Author: james Carter

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

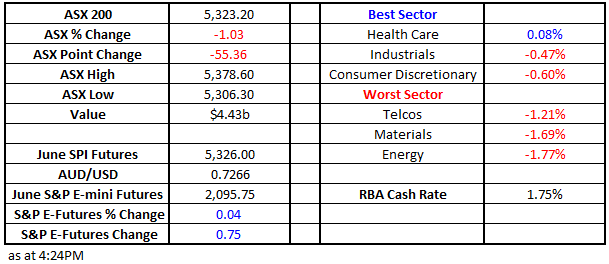

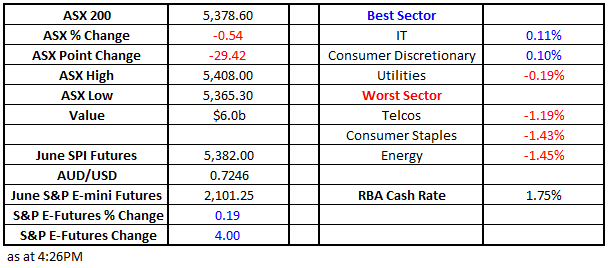

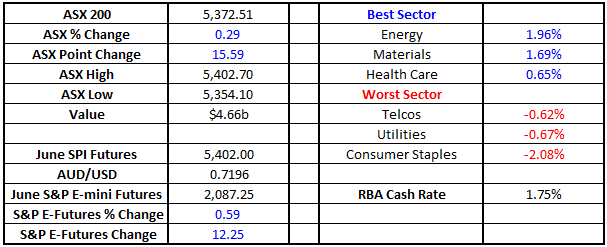

Market Data What Mattered Today As expected ahead of the US Memorial Day holiday, the local market was extremely quiet today, closing 2 points higher at 5408 and only trading within a very tight 24 point range. Volumes were also low, as the ASX200 hovered around the 5400 area, looking for a catalyst to drive it out of the recent holding pattern. As was outlined in this morning’s report June, and especially the first few weeks, are normally soft for local stocks so this week should prove interesting. ASX200 Intraday Chart The gold sector was the standout for all the wrong reasons as it got whacked, following the precious metal in Asia which fell ~1% to test the $US1200/oz area. Newcrest closed down 1.5% and Northern Start (NST) 5.8%. Regis Resources (RRL) fell into our initial buy level today, hitting $2.81, and we allocated 5% of our portfolio to the stock ~$2.83. We intend to average if weakness continues towards $2.50, but also a quick spike back over $3 may force us to take a quick 6-7% profit – watch for trading alerts. Regis Resources (RRL) Weekly Chart Stocks & Sectors Today Source; Bloomberg ASX 200 Movers **Note US share markets are closed for Memorial Day

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Show more…

You need to be a member to view this article

REGISTER FOR FREE INSTANT ACCESS

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.