Author: james Carter

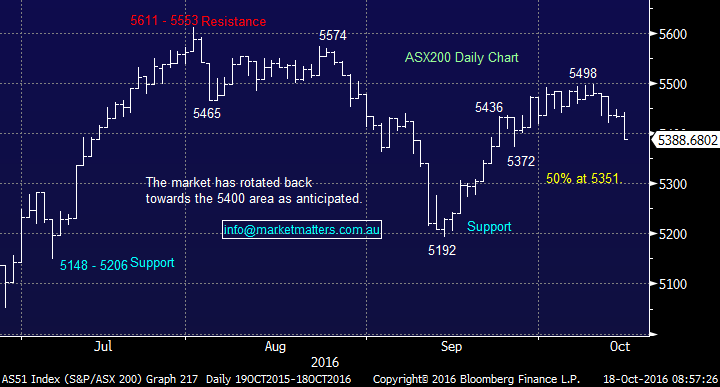

Happy Friday everybody, Sydney is delivering us a beautiful 27 degrees today as summer continues to raise its head. As we have mentioned recently global stocks have been quiet for the last 4-weeks and it feels they are likely to attempt a move in the not too distant future – the obvious question is in which direction! We are watching two important points carefully on the ASX200:

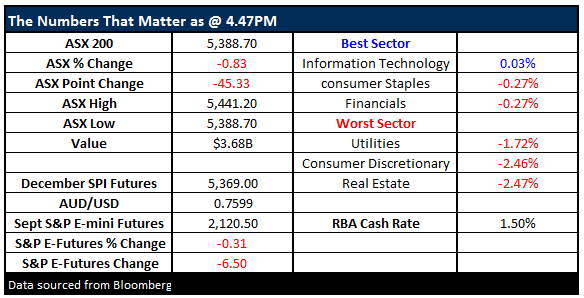

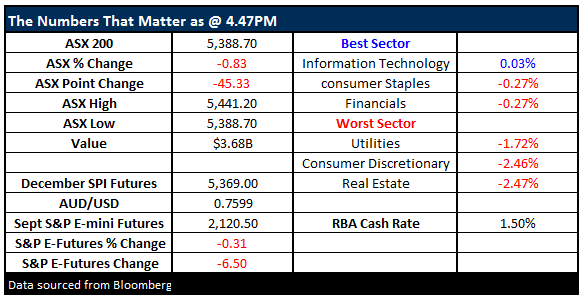

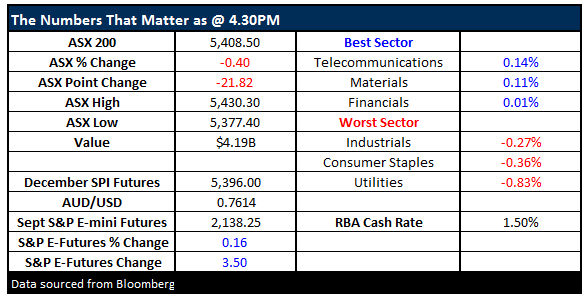

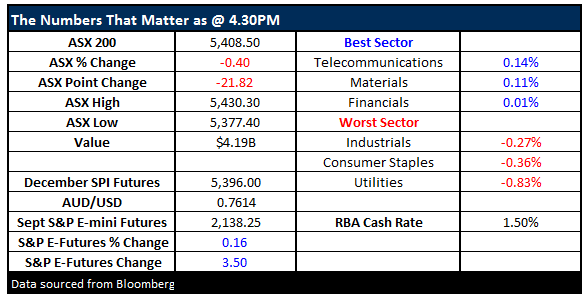

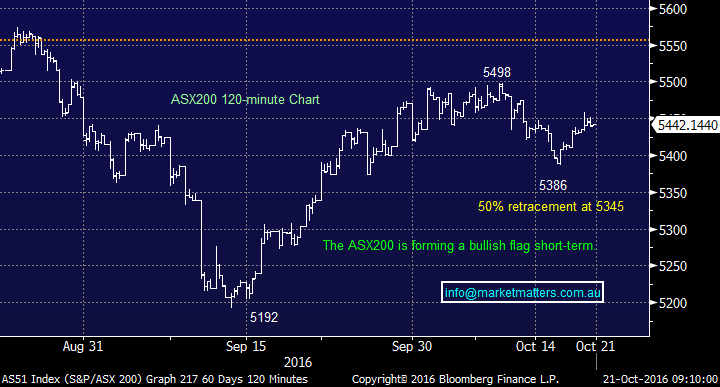

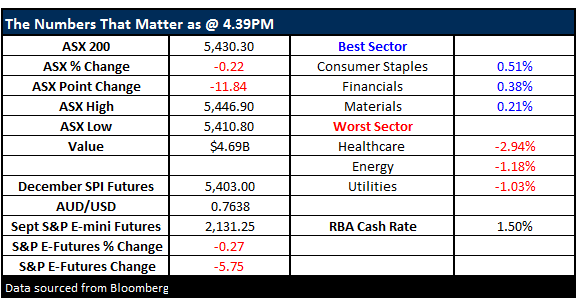

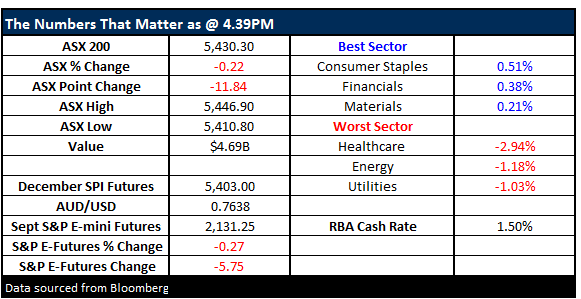

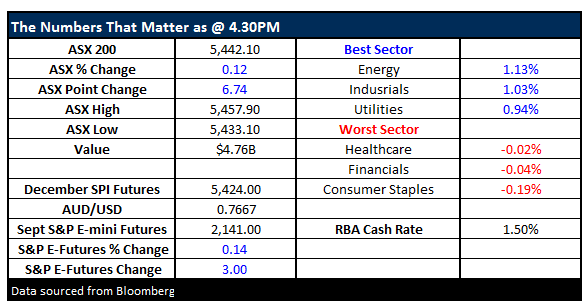

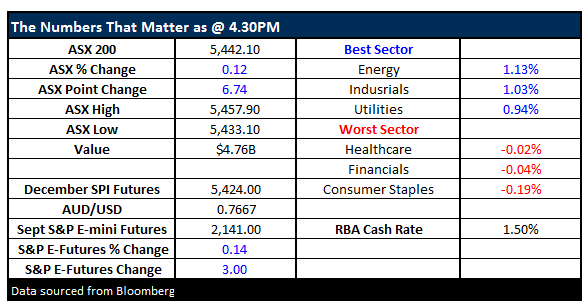

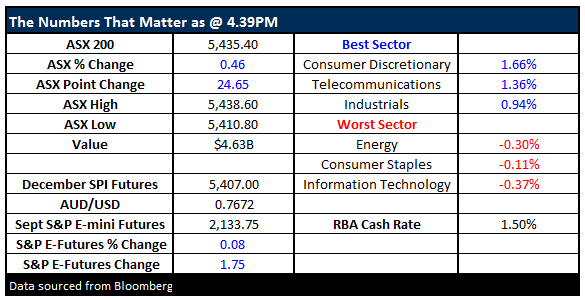

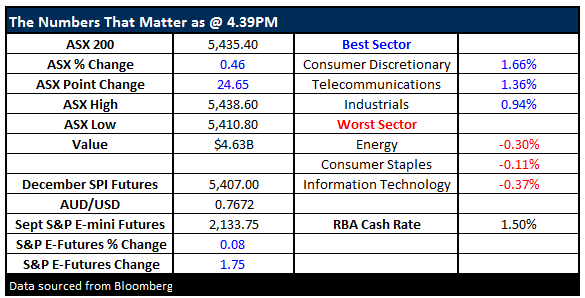

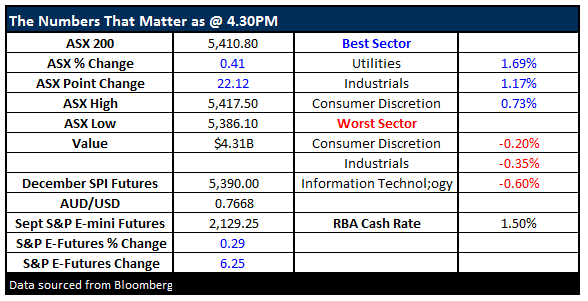

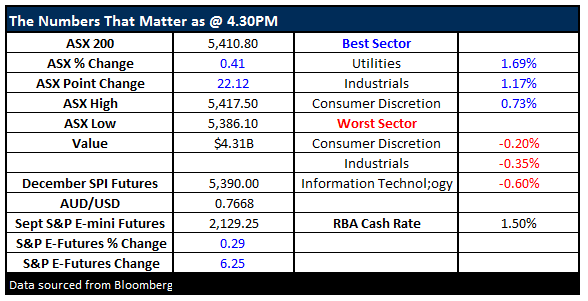

Last night US stocks rallied for a second day with the energy sector up 1.36% and the financials up another 0.9% but again the healthcare sector was a noticeable underperformer falling 0.27%. Markets are continuing to follow their seasonality path i.e. banks very strong in October followed by typical weakness in November, whereas the healthcare sector struggles in October prior to significantly outperforming in November / December. If the banking index is going to satisfy its usually strong October statistics we are likely to see some renewed strength from the anemic ASX200. So far October has seen a very tight 112-point trading range between 5386 and 5498. Remembering the “DOT Theory” a break of either of the two extremes is likely to at least see 125-point follow through if we simply apply the lowest monthly range of 2016 i.e. over 5600 on the upside and ~5250 on the downside.

We often quote the seasonal statistics when we are explaining our short-term view on the markets. The current period is definitely no exception. As you know October is usually the strongest month for the banking sector which makes sense considering that ANZ, NAB, and Westpac pay extremely attractive fully franked dividends in November, the 3-statistics that matter is as below:

Are gaming stocks worth a punt?

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.