Author: james Carter

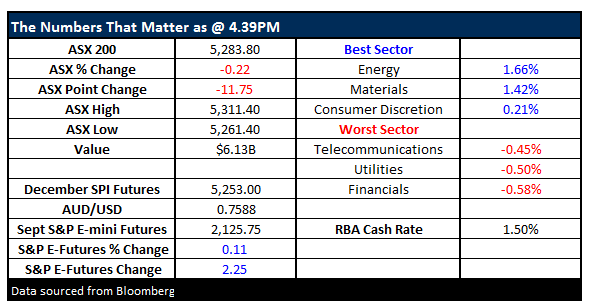

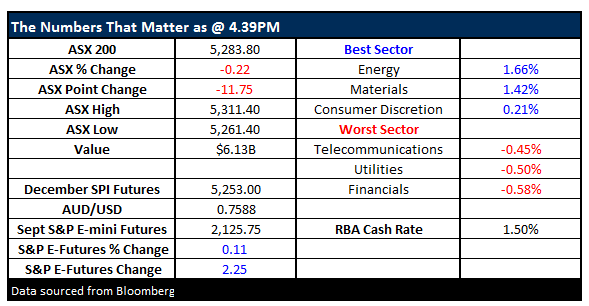

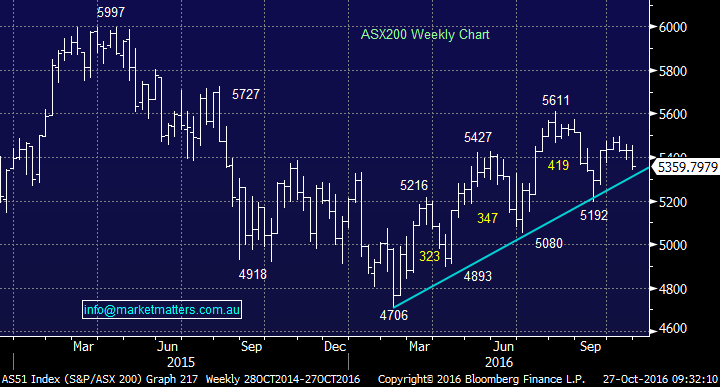

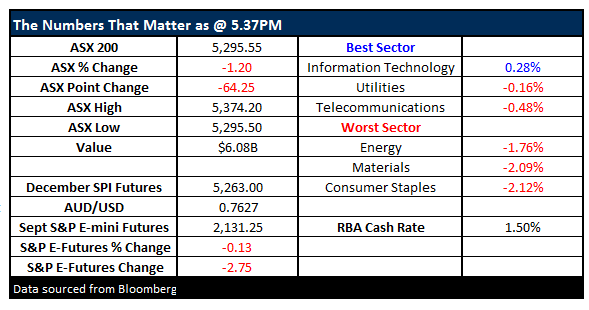

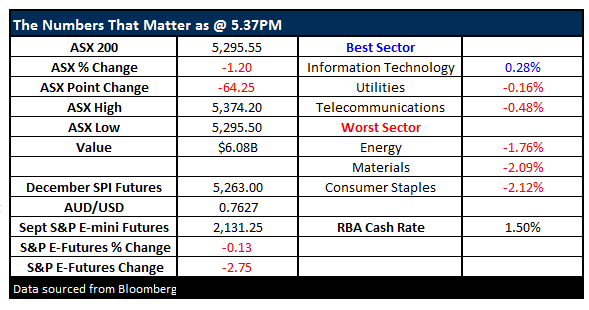

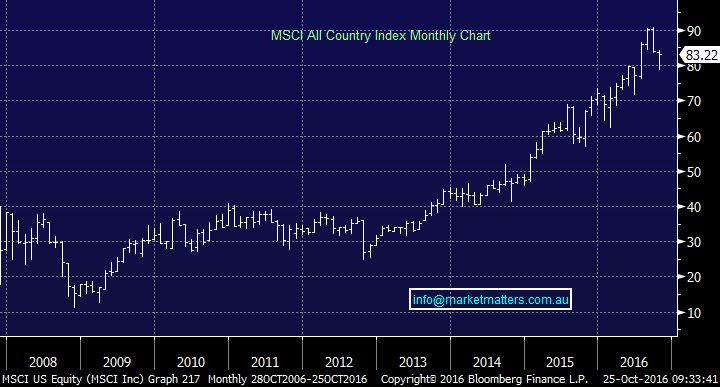

Yesterday our market was hammered another 64-points (1.2%) and suddenly the whole picture for our local market has changed. The Dow remains only 2.7% below its all-time high and 0.8% lower for November BUT the ASX200 is now down 2.6% for October after the last 2 days of aggressive selling. It’s hard at this stage to know why we have been singled out as the market to flee but reasons will probably unfold in time e.g. the $A is up well over 10% from the lows of 2016 and the ASX200 is still up 12% from its low hence for a $US based investor who feels the $A is toppy selling our market aggressively here makes total sense.

