Author: james Carter

Many local tech. stocks which charged ahead of the pack for so long have come back to earth with a huge bang over last few months. The standout 2 themes within our market recently has been the aggressive selling of the yield play stocks plus those with high demanding valuations (P/E’s) as the market fears disappointment – it’s received a few! Today we are focusing on 4 quality IT disruptors, all of which are household names, that have experienced significant corrections while asking the question are buying opportunities presenting themselves:

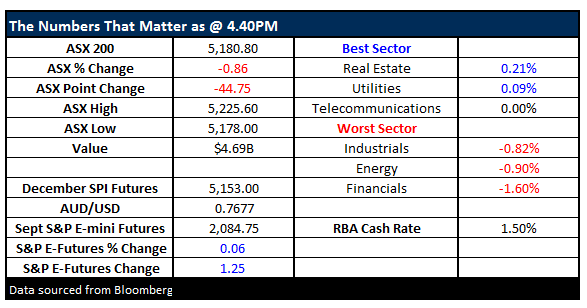

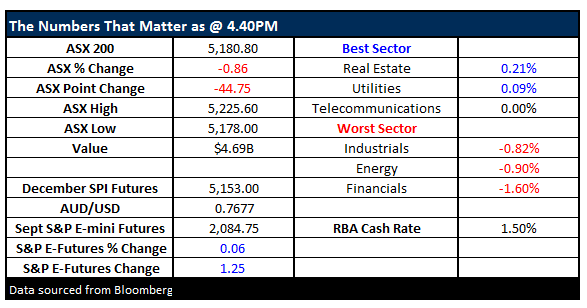

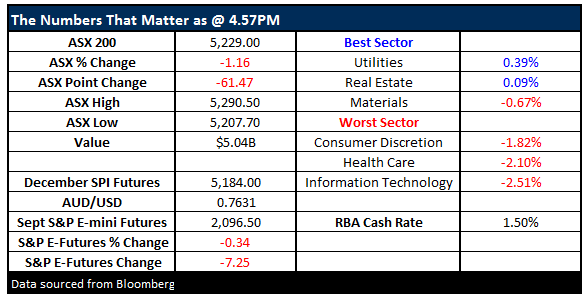

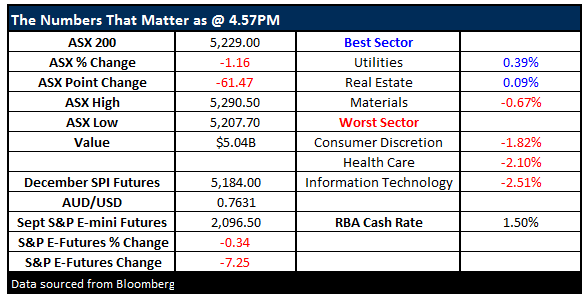

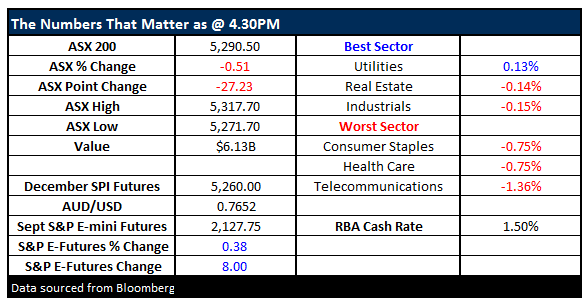

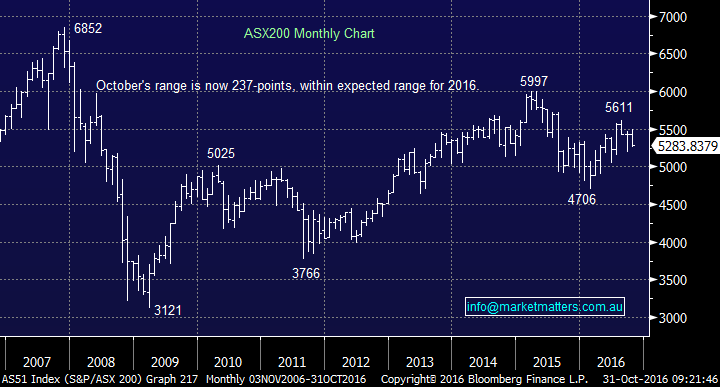

Yesterday the local ASX200 fell another 61-points (1.16%), over double the US retreat, as yet again “when the Dow sneezes we catch a cold!”. Fortunately, we increased our cash position to over 20% last month but it never feels enough when the market comes under such intense pressure. Today we are going to focus on the overall market and decide if we should start buying this weakness or perhaps even sell further. A tough decision with next week’s binary outcome looming i.e. Trump or Clinton. A Trump win is largely predicted to be negative for stocks – fear of the unknown.

