Author: james Carter

- The ASX 200 came under early pressure and fell close to fifty points within ten minutes of the opening. From there it started to improve, albeit slowly in the late morning. However by the 2.30pm it started to lose ground yet again and closed 28 points (-0.6%) to 5,080.

- The main focus was on BHP Billiton (BHP) and RIO Tinto (RIO) after RIO announced yesterday that it would slash again its capital investment, the second time in four months. RIO hit a low of $40.39 (a loss of $2.01 from the close), before recovering to close at $$42.05, down only 35c. BHP fared better however after it suffered strong selling in the UK last night. However it wasn’t such a bad day after all and it was down just 34c at its worst and closed up 11c to $17.16.

- The banks were at best mixed. Commonwealth Bank (CBA) had an intraday high of $80.90 (+76c) but faded in the afternoon to close up 15c to $80.29. Australia New Zealand Bank (ANZ) didn’t make it into the plus territory at all and closed down 39c to $26.43.

- Oil stocks performed stronger today with Woodside Petroleum (WPL) up 14c to $27.03, Santos (STO) up 19c to $3.50 and Oil Search (OSH) closed up 6c to $6.35.

Resources are hammered yet again!Good morning everyoneOverviewThis morning Bloomberg screens are awash with red, especially around commodity prices; notably – Crude Oil -6%, Iron Ore -2.4% and copper -1.6%.Turning to the MarketsLet’s look at these three commodities, both fundamentally and technically, at a very simple level:1 Crude Oil

- The ASX 200 felt like it really was on the skids, with the resources and energy names being sold off, yet again. The market closed down 47 points (-0.9%) to 5,108.

- The energy sector stocks were decimated today after the oil price broke below the $US40 level and Woodside Petroleum (WPL) announced this morning that it had shelved its ambitions in relation to rival, Oil Search (OSH). OSH plummeted on its opening and closed the day down $1.23 (-16.4%) to $6.29. WPL also suffered and closed the day down $1.11 (-4%) to $26.89.

- The Major Resources continued to repeat its theme song – BHP lost 5.3% to $17.05, while RIO closed 4.3% lower at $42.40.

- While the resource sector was down Evolution Mining Limited (EVN) had a good day up 2.8% to $1.31, as did Northern Star Resources Ltd (NST) up 2.4% to $2.54

- There was a short glimmer of hope this morning in the banks, however, they unsurprisingly closed in the red sea. ANZ was the weakest link, down 1.7% to $26.82.

- With weaker oil prices, the transportation sector looks to benefit. Qantas (QAN) rallied 4.9% to $3.86 and Virgin Australia (VAH) up 1.1% to $0.45.

- Orica (ORI) slumped 3.7% lower to $15.02 after losing a Federal Court ruling in Melbourne and was found to have set up a $900m tax avoidance scheme to support the strength in its share price.

Best Sector – Industrials

Worst Sector – Energy

Looking at 3 stocks that have performed well over the last monthGood morning everyoneOverviewEquities have been very tricky and choppy over the last few weeks as demonstrated by the Dow’s 370 point rally on Friday after a +250 point fall on Thursday. When you stand back and simply look at the Dow over recent times it has been in a sideways range for seven weeks; not surprising after October’s impressive rally- see chart 1.Turning to the MarketSo, in a volatile month where the ASX200 is down 1.2% we have decided to look at 3 stocks that have performed well to see how they look technically going forward:1 Tatts Group (TTS) $4.28