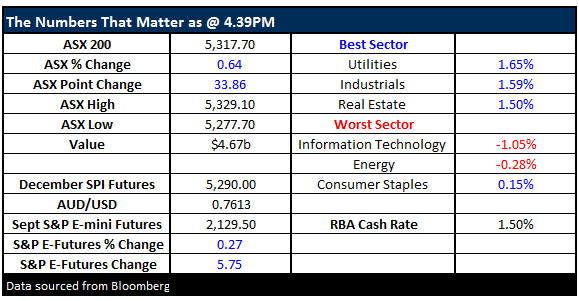

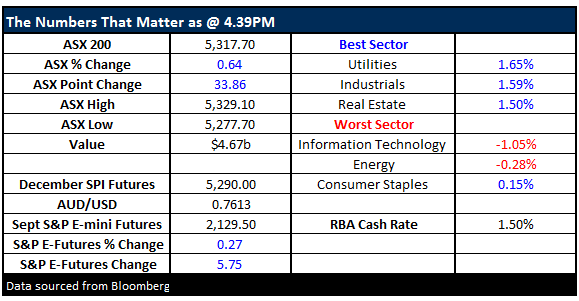

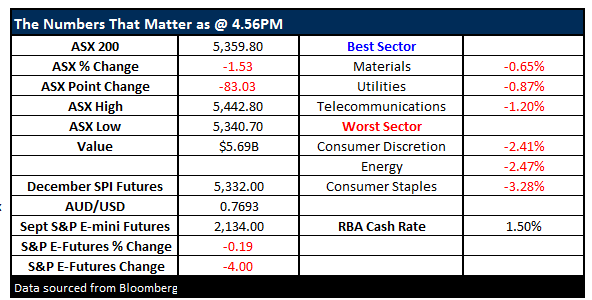

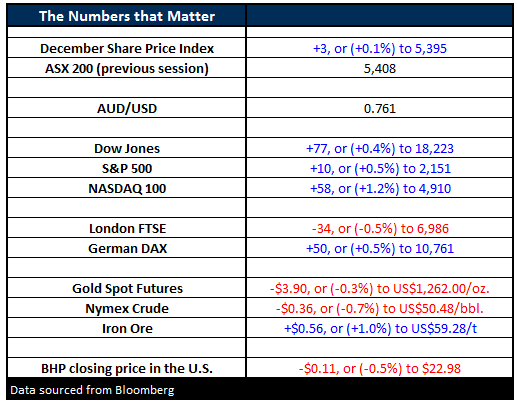

Yesterday our market was hammered 83-points / 1.5% with selling across the board locally and most of the region. The New Zealand market also fell 1.5% while Hong Kong was down 1.4% but there was no major negative influence from the US or Europe. The local market has now corrected 2.5% from its October high and 4.5% from the 2016 high, while the Dow Jones is only 2.5% below its all-time high – we are a painful 21.8% below that distant equivalent milestone. The volume of selling that hit our market yesterday is likely to have broken its short-term resolve unless NAB can report well today.