Donald Trump now has his nose ahead of Hillary Clinton according to the latest polls and the market doesn’t like it – this prompted selling of US stocks, buying of Gold and selling of the $US overnight. Since the FBI reignited their investigation into Clinton’s leaked emails, Trump has roared back into contention and clearly that’s a concern for markets.

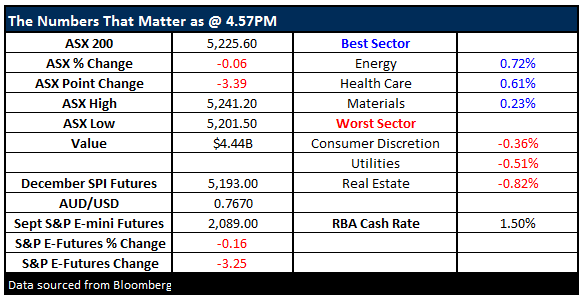

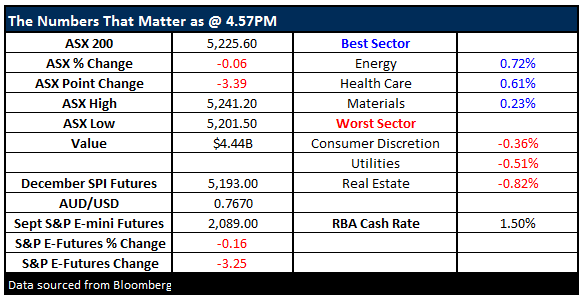

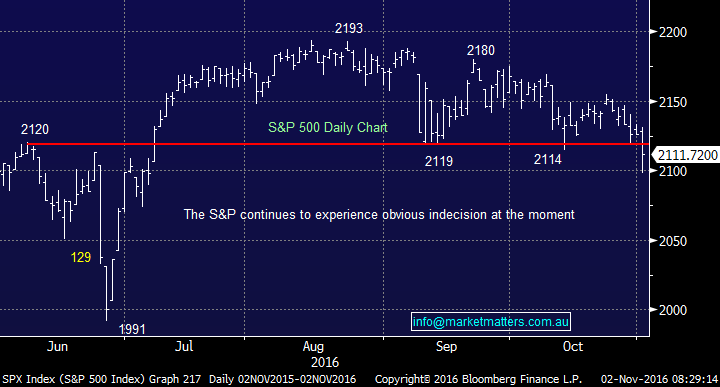

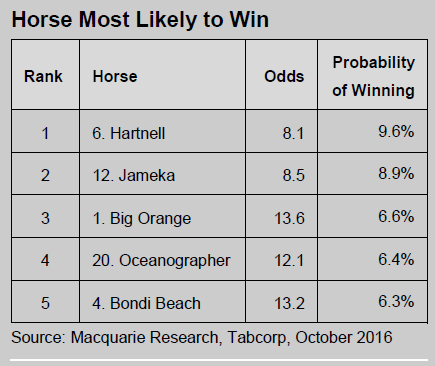

Most focus will be on the Melbourne Cup today (“The race that stops the nation”) at 3pm only 30 minutes after the RBA announces their decision on interest rates at 230pm. For the record we believe interest rates will remain unchanged and our “punt” for the Cup is “Big Orange”! We actually believe rates are likely to remain on hold for the next 6-months while the local economy shows its hand and the RBA get to see how aggressively the US will recommence with its rate hiking cycle.

Last year’s Cup saw the first female Jockey win on the back of 100-1 ‘roughy’ Prince of Penzance blowing all modeling, form, statistics and ‘good oil’ out of the water. Does a ‘quant model’ actually help or are we better off picking bycolor or name or simply pulling a name at random in the office sweep?

Last week the local ASX200 had an awful time underperforming pretty much all of its global counterparts. This was unfortunately another great example that having a finger on the pulse of US stocks regularly has little impact on forecasting our market on a week to week basis. While we remain a healthy 12.3% above last Decembers lows it does demonstrate how quickly the ASX200 can decline under its own steam.

Really bullish, there's more to go in the reflation rally

Please enter your login details

Forgot password? Request a One Time Password or reset your password

One Time Password

Check your email for an email from [email protected]

Subject: Your OTP for Account Access

This email will have a code you can use as your One Time Password for instant access

To reset your password, enter your email address

A link to create a new password will be sent to the email address you have registered to your account.

Enter and confirm your new password

Congratulations your password has been reset

Sorry, but your key is expired.

Sorry, but your key is invalid.

Something go wrong.

Only available to Market Matters members

Hi, this is only available to members. Join today and access the latest views on the latest developments from a professional money manager.

Smart Phone App

Our Smart Phone App will give you access to much of our content and notifications. Download for free today.