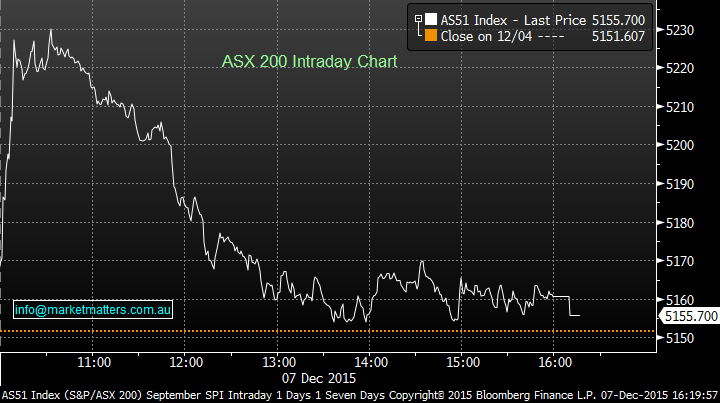

- A frustrating session was experienced today, where a glimmer of hope was witnessed early this morning in the ASX 200, rallying as high as 5,229, only to see some selling in the Futures Market, leaving the broader market to end only 4 points higher (+0.1%) at 5,156.

- The bank sector were the safest bet, with the big 4 banks up an average of 0.4% and Westpac (WBC) the main positive contributor, up 0.7% to $32.52.

- In the Telco sector, a shift to Vocus Communications (VOC) was apparent, ending 1.4% higher to $7.51, while Telstra lost 1.7% to $5.32.

- Not surprisingly, the Gold Sector followed suit from the performance of the physical commodity over the weekend. Newcrest Mining (NCM) rallied 2.9% higher to $11.97 and Regis Resources (RRL) closed 4.6% higher at $2.05.

- On the flipside, with the Energy sector lost ground after comments from OPEC in terms of leaving current production output as is. Santos (STO) closed 9.9% lower at $3.81, while Woodside Petroleum (WPL) ended 3.7% lower to $28.00.

- On the Mergers & Acquisitions front, Broad Spectrum (BRS) rallied 47.75 higher to $1.255 after receiving a takeover offer by Spanish Giant, Ferrovial.

- Dexus Property Group has offered to buy Investa Office Fund in a deal valuing the real estate investment trust at $2.15 billion. The board of IOF intends to unanimously recommend the indicative, non-binding offer, according to a statement.

- Real estate agent McGrath shares debut well below their IPO price of $21.10. They closed 13% below the price at $1.835. Market Matters indicated we had no interest in a real estate business which was listing whilst the residential property market was starting to slow.

- Job ads in newspapers and on the internet grew for the fourth straight month in November, which is another encouraging sign that the labour market in improving.

Best Sector – Consumer Discretionary

Worst Sector – Energy

What now that the ECB has disappointed equity markets?

- The ASX 200 lost ground as expected, ending the day 1.5% lower at 5,151 with the Materials being the main drag.

- BHP Billiton (BHP) closed 1.3% lower at $81.83 as investors turn its back on the once golden child.

- In the bank sector WBC was the weakest link, losing 1.8% to $32.30. Will there be a Christmas rally this year?

- Please watch out for the weekend report tomorrow.

Best Sector – Consumer Staples

Worst Sector – Telcos

Yesterday the ASX200 saw yet another landmine explode when cleaning company Spotless (SPO) crashed 40% in one day after horrifying the market with an ugly profit warning – see chart 1.

- The ASX 200 managed to recover some of the losses this morning and close 30 points lower (-0.6%) at 5,227 after trading as low as 5,200.

- The Banks closed mixed, with Westpac (WBC) the weakest link, down 0.6% to $32.91, while NAB scraped in $0.04 higher to $30.04.

- The Resources sector resumed its descent, BHP continued to lose the battle and close 3% lower to $18.19, while RIO also managed to lose 2.1% to $45.59.

- Santos (STO) resumed trading after its retail shortfall book build and managed to close at $4.13 – 3c above the book build price.

Best Sector – IT

Worst Sector – Energy

Yesterday the ASX200 kicked December off with a big bang rallying 100 points (1.93%)! Buying was witnessed across the board, from banks to the embattled resources, with BHP rebounding 3.6% and RIO 2.2%. Many people are now saying the Christmas rally is off and running; so after November’s very typical 7.5% correction (discussed at length in previous reports) it’s time to look closely at what followed in the various Decembers since the GFC.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.