Author: james Carter

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

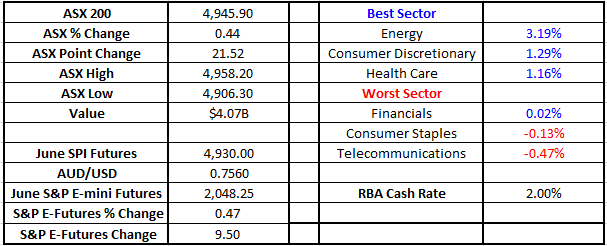

All eyes on the RBA at 2.30pm Good Morning everyone Overview A fairly quiet night overseas and our FUTURES are up just +2pts…so a tepid open is expected with most waiting around the RBA decision at 2.30pm this afternoon. Obviously no change is expected, however as we wrote yesterday, language around the level of the currency will be the most watched part of the statement. If Glenn Stevens comments about the AUD being too high relative to prevailing economic conditions expect a sharp sell-off in the currency – although we doubt that will happen. Key level for ASX 200

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

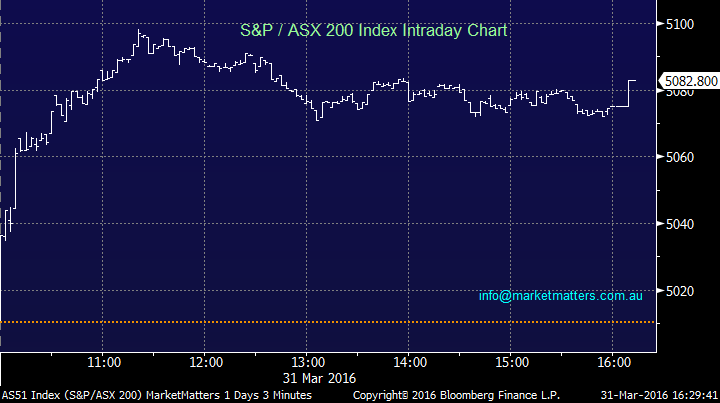

End of month – end of quarter – volatility reigned supreme Good Morning everyone Overview The last day of the month and last day of the quarter is here – and what a start to 2016 it has been. Volatility has reigned supreme in global markets with only one major global index (still with one day to go) in the black. Of course, that’s the S&P 500 in the US which has been supported by a very ‘accommodative’ central bank. If we look at the German DAX, French CAC and UK FTSE it’s also obvious that central bank support from the ECB has helped to support those markets….. On the flip side, Asian markets have been soft and we’ve been caught up to a large degree in that weakness.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.