Regis Resources (RRL) closed 3.8% lower to $2.01. We recently recommended closing out gold longs, and are now sitting watching for potential future opportunities.

Best Sector – Health Care

Worst Sector – Financials

Oil looks to be shinning more than gold into ChristmasGood morning everyoneOverviewMarket Matters hope a few people backed Prince of Penzance to win the Melbourne Cup, as the race again proved why we stick to financial markets!The US stock market continues to race ahead with the S&P500 now only 1.1% below its recent all-time high, perhaps the recent correction locally is over and optimism will return?Technically, Market Matters has been predicting this bullish move in the S&P500 with an ideal target ~2200 now only around 4% away. The million dollar question remains how far can the ASX200 rally with all the existing headwinds….5600-5700 resistance area would be ideal.However, within the stock market gold and oil stocks look to be in very different positions.Turning to the MarketOil stocks

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.