Author: james Carter

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

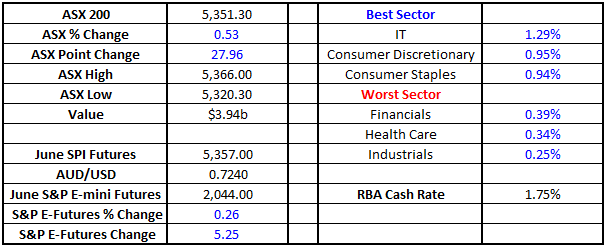

Healthcare continues to outperform in Australia Whether we consider the last week, or the last 12months, the Australian Healthcare Sector remains a shining light on the local stock market. As would be expected there are some blemishes within the sector, with Ansell (ANN) and Primary Health Care (PRY) experiencing a disappointing 12 months. However, overall the sector remains in the black for the last 12 months, while the ASX200 is down 5.5%. The obvious fundamentals of a population continuing to grow and enjoy better quality health conditions remain firmly in play. The concern with the sector has been the same for a lot of investors over recent years and remains today, relatively high valuations and low dividend yields compared to the market as whole. However, if a company is growing and increasing earnings per share, both of these concerns dissipate very rapidly. ASX200 Health Care Index Quarterly Chart

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.