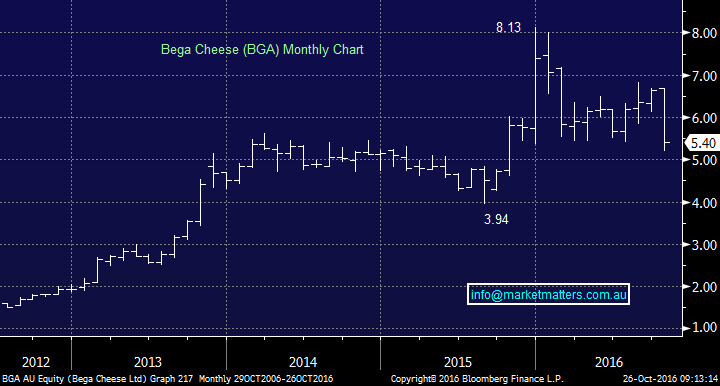

Yesterday Bega Cheese (BGA) was hammered 16.8% after writing down the value of its infant formula joint venture with Blackmores saying that since they launched the venture early this year, changes to Chinese regulation have resulted in an oversupplied market for baby formula which has forced a decent drop in prices. The company now saying that the ‘change in market circumstances has seen our expected sales not materialise at levels that were initially forecasted’ or in other words, we’ve gotten it wrong and now need to back pedal.

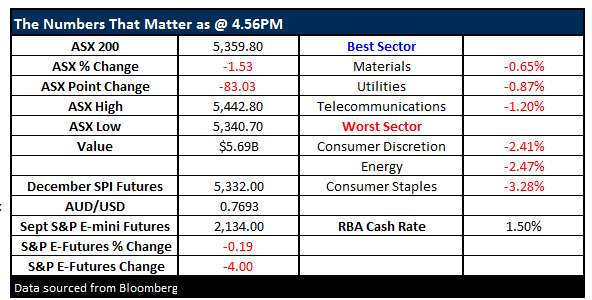

Last night US equities again rallied nicely with the tech NASDAQ Index again making fresh all-time highs – as we have said previously this index often leads the broader market. Takeover activity and solid earnings numbers were the major catalysts, a very different feel to our local market where earnings numbers have recently belted a number of household names. Yesterday the MSCI All Country World Index (MXWD) gained 0.3% while our local market fell 0.4% – The MXWD is a combination of both emerging and developed world markets. We remain bullish global equities targeting ~10% further gains – hopefully the ASX200 can participate if we are correct!

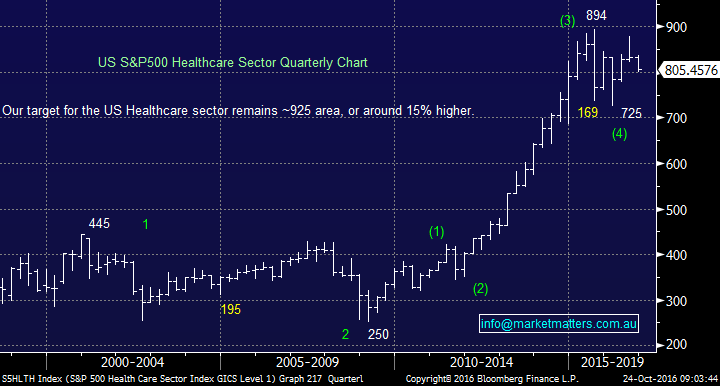

A change from our usual Monday morning questions format as we want to be totally prepared for any opportunities in the coming days /weeks. Over recent reports, we have made no secret of our likely intention to switch some of our overweight banking positions into the healthcare space. In last Thursday mornings report we covered Ansell, Cochlear, and Healthscope and after some short-term poor news for Healthscope, we purchased the stock on Friday under $2.40. Note Ansell is approaching our buy zone under $22 and ideally close to $21.50.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.