Author: james Carter

- A soft start was experienced in the ASX200 this morning, trading as low as 5082, only to rally and recover from midday to end the day 15 points higher to 5133.

- The rally continued to stem from the financials, with the big four banks adding ~11 points to the broader market. Commonwealth Bank (CBA) closed 1% higher TO $77.84, UP 4.1% for the past 2 days.

- With Iron Ore slumping overnight, it was no surprise to see this flow through to its related stocks today. BHP Billiton (BHP) closed 2.8% lower to $19.81, RIO down 2.7% to $46.80 and Fortescue Metals (FMG) down 3.2% to $2.15.

- Explosives Company, Orica (ORI) rallied 2.3% higher to $15.97, after investors embraced its full year results.

Best Sector – Financials

Worst Sector – Materials

Equity market rebound solidly after the Paris terrorist attacks

- The market today looked a lot better after a better night from overseas markets. After a shaky start, the ASX 200 rallied hard on the open only to drop back after about 15 minutes. It wasn’t until approximately 11.00am that it started to kick higher, then finally rallying hard into the last hour. The market closed up 90 points (+1.8%) to 5,094.

- QBE Insurance Group (QBE) shares suffered a setback (again) after the insurer advised the market that margins would come in at the bottom end of expectations. Expectations were that an 8.5 to 10% profit margin would be achieved. The stock closed down 2.1% to $12.89 after being down over 3% to $12.42.

- QANTAS (QAN) had some better news with Standard & Poor’s upgrading its credit rating one notch to BBB- citing an improved balance sheet. The shares rallied to a high of $3.74 and closed at $3.72 up 17c (+4.8%).

- BHP Billiton (BHP) also had a better day, but it was far from convincing. Being headline news in the financial papers over the last few days is still an obvious weight around the company’s neck. The shares closed up 15c to close at $20.25. RIO Tinto was also quiet, closing up 51c to $47.92.

- The energy sector followed the lead from overseas and performed the strongest with Origin Energy (ORG) excelling, up 6.8% to $5.25. Santos (STO) performed well, up 4.6% to $4.32, however, Woodside Petroleum (WPL) lagged behind, after being down on the day at one stage, but closed up 1.7% to $29.37.

Best Sector – Energy

Worst Sector – I T

Writing today’s report is one of the most difficult of recent times as we think about the people / families in Paris and the degree of guesswork it creates within markets.

- Despite the ASX 200 ending its day 0.8% lower to 5,018, it was surprising for most to see it recover from the lows of 4,979 after falling below 5000 for the first time since September.

- BHP Billiton (BHP) recovered well from its lows, rallying 1.3% from $19.90 to end the day only 7c lower to $20.16.

- The big four banks were all off with Westpac falling 1.6 per cent, ANZ 1.5 per cent, CBA 1.3 per cent and NAB 1.4 per cent.

- Woolies dropped 1.8 percent and is trading at its lowest in over three years. Wesfarmers dropped 0.9 percent. We are watching these stocks as indicated in previous reports when we have called Woolies a sell.

- Telstra managed to buck the trend – around one in five stocks managed a gain – climbing 0.4 percent. Woodside climbed 1.3 percent as the energy sector enjoyed the day’s best gains as oil bounced in Asian trade. Santos added 4 percent, Oil Search 2.7 per cent and Origin 3 per cent.

- Gold miners also climbed, with Newcrest closing up 2.8 per cent.

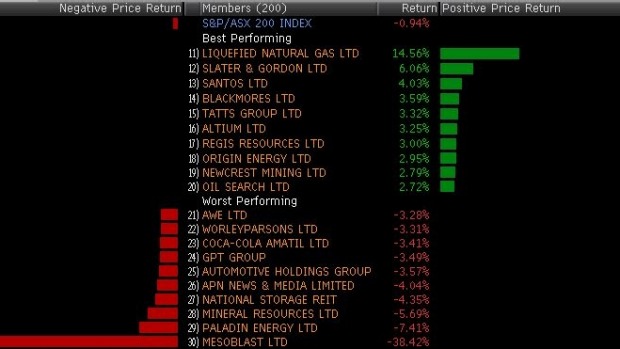

- The day’s best was LNG Ltd, up 15 percent after the company announced the major construction contract pricing for its US LNG export venture, another step along the way of the regulatory approvals process.

