Author: james Carter

- The ASX 200 finished strongly on the back of good fundamentals for the Australian market, closing 53 points higher (+1%) at 5,143.

- The resources sector was unsurprisingly strong in Asia trade. BHP finished the day up 88c (+5%) to $18.55, RIO up $1.57 (+3.5%) to $46.47 and Fortescue up a massive 59c (+23.7%) to $3.08.

- WorleyParsons (WOR) rallied 10.6% higher at $6.55 with investors now anticipating a capital raising in the near future.

- The Big Four banks also screamed higher, with NAB being the outperformer, up 2.3% to $27.23.

Best Sector –Materials

Worst Sector – Info Tech

Healthcare stocks showing signs of underperformance, is it a trend change?

- What a week that changed investors’ sentiment. The ASX 200 rallied 9 points higher (+0.2%) today to 5,090, up 4.3% for the week.

- ANZ rallied 0.9% higher to $25.02, despite reports of ASIC filing a civil court suit against them due to market rate rigging.

- With Crude Oil rallying recently this week, Caltex (CTX) somehow lost 6.1% to $32.63.

- Diversified miners performed well today though BHP continues to benefit from the strength in its invested commodities, rallying 2.4% higher to $17.67, RIO had a firm day up 1.6% to $44.90 and Fortescue (FMG)finished up 3.7% to $2.49.

* Please watch out for the weekend report tomorrow.

Good morning everyone Overview As regular readers know, Market Matters’ preferred short / medium term scenario is that US equities rally to all-time highs i.e. ~7.5% higher for the S&P500. Near term, after an explosive 10% rally over only 4 weeks, some consolidation is due; however, many investors remain short / underweight stocks. This is (currently) supportive and leading to strong buying of any weakness. Regular readers are also aware that we were an aggressive buyer down around 4750 in the ASX200 moving to over 95% invested. Over the last week we have taken excellent profits on BHP, FMG and RIO, moving back to a 17% cash holding. After the 8% rally locally, Market Matters is now firmly wearing its sell hat and looking for areas / triggers to commence selling stocks. “Selling is 50% of the investment process but one that receives under 5% of the attention leading to underperformance by many investors” – Market Matters! Investors need to plan and consider right now if and how they will follow these sell recommendations over coming weeks / months e.g. simply sell shares or, for the sophisticated, using options to hedge portfolios. It is widely recognised that the ability to sell at good levels, whether taking profit or cutting losses, is one of the most significant of investor / trader weaknesses; hence, we are likely to mention this often over future weeks. Remember, longer term we are targeting the 1600 area for the S&P500 irrespective of whether in the interim it can make fresh all-time highs i.e. almost 20% below this morning’s level- see chart 1 below.

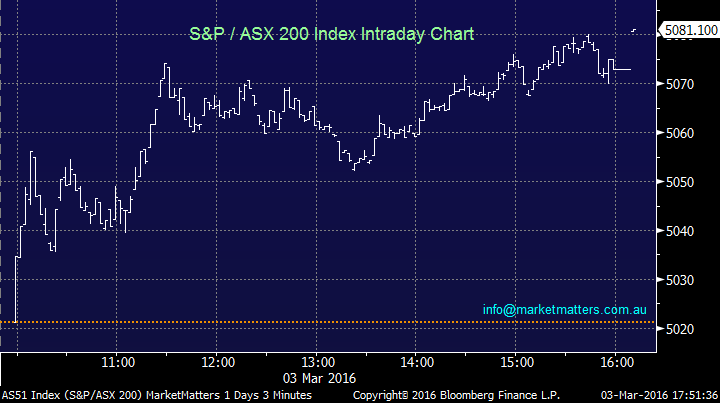

• Another great day was witnessed in the ASX200 today, with the broader market rallying 60 points higher (+1.2%) at 5,081.

• Economic data showed Australia’s trade deficit reported at -$2.937b, vs a consensus of -$3.2b. This lifted our Aussie battler to trade back to US73.12c.

• BHP followed on from the performance it had in the US overnight, rallying 3.1% higher to $17.25 as the risks of cost uncertainty with the Brazilian JV disaster was settled at a cost of US$2.3b.

• Banks rallied yet again, as the short squeeze in this sector looks apparent. National Australia Bank was the strongest of the big four, rallying 3.2% higher to $26.37. The strength in the GDP outshone the recent scary report of a potential property bubble and its implications.

• Focus in the US tonight will be in the jobless claims at 12.30am and their ISM non-manufacturing PMI data (2AM our time), where it is a leading indicator of economic health in regards to its business market conditions. Current consensus on the Markit PMI shows a level of 50, where anywhere 50 or above is a positive sign of where the US economy is currently tracking.

Good morning everyone Overview Market Matters are a market leading advisory service, to subscribe to their free newsletter click here Equities have rallied very strongly from their mid-February lows when economic pessimism ran way ahead of itself leading to a significant market correction. The US S&P500 corrected exactly into our 1800-1815 target area from where it has now staged a very impressive 9.4% rally; amazingly, we are now only 7.8% below all-time highs for US equities. Last night we witnessed some “internal characteristics” of a strong market: 1. After surging well over 300 points yesterday US equities held their gains, implying this explosive leg of the rally has further to go.

- The ASX 200 Roared 99 points higher (+2%) at 5,021 today, with all banks and resources leading the way.

- Of the Big four banks, ANZ was the strongest link, rallying 4.5% higher at $24.10, while CBA closed 3.5% higher at $73.94.

- The gold sector unsurprisingly retreated, with Newcrest Mining (NCM) down 6.2% at $17.15.

- Woolworths (WOW) lost 1.33% lower after Moody’s downgraded its credit rating earlier this morning.

- Telstra (TLS) recovered much of its loss yesterday, rallying 1.8% higher to $5.09.

Best Sector –Energy

Worst Sector – Utilities

Good morning everyone Overview Well, an exciting market in the US overnight! But let’s talk about Telstra. As readers are aware, Market Matters had been planning to buy Telstra around $5 over recent weeks. Interestingly, yesterday’s “Buy Alert” resulted in almost 20x more questions than we have ever previously experienced; we find this very exciting because moving forward Market Matters can help educate subscribers as well as aiding with classic investment decision making. The majority of questions were focussed on “what is” and “why” we were buying in the cum dividend market. Firstly, sorry that the first alert had the incorrect stock code; it should have been TLSCD and this was quickly corrected. So, let’s first readdress “why TLS” and then discuss “why and what” is the cum dividend market. Yesterday, Telstra (TLS) went ex-dividend 15.5c fully franked and the underlying stock closed at $5 down 25c on the day (4.8%). However, as TLS traded ex-dividend 15.5c fully franked the fall was in reality 9.5c or 1.8% on a day when the market gained 0.85%; this ignores franking credits because they have different benefits to different investors. For Market Matters yesterday it was a classic “Plan your trade and then trade your plan!” Remember, the above classic trading mantra is just as important to investors as traders.Investors and traders alike all think far more clearly, logically and analytically prior to committing money to the market. Unplanned market activity can let loose human emotions and their influences on decision making; generally in a poor manner – Fear & Greed. Market Matters is bullish TLS from this $5 level targeting a bounce back over $5.50, we believe the 31c fully franked yield (6.2%) is sustainable and hence very supportive of the stock.

- The ASX 200 managed to start the month of March on a positive note, rallying 41 points (+0.9%) to 4,922.

- Today’s focus was purely on economic data, both on the domestic and global front.

o The RBA left interest rates on hold, at 2% with no surprises with the comments on monetary policy.

Signs are occurring of a US equities – oil disconnect

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.