Author: james Carter

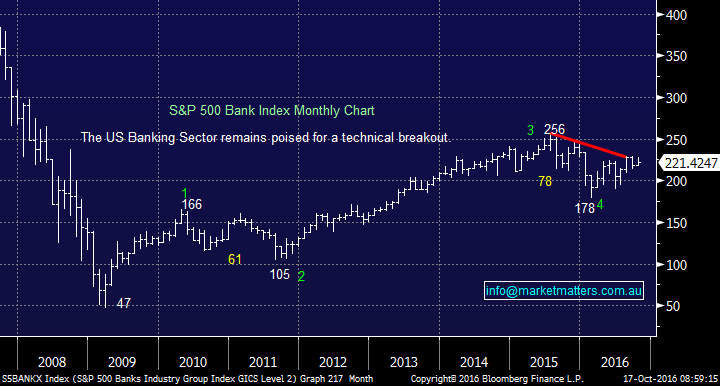

Last week ended in the same quiet manner as the previous few weeks. The market is showing a frustrating inability to rally on good news, or fall on bad news, for more than a few hours. On Friday, 3 of the largest US banks beat estimates – JP Morgan, Citigroup and Wells Fargo. While the US banking Index closed up an ok 0.49% for the day overall it was a disappointing session with the Dow closing up 39-points, well below its up 160-ponts intra-day high.

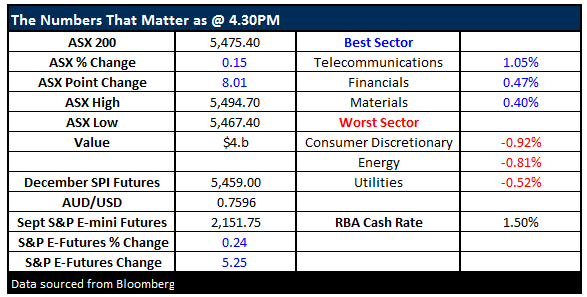

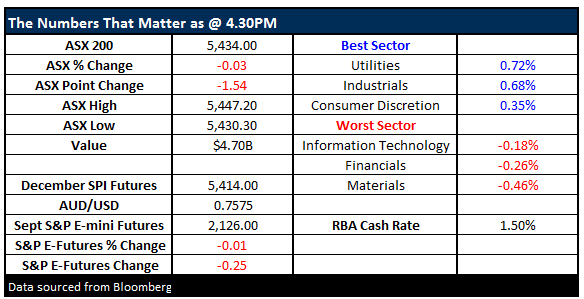

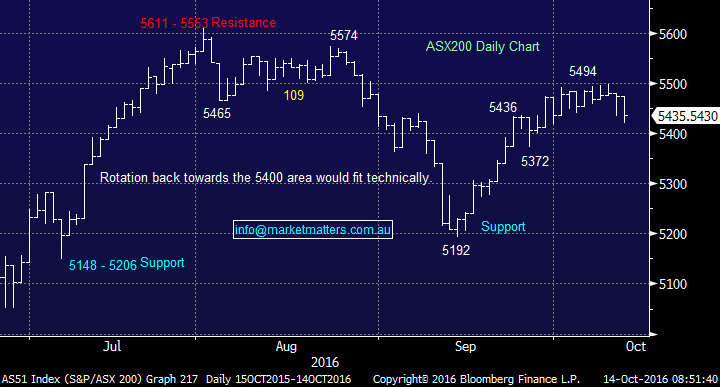

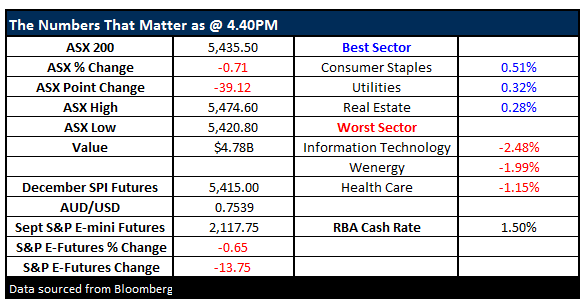

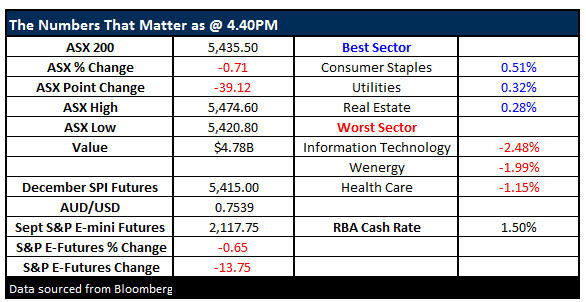

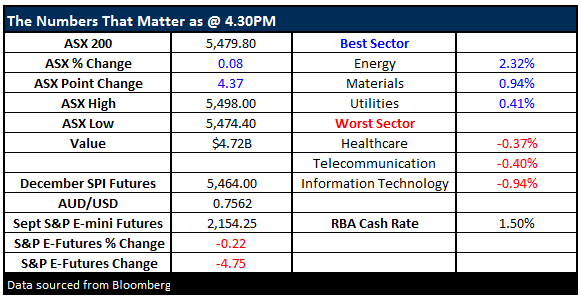

Yesterday we experienced a relatively volatile session for local stocks with the combination of disappointing Chinese trade data and the sad news of the Thai Kings passing leading to selling across the board in global equity futures, which in turn dragged the ASX200 almost 40-points lower. Unsurprisingly the weakness was led by the resources stocks due to the significant negative Chinese influence with Fortescue -2.6%, RIO -2.7%, S32 -2.8% and BHP -2.9%.