- Mesoblast plunged close to 40 per cent following its disappointing float in New York’s Nasdaq exchange.

- In the gaming sector, Tabcorp (TAH) and Tatts Group (TTS) announced that they failed to agree on its possible merger agreement. This sent TTS to rally 3.1% higher to $4.04 while TAH ended 0.2% to lower $4.41.

- Talks resumed with Asciano (AIO) and Qube Logistics (QUB) as AIO granted QUB to conduct Due Diligence in its books.

Best Sector – Energy

Worst Sector – Industrials

Is the Resource sector simply too dangerous at the moment?

- Just a short afternoon note given the weekend report tomorrow.

- The ASX 200 performed in line with expectations and disappointed investors by ending the day 74 points lower (-1.5%) to 5,051 – Down 3.4% for the week! The market closed bang on the 5050 level we have spoken about in recent reports.

- As expected, BHP lost ground, down 1.8% to $20.23, however, it was surprisingly stronger than some of the Big 4 banks. It kicked extremely well from below $20 and will be watched extremely next week as indicated in the morning note.

- Commonwealth Bank (CBA) was the weakest link of the big four banks, shedding 2.1% to $75.76.

- The performance of specific stocks in the ASX200 this week is highlighted in the chart below, positive to see ANN one of our plays we own from higher levels having a good week.

- Please watch out for the weekend report where a close look will be taking at the current market.

Earlier in the week Market Matters made the aggressive call to switch Macquarie Group (MQG) into BHP Billiton (BHP), a stock that has fallen over 30% in the last year – see chart 1. A quick summary of the logic was that BHP looks technically in a support region from where it can bounce over $4 (~2%) and MQG had reached our target of fresh 2015 highs at the end of October – see chart 2.

- The ASX 200 recovered from an early sell-off and buyers returned at around 10.30am to push the market higher. After the unemployment numbers were released at 11.30am, the market continued to improve and at one stage was up 28 points. However, as the close approached, the sellers returned and the market closed up 3 points to 5,126.

- Santos (STO) returned to the bourse today after it raised $3.5b and the stock slumped by 27% hitting a low of $4.20. Volume today was over 59m shares, and it traded as high as $4.55 before succumbing to late selling and closed at $4.30. We will be covering STO more thoroughly in tomorrow’s morning note.

- Apparently the economy created 58,600 new jobs in October, well above the expected 15,000. This surge in employment has taken the jobless rate down to 5.9 per-cent, from 6.2 per-cent. This is the first time we have gone below 6 per cent since a one-off move in May this year. The jobs number put a rocket under the Australian dollar which surged up 1 per-cent to 71.28 US cents as investors start factoring in no more rate cuts. (see chart below – source Bloomberg)

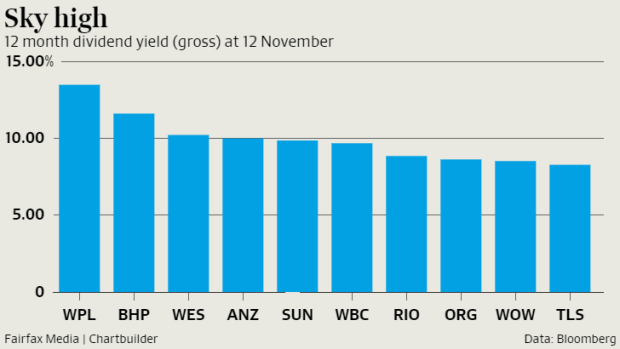

- Dividend yields in the top 20 stocks are at their highest since the global financial crisis, but their recent share price performance suggests investor concerns are growing that these dividends may have to be cut. The average gross yield of the S&P/ASX 20 index, constituting companies that have been a staple of share portfolios for decades, is at 7 per-cent, the highest since 2008, according to data provided by Morningstar. (see chart below)

The broad-based market rout, which began in April has driven up yields, but the heavyweight banks and miners have been especially pummelled, losing a quarter or more of their share price value. - BHP had another rough day amid worries about the Brazil fallout. We will look to cover this in the a.m. note tomorrow.

It’s only a relatively short report today but an important one given the position of the market and what seems to be a nice aligning of our market expectations.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.