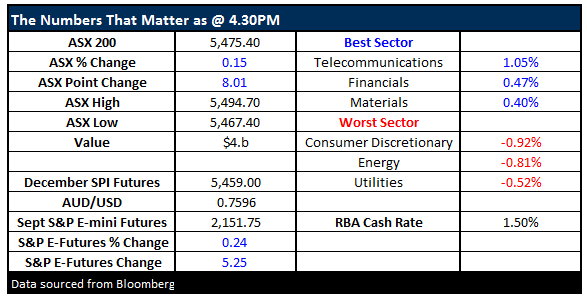

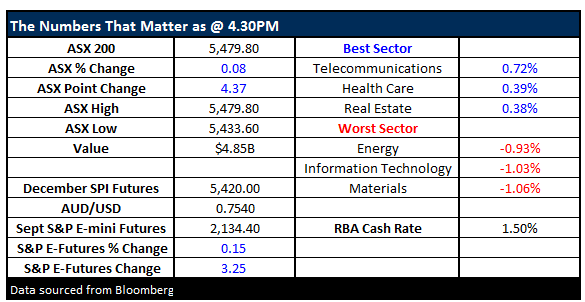

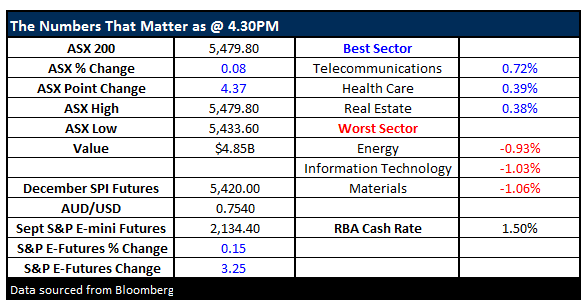

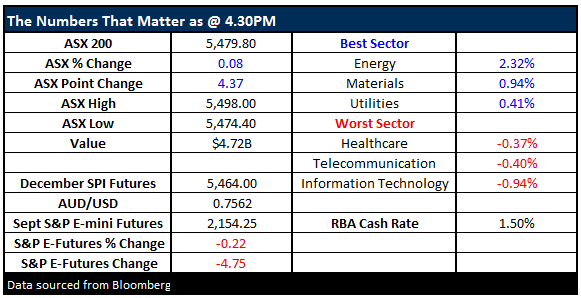

**Firstly, the ‘Numbers that Matter’ table in yesterday afternoons note was incorrect – we apologise for the inaccuracy. Alex, our resident spreadsheet jockey is travelling in the US for the next few weeks and we’re blooding new talent**

Last night Alcoa shares tumbled over 10% after the US metals companies quarterly profit missed estimates, and perhaps more importantly lowered its future revenue forecast. The numbers were weak with nearly all divisions missing expectations and it’s not surprising to see shares hit hard. This is the last time we’ll see Alcoa report in its current form, with the company splitting in two.

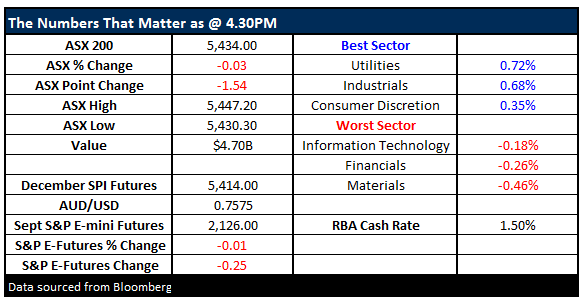

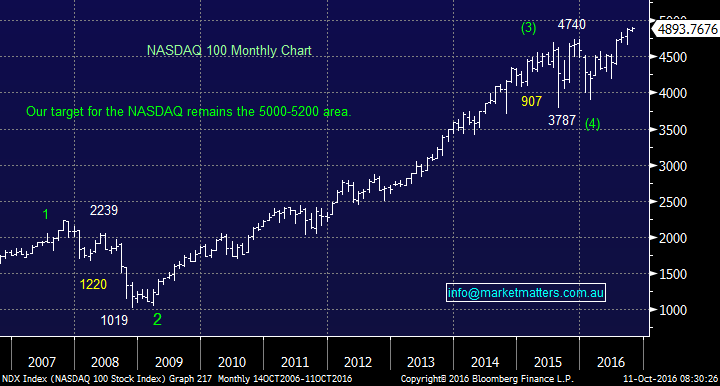

After a bad few days for Donald Trump, equities, the Mexican Peso and commodities all rallied last night. What caught our eye was the US Tech Index, the NASDAQ, which made fresh all-time highs – we have to reiterate it feels premature to be getting hyper-bearish on stocks despite the continuing negativity about valuations / earnings etc. The NASDAQ is very often the leading index for US stocks and our ideal target remains 5-6% higher. Also last night the Russians implied they would join OPEC in capping production thus supporting the oil price leading to an almost 3% rally in crude oil which should rally our energy sector up nicely today.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.